Contents

Gusto is a virtual platform that handles payroll processing, taxes and fulfills HR administrative needs.

What does Gusto provide?

The platform provides automated as well as manual payroll options, unlimited pay runs, employee or contractor self-service profiles, payroll tax filings, year-end reports and so much more.

Let’s discuss all that platform has to offer in this extensive and detailed Gusto Review. We will be covering topics such as pricing plans, services, resources, features, customer support, user interface along with pros and cons.

Gusto Overview

The platform was launched in 2012 as ZenPayroll and is headquartered in San Francisco. They currently offer their services to over 200K businesses globally. The company is backed by renowned investors such as T.Rowe Price, General Catalyst, Franklin Templeton, Sands Capital, Glynn Capital and so many more.

Gusto manages basic as well as advanced human resources operations while offering their services at affordable prices. To make employee boarding easier specialized tools are integrated along with additional benefits.😚

Gusto Pricing Plans

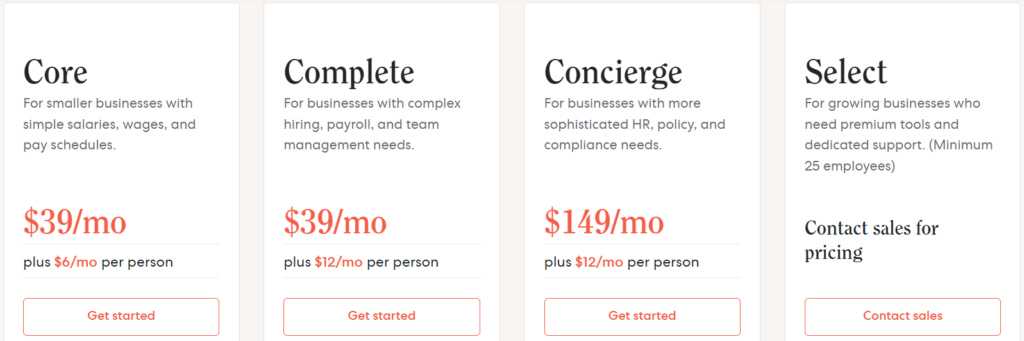

Gusto offers five different kinds of pricing plans depending upon the needs and size of the businesses. The following are the plans organizations can use:

- Core – This is particularly designed and works effectively for small businesses which need simple responsibilities to be taken care of such as to deal with salaries and wages according to the pay schedules. The plan costs $39 on a monthly basis and $6 per month per employee. Some of the features and services incorporated are full service payroll including W-2s and 1099s, Paystubs, tax forms, lifetime access, employee profiles and & self service, employee health benefits, financial benefits, accounting integrations, time tracking, unlimited payroll runs, tax filings, direct deposits, payroll reports, multiple pay rates and schedules, etc.😉

- Complete – Businesses with complex and tedious work operations and team management needs can purchase the “complete” plan. It costs around $39 on a monthly basis and $12 per month per employee. It includes all the “core” plan features along with some added functionalities such as next day direct deposit, PTO management, hiring and onboarding tools, project tracking, unlimited projects, workforce cost reports, performance reviews, automated payroll syncing, etc.

- Concierge – It is specifically curated and works well with companies who have sophisticated HR needs, multiple policy and compliance principles. The plan costs $149 on a monthly basis and $12 per month per employee. Some of the exclusive services offered in this scheme are HR resource center, certified HR pros, compliance alerts and dedicated support team.

- Select – Plan created for exponentially growing businesses which require a dedicated support team and advanced tools for organized working. For price details Gusto’s sales team has to be contacted. Some of the additional attributes are full-service payroll migration, health insurance broker integration, direct access to customer success manager, waived fees and exclusive pricing.

- Contractor Only – The plan is available for contractor only businesses who have so far not hired any W-2 employees. It costs $6 per month per person. It includes unlimited contractor payments across all 50 U.S states, 4-day direct deposit, 1099-NECs at the year end, etc.

Security Measures

Let’s look at some of the measures and protocols Gusto follows in order to secure the product, people and other information.

- Data encryption – Gusto uses TLS v1.2 to protect all the data that’s being transferred back and forth between the user’s browser and Gusto’s servers. It uses AES-256 key encryption to secure the resting data in AWS.

