Contents

Businesses of all shapes and sizes have it a little easy these days since they are blessed with multiple affordable and feature-rich HR and payroll software, that allow them to focus on their niche.

Gusto and QuickBooks are two of the most popular and trusted online payroll platforms. In this guide we’ll try to figure out which is the better option than the other. 😇

In this Gusto vs QuickBooks review, we will be comparing both the platforms on the basis of pricing & plans, payroll features, automated tools, benefits, integrations, user interface experience, customer support.

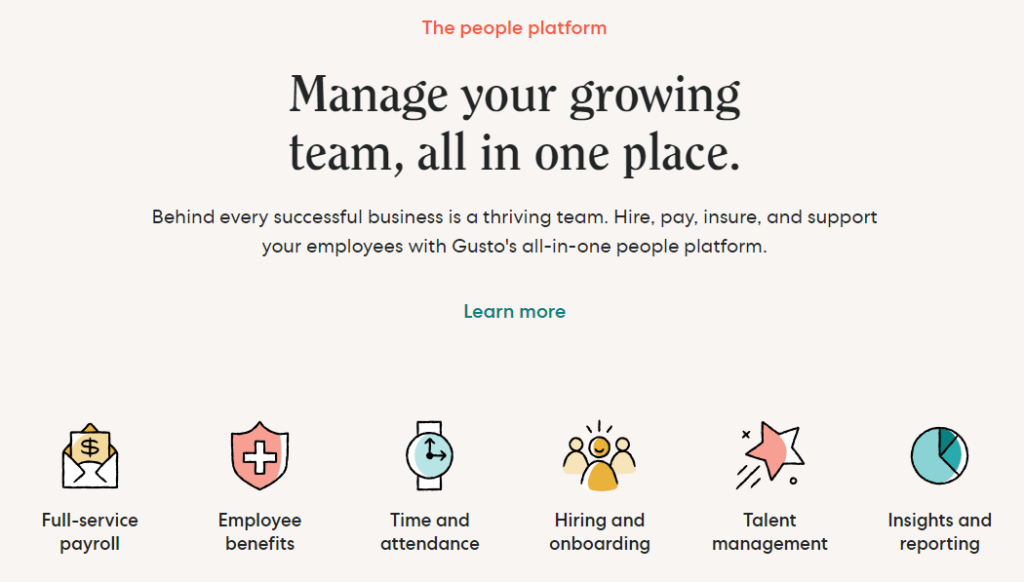

Gusto Overview

Gusto was launched as ZenPayroll in 2012 and is headquartered in San Francisco. The platform is catering to more than 200K businesses internationally and is backed by investors like T.Rowe Price, Franklin Templeton, Sands Capital, Glynn Capital, etc.

It offers automated and manual payroll options, unlimited pay runs, employee benefits, contractor self-service profiles, worker’s compensation, payroll tax filings, year-end reports, time tracking and so much more.

QuickBooks Overview

The cloud based virtual platform was first launched in 1983 and has helped 7 million businesses till date. QuickBooks provides tons of features, some of which are reports generation, sales tracking, live bookkeeping, automated sales taxes, project tracking, tax deductions, inventory management, electronic invoicing, etc.

Gusto vs QuickBooks – Pricing plans

We all show an inclination towards an affordable platform that comes jam packed with rich functionalities. Let us look at the pricing options that are available to us by both the platforms individually.

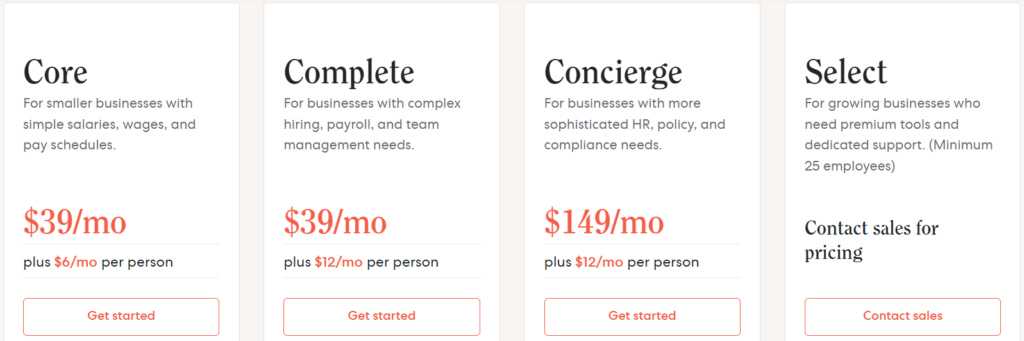

Gusto Subscription Plans

- Core – The plan costs $39 on a monthly basis and $6 per month per employee. “Core” plan is curated for small businesses that deal with simple responsibilities like paying salaries according to pay schedules.

