Contents

What is QuickBooks?

QuickBooks is an online accounting platform which offers its services for new, small and medium sized businesses.

So, if you are looking for the right accounting software for your organization and want to know more about QuickBooks, stick till the end of this review. 😊

In this QuickBooks review we will be judging the cloud-based platform on the basis of plans & pricing, features, user experience, contact support along with its benefits and drawbacks.

QuickBooks Overview

QuickBooks was initially launched in 1983 and has been around for almost 40 years now. The company is catering to over 7 million businesses which says plenty about their product and reputation.

QuickBooks comes jam packed with features and functionalities such as cash flow management, reports generation, sales tracking, sales taxes, time tracking, inventory tracking, 1099 contractors management and much more.

Users can select any of the four pricing plans along with the optional payroll functionality. Let’s start with our extensive and in-depth QuickBooks review without any further ado. 😇

Also Read: Gusto vs QuickBooks: Which One Is BEST?

QuickBooks Pricing Plans

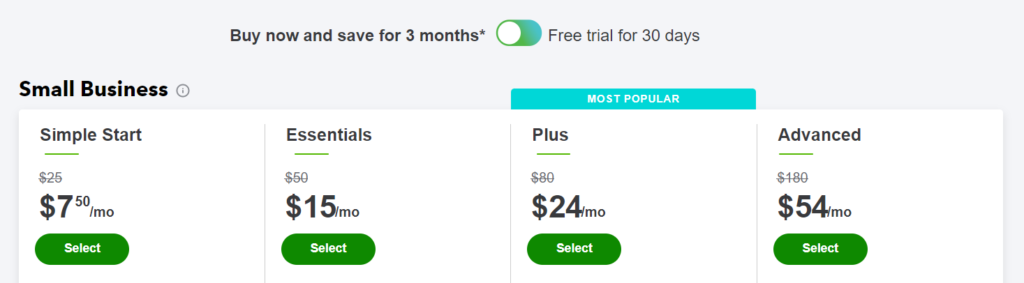

The prices are categorized into four different plans and users can opt for the one that meets their requirements. All the plans provide a 30-day free trial. The following are the available selection plans:

- Simple Start – The plan usually costs around $25 per month but users can avail a discount and get it for $7.50 on a monthly basis for three consecutive months. The functionalities included in this plan are as follows: track income & expenses, invoices, accept payments, maximum tax deductions, run general reports, capture and organize receipts, track miles, manage cash flow, send estimates, manage 1099 contractors and track sales & taxes.

- Essentials – The plan costs $50 per month but can be currently bought for $15 per month for three months. It includes all the Simple Start features along with manage & pay bills, 3 user access for seamless teamwork and time tracking.

- Plus – One can get it for $24 per month on a sale, however it normally costs $80 on a monthly basis. In addition to Essentials, it incorporates inventory tracking, 5 user access and track project profitability.

- Advanced – The plan can be presently bought for $54 on a monthly basis for three months although it costs $180. Extra functionality includes more than 5 users, business analytics & insights, managing employee expenses, batch invoices & expenses, customize access by roles, app integrations, dedicated account team, on-demand online training, automate processes & tasks and restoration of company’s data.

Optional Payroll

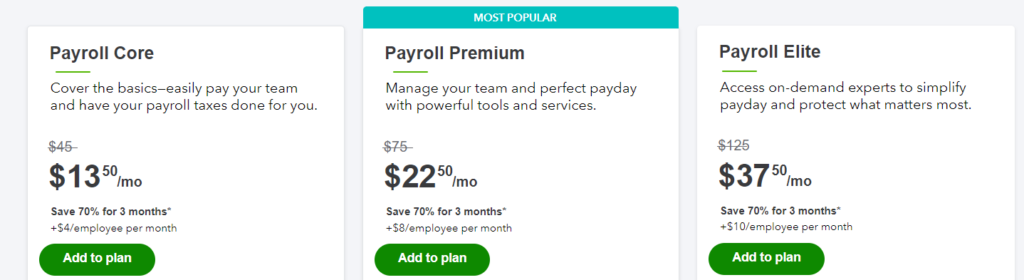

Three plans are offered to users through which payrolls and HR management chores become super easy to deal with. All of the plans include auto payroll, paycheck & tax calculation, automated tax & forms, manage garnishments, unlimited payroll runs, manage deductions, reports, etc.

The following are the available options:

- Payroll Core – $13.50 per month for three months plus $4 per employee.

- Payroll Premium – $22.50 per month for three months plus $8 per employee. It offers additional features like same day direct deposit, worker’s compensation, HR support center, etc.