- Data availability – Data is backed up on a regular basis and checklists are executed to verify if the data is being recorded or not.

- Product security – Two-factor authentication acts as an added layer of security to the account and admins can grant limited access permissions to some accounts.

- Information security – The platform maintains a SOC 2 Type II report, follows HIPAA guidelines and sustain business associate agreements.

Business Services

Let’s dive into the beneficial resources Gusto offers to organizations.

Payroll

Just with a few clicks the payroll processing can be initiated and you’ll be done with paying your whole team.

The platform not only calculates the local, state and federal payroll taxes but files them to authorized government agencies. The platform is integrated with features like health insurance, Clover, TSheets, QuickBooks, Trainual, etc.

The automation works wonders by accurately filling up the forms, calculating right tax by tracking the changes in tax laws, stores and organizes Employee I-9s and W-2s & contractor 1099s online, makes contractor payments in more than 80 countries, etc. Let’s look into the payroll attributes in detail.

- Automated taxes – Local, state and federal taxes are calculated, filed and paid automatically without any human interference.

- W-2s and 1099s – The platform issues, files and sends W-2s and 1099s to employees and contractors.

- Child support garnishments – Automatic single or recurring deductions from employee’s salaries to account for wage garnishments. The payment can be sent in all states except South Carolina.

- Payroll on AutoPilot – Payroll can be set to run automatically for each pay period.

- New hire reporting – Government authorities are informed whenever new employees are recruited.

- FLSA Tip credits: Minimum wage requirement – Automatically adjust salaries to meet the minimum wage requirements.

- Gusto debit card – Enables easier access to salaries on payday.

- Unlimited bonus and off-cycle payrolls – Employees can be paid a bonus without having to wait for paydays.

- Multiple pay rates – Employees can be paid at different rates based on their positions and work responsibilities.

Advanced Payroll Features:

- Payroll reports – One can generate and download reports for payroll history, bank transactions, contractor payments, paid time off, tax payments, etc.

- Integrations – Accounting, expense and pre-tax options are integrated such as medical insurance, 401(k), receipt bank, Xero, QuickBooks, etc.

Additional features include easy payroll cancellations, hourly salaried employees, paperless paychecks, multiple states, direct deposit, lifetime accounts, teams, paperless employee onboarding, charitable donations, vacation and sick policies, digital paystubs, no payroll setup fees, digital signatures, collaborations and calendar sync.

Also Read: Gusto Vs Justworks: Which Payroll Platform is Best for You?

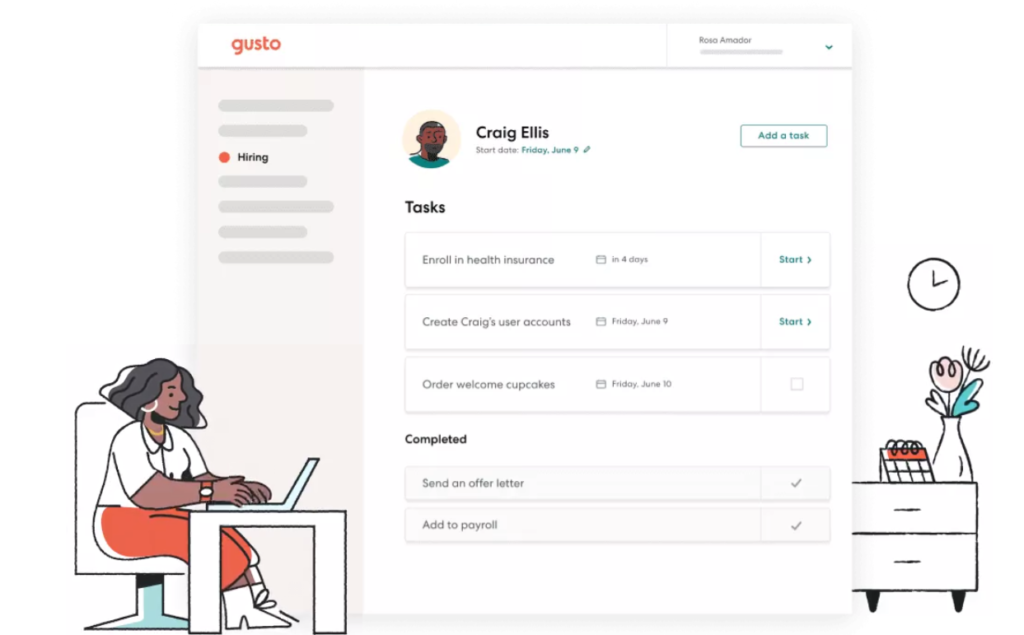

Hiring and Onboarding

Gusto helps organizations in finding and recruiting skilled employees, handles as well as supports them. Job offers are posted on public forums, applications can be tracked and on-boarding checklist generated contains must-haves but can be modified too.