- Complete – The plan can be availed for $39 on a monthly basis and $12 per month per employee. This is designed for businesses with complex work operations and team management needs.

- Concierge – The plan costs $149 on a monthly basis and $12 per month per employee. It works effectively with companies who have sophisticated HR needs, multiple compliance principles and policies.

- Select – Gusto’s sales team has to be contacted in order to inquire about prices. Rapidly growing businesses in need of a dedicated support team and advanced tools can use “Select”.

- Contractor Only – The plan costs $6 per month per person and is available for contractor only businesses who have not hired any W-2 employees yet.

Some of the features and services incorporated in all the plans are unlimited payrolls, multi-state payroll, tax filings & payments, 2-day direct deposit, garnishments, multiple pay rates, accounting integrations, payroll on Autopilot, tax forms, automated billing, onboarding checklist, payroll reports, etc.

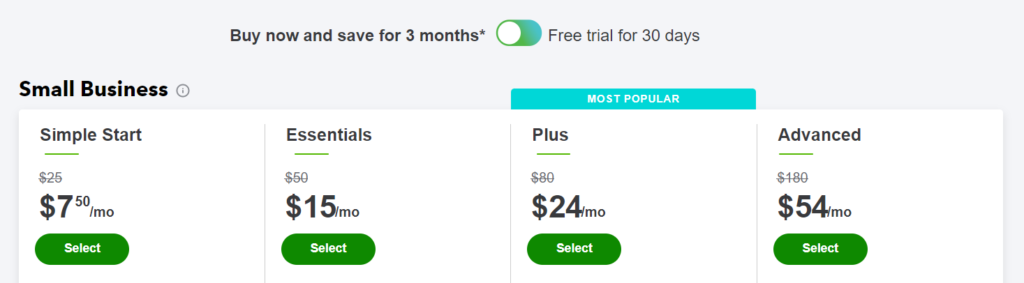

QuickBooks Subscription Plan

- Simple Start – The plan costs around $25 per month but is available for $7.50 on a discounted price for three consecutive months.

- Essentials – The plan costs $50 per month but can be currently bought for $15 /month for three months.

- Plus – The plan can be availed $24 per month on a sale; however, it usually costs $80 on a monthly basis.

- Advanced – The plan can be presently bought for $54 although it normally costs $180 per month.

All the QuickBooks plans incorporate the following functionalities; track income & expenses, invoices, accept payments, manage 1099 contractors, track miles, manage cash flow, send estimates, maximum tax deductions, run general reports, capture and organize receipts and track sales & taxes.

Also Read: Gusto Vs Justworks: Which Payroll Platform is Best for You?

Gusto Features

Gusto and QuickBooks both offer a plethora of features to their customers and since both of them are payroll and HR administrative softwares most of the functionalities are similar. Let us look further into these features. 😍

Payroll

- Automated taxes – Local, state and federal taxes are calculated, filed and paid automatically.

- Child support garnishments – One time or recurring deductions can be automated from employee’s salary to wage garnishment accounts.

- W-2s and 1099s – The platform creates, files and sends W-2s and 1099s forms to employees and contractors automatically.

- New hire reporting – New employee’s recruitment details are updated without any human interference.

- FLSA Tip credits: Minimum wage requirement – Employees’ salaries are adjusted to meet the minimum wage requirements.

- Gusto debit card – All the employees get debit cards which allow them easier access to their salaries on payday.

- Multiple pay rates – Employees can be paid at different rates based on their responsibilities and designations.

Time and Project Tracking

Project tracking – All the workforce costs can be determined through project tracking along with detailed reports and real time insights. Employees can track the time they devote to individual tasks.

Time tracking – Employee’s hours are tracked on a per workweek basis if they are hired at multiple rates. W-2 employees can clock in and out during each shift or manually enter the hours every day.

Time off tools – Employers can decide on carryover balances, rollovers and time off policies such as parental leave, holidays, sick leaves, personal day, bereavement, volunteer, weather, etc.