- Payroll Elite – $37.50 per month for three months plus $10 per employee and incorporates functionalities such as 24/7 expert product support, tax penalty protection, personal HR advisor, etc.

QuickBooks Features

Project profitability and job costing – Since the success of any business is tied with the losses and gains, this feature keeps the records of all the expenses related to a job or a project. This helps the team analyze the projects that are profitable whereas those which are just running for the mill.

The dashboard displays the income made and costs, insights showing the trending projects in order to improvise and make better decisions, reports on the basis of labour wages, time, avoids cost overruns, and predicts assets cost in real time and other expenses.

QuickBooks Live Bookkeeping – It gathers the company’s financial data, maintains the records of transactions on an accounting system and keeps the business running smoothly. It assists in managing tax filings and deductions, making smarter management decisions and financing your business.

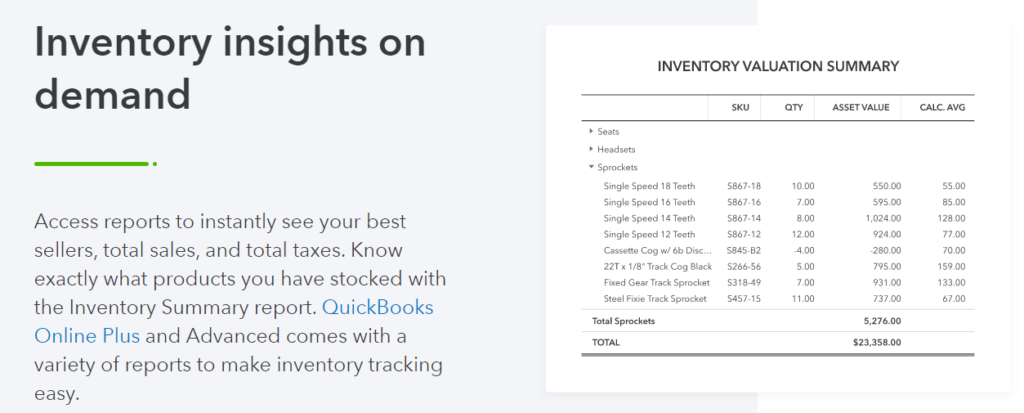

Inventory Management – The system enables users to track the details related to sales, purchases, payments, raw materials and finished product. It monitors the supply in real time and helps users plan their purchases from manufacturers. This not only saves user’s time but helps them in hassle free auditing, forecasting the sales and budget planning.

Bills management – All the bills can be organized and managed from a single interface while automatically being recorded and tracked. The expenses can be paid to multiple vendors either by “Pay Bills” for the ones that are supposed to be paid later and “Write checks” for the ones you need to immediately pay or have been paid for. The partial amount of any bill can also be settled. The credit cards can be used to postpone the bills and simultaneously earn rewards however a fee of 2.9% is charged.

Track expenses – Users can connect their bank accounts, credit cards, PayPal, Square and a couple other payment gateways, categorize their expenses and check the built-in reports to track every single transaction made. An option for scanning the receipts is provided to the users which they can use to upload the bills for future references such as vendor’s information, date and amount of purchase, mode of payment, etc. 😍

1099 Contractors Management – It records all the payments being transferred to the contractors and then generates 1099 forms ready to be sent during tax filings. A separate log for expenses and rental supplies by contractors can be maintained to keep things organized and easy. The platform is an authorized IRS e-file provider and can submit the tax forms for users electronically.

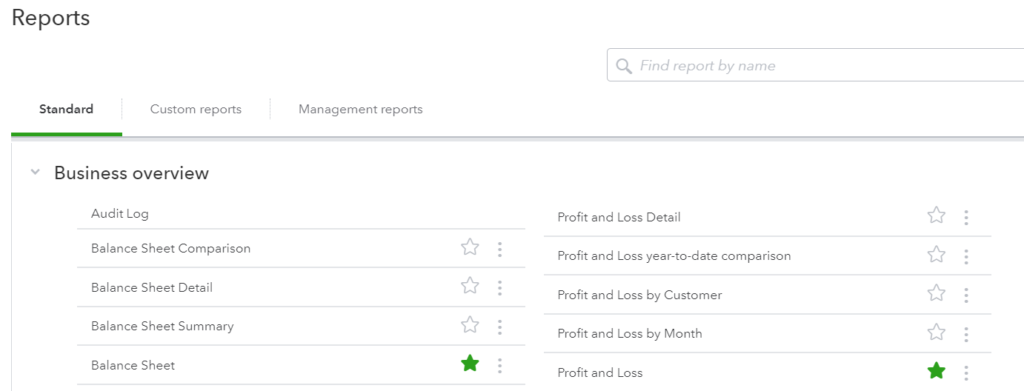

Reporting – Reports show real time business performance with financial insights such as income statements, cash flow statements, balance sheets, etc. The reports can be customized to create a professional summary in order to present it to your business partners. Accounting reports show details regarding open invoices, due amounts, customer balances, etc.