Hiring workflows can be integrated to view and import candidates into payroll. Confidential employee documents can be signed digitally and are stored safely online.

Various tools can be integrated with accounts for quick access such as Livestorm, Microsoft 365, Slack, Zoom, LastPass, Twist, Asana, Box, GitHub, etc. Some of the features are as follows:

- Talent Management – Provides tools that evaluate employee’s performance, improves culture building, provides career development resources and manager reviews.

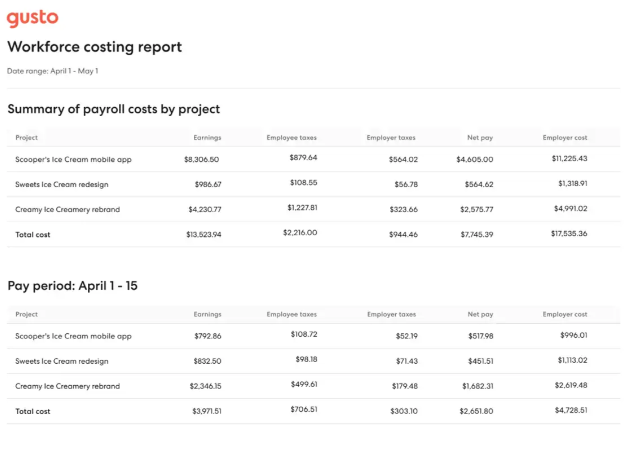

- Insights and reporting – Customizable reports can be prepared to analyze crucial data in order to take effective and accurate decisions. Employee surveys can be done anonymously every month to determine areas of concerns, triumph and trends to take relevant steps of action. Workforce costing tools are also included that tracks each team’s project time, funds used on wages, benefits, etc.

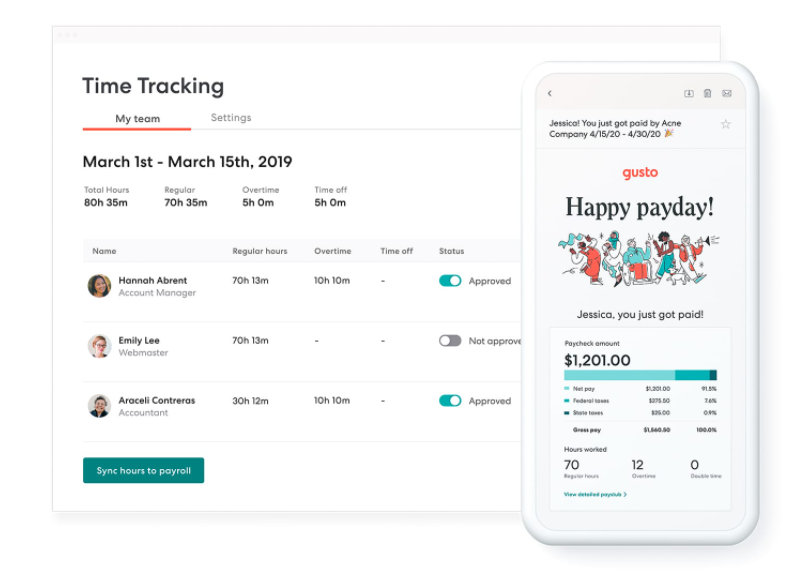

- Time and attendance – Time tracking can be done via automated tools that tracks team member’s working hours, time offs and holidays. Paid holidays and time off policies can be synced while reports can be organized on the basis of date, department or employee. Employees can clock in and out by using Gusto’s mobile app or computer, their presence can be verified with geolocation and once the hours are approved, they are added to the payroll. Projects can be assigned certain funds and hours to meet the deadline.