Hiring and Onboarding

Gusto helps organizations find and recruit skilled employees by posting the job offers on public forums and tracks the applications. Employee documents can be signed digitally and are stored online to maintain confidentiality. Some of the functionalities provided are as follows:

- Talent Management – Provides tools that evaluate employee’s performance, improves culture building, provides career development resources and manager reviews.

- Time and attendance – Team member’s working hours, time offs and holidays can be tracked on the basis of employee, date or department. Employees can clock in and out by using Gusto’s mobile app or computer while their presence is verified by a geolocation tracker.

- Insights and reporting – Reports and surveys can be created to analyze crucial data to help make effective decisions.

QuickBooks Features

Inventory Management

It allows users to monitor the supply in real time and tracks the information related to sales, payments, raw materials, purchases, left stock and finished products. This helps business owners plan their purchases, sales and budgets.

Track expenses

Users can connect their financial accounts such as bank account, credit cards, PayPal, etc and this feature allows them to categorize their expenses, scan the receipts for future references and analyze built-in reports of all the transactions. 😚

Live Bookkeeping

It stores company’s data and maintains records of transactions to keep the business running smoothly. It assists in tax filings, tax deductions, management decisions and finance related issues.

Bills management

Bills are organized, managed, recorded and tracked automatically and can be accessed from a single interface. Users can settle the bills either by “Pay Bills” or “Write checks”.

The platform allows users to pay the partial amount of any bill and on top of that credit cards can be used to postpone them altogether, however a fee of 2.9% is incurred.

Employee Benefits

When it comes to employee benefits both the platforms do support similar as well as different kinds of insurances and reimbursements.

- Worker’s Compensation – It is one such insurance supported by both the platforms. It covers employees in case they get hurt or sick at work and can settle their medical bills, rehabilitation costs, etc through it.

- 401(k) plans – Gusto and QuickBooks both have partnered with Guideline for 401(k) plans which are basically retirement plans. This allows employees to contribute a certain amount of their pre-tax salary into an account which cannot be accessed until they do not meet certain requirements such as retirement.

Gusto

The platform also supports commuter and health benefits.

Commuter benefits – Includes transit expenses (train, subway, bus, vanpool, ferry, lyft line and uber pool) and parking expenses (parking lots, meters and garages).

Health benefits – Employees can be reimbursed against the following bills; emergency services, hospitalization, maternity and newborn care, mental health, substance use disorder services, chronic disease, prescription drugs, rehabilitative services, oral and vision care, etc.

Integrations

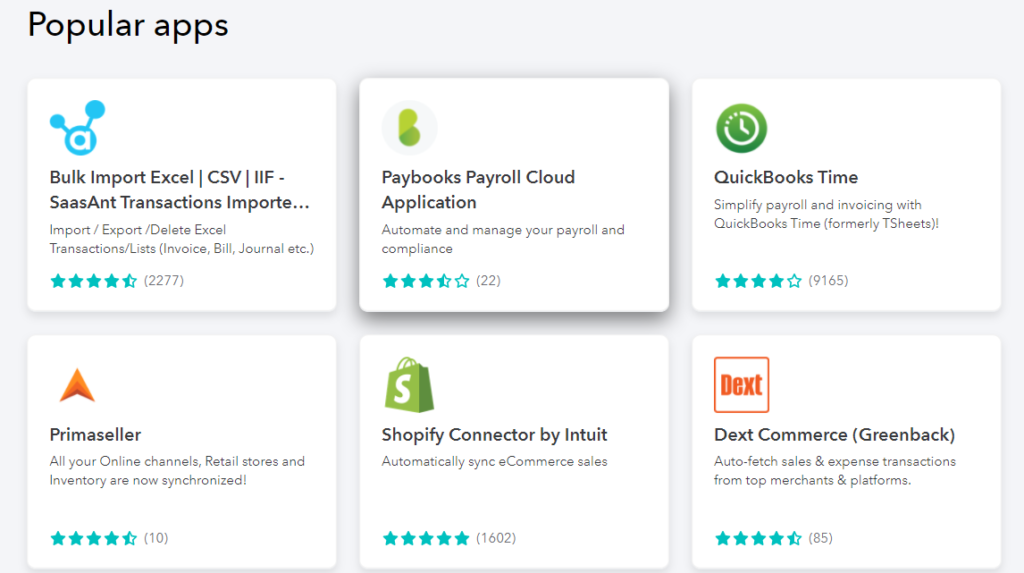

QuickBooks – The platform integrates with over 650 softwares for a number of categories, some of which are:

- Calculate Quotes – Arka Inventory, QuoteWerks, Scoro, Lydul, etc.