Automated sales tax calculation – One can easily add sales tax to the invoices in order for QuickBooks to automatically calculate the sales tax rate depending upon the date, type of product or service, location and customer. One can easily access the sales tax liability report which shows the total amount of sales tax that has been collected along with what is owed to the authorities. It displays total taxable sales, total nontaxable sales, tax rate, etc all broken by the tax agency.

Electronic Invoicing – It is one of the many timesaving tools offered by QuickBooks through which email invoices can be sent to the customers and can accept the payments via credit/debit cards and ACH bank transfers. Accelerated invoices can be scheduled, customized and duplicated for multiple customers. Progress invoicing automatically tracks the total amount estimate and splits it up into multiple ones on the basis of stages, project milestones and percentage of the work completed.

Integrations – QuickBooks offers a plethora of integration options to make accounting and business management easy. Some of the third-party software APIs available are PayPal, Shopify, Amazon business, Square, Fathom, etc.

Tax deductions – One can either use QuickBooks tax categories or can create their own to organize and sort their business expenses automatically which comes handy during tax filings. The receipts can be scanned and are automatically arranged. The quarterly tax calculation gives users a heads up on how much amount needs to be kept aside for tax purposes.

Estimates – One can design and customize a professional estimate template which includes discounts, product stock keeping units, payment terms, etc. It can be emailed to the customers and they can accept as well as sign it digitally. Once accepted, these estimates can be turned into invoices while QuickBooks handles payment processing, tracking of transactions and transferring the funds into your account.

Mobile Application – Running a business has never been easier, one can use their smartphones to enter transaction details, record costs, invoice customers and send reports. One can access a balance sheet, run a quick profit loss report and so much more. One can sign in QuickBooks using account details and the mobile application is available for both iOS and Android users. 😚

Automatic backups – The platform automatically backs up company’s data on the cloud and so users do not have to worry about losing their important files and information.

Also Read: Gusto Review: Is It Legit Payroll & HR Platform?