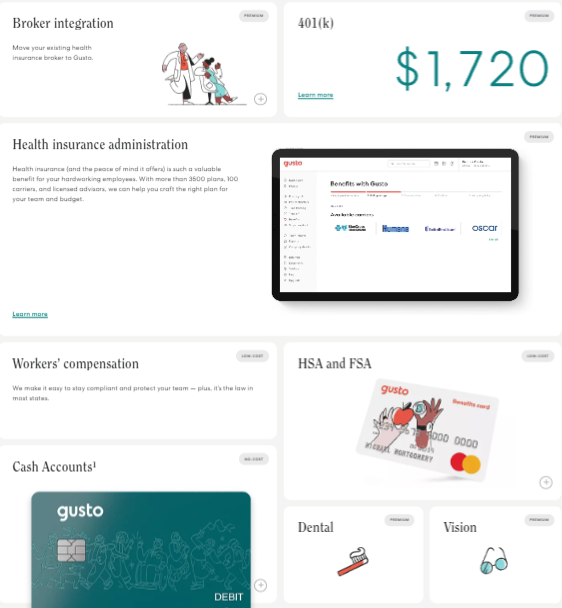

Employee Benefits

Gusto offers affordable financial and health benefits that enterprises can combine to the employees’ packages. Gusto can integrate an individual company’s existing broker and their health plans.

The platform offers over 3500 plans, 100 insurance carriers and licensed advisors so that the company can create a perfect plan for their team while staying within the budget.😍

It offers worker’s compensation, health savings accounts, flexible spending accounts, cash accounts, cash outs, commuter benefits, etc.

- 401(k) plans – Gusto has partnered with Guideline and enables 401(k) savings with no setup fees and minimum number of members. Employees can manage their own accounts and are offered extensive portfolio recommendations. They can adjust contributions according to their needs which can be deducted automatically on every payday.

- HSA – It is a tax-advantaged account for employees who are enrolled in a high-deductible health plan which can be used to pay for health expenses like dental or vision costs. Pre-tax dollars accumulate every year without expiring.

- FSA – Employees can make pre-tax contributions which are pre-funded by the employer and are repaid through payroll deductions. However, the amount can be used to pay for the applicable expenses before the end of the plan year.

- Cashout – Employees can request for a portion of their paycheck in advance. The Cashout loan is automatically repaid through their regular paycheck. The eligibility criteria conditions have to be met which states that an employee must live in a supported area, is an active W-2 worker, is over 18 years old, has been continuously employed for 30 days, has passed a personal information check and is paid via direct deposit.

- Worker’s Compensation – It is a type of insurance that can cover for employees in case they get hurt or sick at work. It can help an employee pay their medical bills, rehabilitation costs and lost wages and can be paid to the employee’s family too.

Types of employee eligibility statuses

- Full time – Employees who work for 30 or more hours a week are always eligible for health benefits.

- Part time – Employees that work between 20 to 29 hours a week are eligible for health benefits depending on the company and the insurance carrier. However, those who work less than 20 hours a week are not eligible for health benefits ever.

- Variable – The number of hours an employee works acts as the deciding factor in whether the employee is eligible for benefits or not.😇

Classification & benefits eligibility

- Health insurance eligibility is based on how benefits are set up between a company and an insurance carrier.

- Commuter benefits eligibility is based on how the company’s benefits package is curated internally.

How to figure out a new employee’s benefit cost?

If the employee benefits are managed by Gusto, you can follow the steps given below to get an estimated idea.

- Login to Gusto admin account.

- Head to the “Benefits” tab.

- Click on “Estimate New Hire Cost”.

- Enter the employee’s personal details (first name, last name and DOB).

- Click on the “Get estimate” button.

The monthly premium cost is estimated according to the employee’s date of birth.

Health Benefits

Some of the health services which are incorporated in an employee’s health plan are ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, preventive and wellness services and chronic disease management, prescription drugs, rehabilitative services and devices, laboratory services, pediatric services, including oral and vision care, etc.

Commuter Benefits

These benefits help employee’s pay for applicable commuting expenses with pre-tax money. Qualified transit expenses include train, subway, bus, vanpool, ferry, lyft line and uber pool (selected cities). Reimbursable parking expenses are parking lots, meters and garages.