- Time Tracking – QuickBooks Time, Hour Timesheet, Time Tracking by eBillity, etc.

- Project Management – Rewind Backups, Jobber, Aero Workflow, ERPAG, etc.

- Run payroll – InStaff, greytHR, Easy Commissions, etc.

- Expense Tracking – Dext Prepare, Transaction Pro, Zoho Expense, etc.

- Inventory Tracking – SOS Inventory, eBay, Synder, Connex, etc.

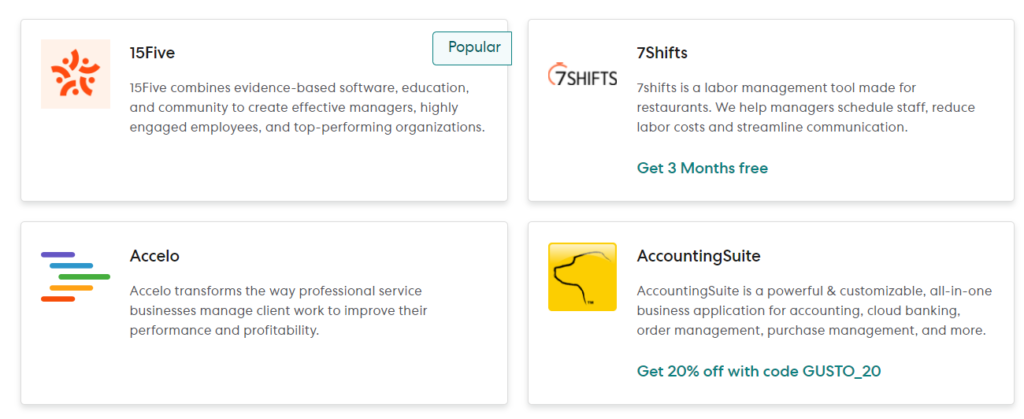

Gusto – The platform also offers tons of third-party apps and softwares, some of which are as follows:

- Collaborations – Google Workspace, Microsoft 365, Zoom, Asana, Dropbox, etc.

- Expense management – Expensify, Expense Management, etc.

- Legal & compliance – Capbase, Secureframe, Vanta, Hyperproof, etc.

- Performance management – 15Five, Bonusly, Empuls, etc.

- Tax preparation – Ardius, Clarus R+D, TaxTaker, YearEnd, etc.

- Time tracking – Homebase, When I Work, Deputy, QuickBooks Time, etc.

- Insights and analytics – Pave, Dataddo, The Calculate Hub, etc.

Also Read: Sage vs Quickbooks: Which Accounting Software Best?

User Interface Experience

Gusto has an intuitive platform, minimalistic design, is pretty simple to use, and has an excellent navigation bar that can be used for quick access to almost every service and resource. 😊

QuickBooks also have a beginner friendly interface. The navigation bar contains a number of tabs for quick access such as banking, sales, cash flow, expenses, projects, mileage, accounting, etc.

Customer Support Services

Gusto – It offers a Help center consisting of extensive articles, video tutorials, business guides, frequently asked questions and blog posts. The company’s support team can be contacted via live chat, email and phone call services, available from 8am to 5pm MST Monday to Friday.

QuickBooks – The platform offers a Knowledge Base which contains articles, blogs, video tutorials, webinars and training classes. Company’s representatives can be reached out via live chat, email and phone call. Users also have the option to connect with the community to have discussions about platform related questions.

Conclusion

Ending this QuickBooks vs Gusto review by stating our opinions on when to choose which platform.

Gusto over QuickBooks

- You want to use more than just a basic health insurance plan for employees.

- You need payroll services for small businesses with limited employees. 😘

- Require an affordable subscription plan for HR management along with payroll services.

QuickBooks over Gusto

- You want to select payroll services according to your needs.

- Want to use the next day direct deposit functionality.

- Need insurance that covers employees across all the 50 US states.

FAQs

No, Gusto only offers payroll processing in the United States.

Yes, the funds are FDIC insured to the standard $250,000 limit*.