QuickBooks User Experience

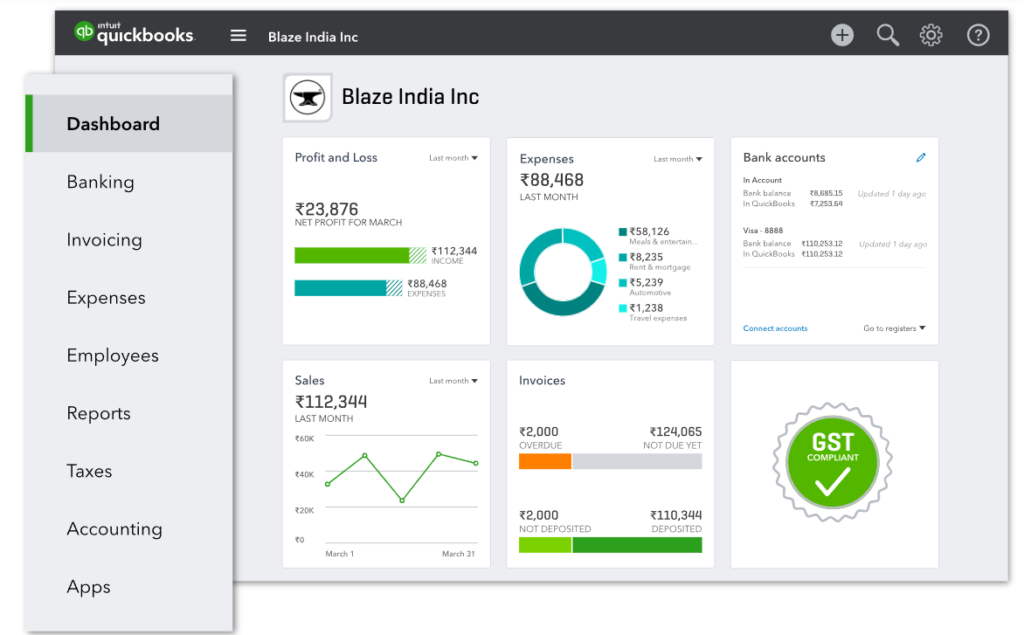

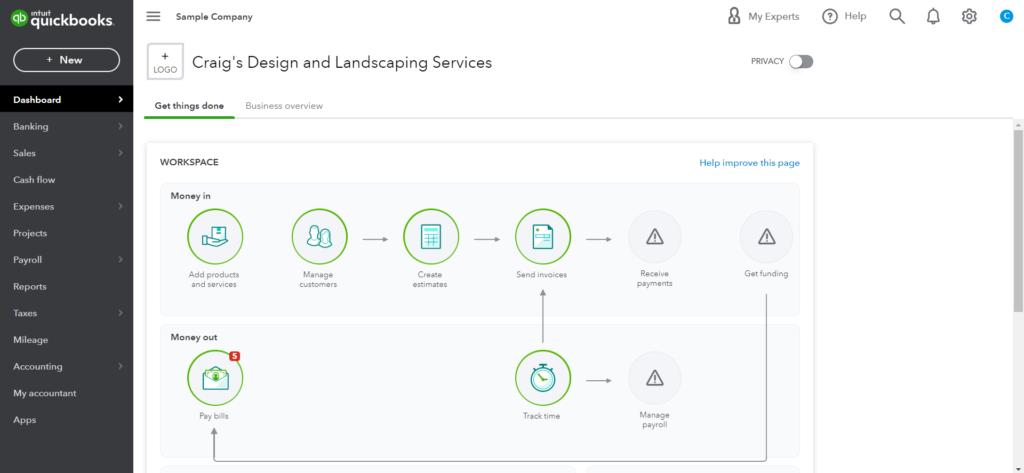

The platform has a simple and clean interface which is very easy to understand and excellent to use which makes it very beginner friendly. The navigation bar contains a number of tabs for quick access such as banking, sales, cash flow, expenses, projects, mileage, accounting, etc.

Pros and Cons

👍 Pros

- Has an intuitive and beginner friendly interface with an excellent dashboard and navigation system.

- Automated payroll, cloud backup, inventory management, comprehensive reporting along with electronic invoicing.

- Easy to maintain and share accounting information via functionalities like live bookkeeping.

- Automated tax filing and forms depending upon the laws of local, state and national authorities.

- Offers tons of educational and support material such as blogs, articles, video tutorials, live classes, etc.

- Integrates a number of third-party applications along with mobile apps for both Android and iOS users.

👎 Cons

- The monthly plan can be a bit expensive.

- Only a limited number of users can access the software.

Customer Support Services

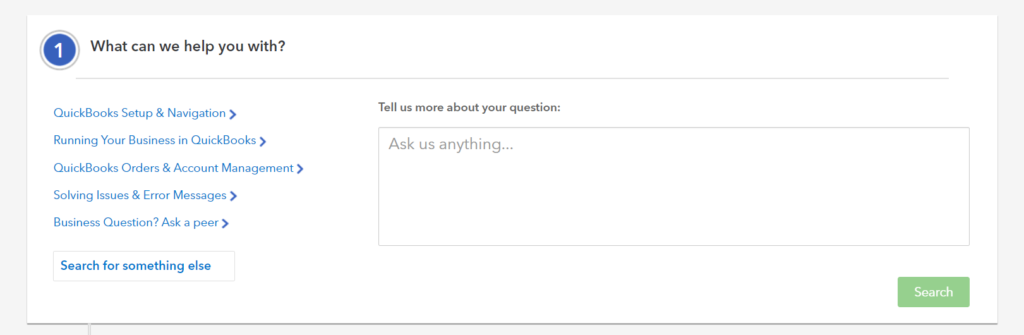

QuickBooks offers plenty of support resources. The knowledge base contains tons of articles on various topics, blog posts, video tutorials, webinars along with training classes.

One can contact the company’s representative via email, live chat and phone call. Users can connect with the community and start discussions on any subject related to the platform or their services.

How to connect to a live person?

- Head to the Help menu.

- In the Assistant window, enter “Chat” in the field.

- Enter your concerns and click on “Let’s talk” and start chatting with the support expert.

Conclusion – Final Say

Let’s end our QuickBooks review by summarizing what we have covered so far. It is one of the best accounting and business management software out there for small and medium sized businesses.

The platform offers tons of features such as automated payroll, tax deductions, worker’s compensation, analytics and insights, wage garnishments, HR experts help, automatic backups, etc. The pricing plans can range from $25 to $180 without any discounts and contracts.

Also Read: Sage vs Quickbooks: Which Accounting Software Best?

FAQ 🤔

The following steps can be followed if users want to enter the amount of time they spent working on a particular task.

1. Click the “Employees” option at the top menu and select “Enter Time”.

2. Weekly timesheet can be created by clicking on “Use Weekly Timesheet”.

3. Choose an employee in the Name drop-down list.

4. If you want to bill the time, choose a customer, service item and mark the time as billable.

5. Choose a payroll item for the time and enter the number of hours worked in the column for the day.

6. Click Save and then Close to save the timesheet.