Gusto Wallet Mobile App

The mobile application of Gusto wallet (for both iOS and Android) enables employees to manage, track, save and access their salaries. The financial tools offered include cash accounts and cashout. The following can be done via Gusto wallet:

- Spending account & debit card – Employees have access to and can use this free, interest bearing checking account to connect their paydays with banking to get paid 2 days earlier. They are eligible to earn 1.7 times more interest than the national average, can withdraw from over 32K ATMs nationwide and supports Apple Pay as well as Google Pay.

- Savings goals – Employees can create saving goals to achieve greater financial security by preserving a portion of their paychecks every month. The salary contribution for these goals can be modified instantly and in case of emergencies can be transferred to a spending account easily.

- Cashout – In case of emergencies, a first time cashout user can request up to 40% of their estimated salary to be deposited in their external bank account. However, a small transactional fee is charged which could either be $5 or 36% APR of the loan amount (whichever fee has a minimum amount).

- Paycheck Splitter – Employees can update their direct deposit split allocation, divide their paycheck and can submit them into multiple accounts automatically.

- Paychecks and tax documents – Paycheck breakdown consists of hours, taxes, deductions, etc which can be analyzed thoroughly. Easy access to tax documents including W-2s and W-4s.

- Time tracking – Employees can manage, review, edit and remove their hours through Gusto wallet.

- Benefit cards & personal details – If an employee is enrolled in tax-advantaged accounts or some kind of insurance which are brokered by Gusto, then they can access the plans, track their transactions as well as update some personal information.

HR Experts

The HR resource center enables customers to contact certified HR professionals to get quick and reliable solutions to their HR related struggles and challenges.

The HR pros can be asked for help if the issues persist in topics such as employee handbooks, PTO, benefit forms, law alert updates, job descriptions, documentation, conflict management, hiring best practices, etc.😊

It is to be kept in mind that only the designated HR resource center admin in Gusto can reach out to the HR pros. The ticket has to be submitted in order to initiate the conversation.

How to contact HR pros?

- Login to your Gusto account.

- Head to the “HR Resources” tab.

- enter the HR Resource Center portal by clicking on any of the tiles on the portal.

- Click on the “HR-On Demand” tile.

- Click on “Ask the Pro”, enter the question in the field and submit your question.

It is to be noted that, HR resource center is available to clients with a Concierge plan only.

Time off

Gusto offers various kinds of time off policies that employers can choose to set up from. The following are the types: bereavement, floating holidays, jury duty, paid time off, parental leave, holidays, sick leaves, personal day, volunteer, weather, unpaid and custom policy.

Carryover balance and rollovers – The either of the following options can be used to handle the carryover limits at the end of the year; let all the hours to rollover or set a limit to 0 for the “max carryover” amount if you do not wish hours to be carried over. Employees can view information such as available hours, requested hours, earning policy, pending requests, approved requests, declined, sick time, etc.

How to request for time offs?

Follow the steps given below to request time offs by your employers:

- Select the “Time Off” tab.

- In case the organization offers multiple time off policies, click on the one you wish to request time off from.

- Click on the “Request Time Off” button.

- Select the days for time off (Full days, partial days, a single date or multiple dates).

- Though optional, you can attach a note to your employer specifying the reason for request.

- Click on the “Send Request” button.😚

Time tools

Time tracking – If the employees are hired on multiple different pay rates, then the hours are tracked on a per workweek basis. The Fair Labor Standards Act requires employers to pay at least one and half times an employee’s regular rate of pay after 40 hours of work in a workweek.

Track employee hours – Hourly W-2 employees can clock in and out during each shift or manually enter and modify the hours for every day.

How can employees track their hours?

- Login to your Gusto account.

- In case there are multiple pay rates, select the role you are clocking in for by selecting the Time Tracking tile present on the dashboard.

- Click on the “Clock In” button.

- Click one the “Clock Out” option when your shift is complete.

- To manually add the hours, click on the “Add Hours” option and select the clock in and clock out time for the day.

Project tracking – Projects can be created and the related workforce costs can be determined through this feature. Employees can track the time they spent on tasks and projects. The detailed report and real time insights are generated indicating the cost of team member’s time which includes salaries, benefits, taxes, worker’s compensation, etc.

How to access real time project insights?

- Head to the “Time tools” section and click on “Time tracking”.

- Click on the “Projects” tile.

- Click on the “Insights” tab and press the “Filter” button.

- Select the information you want to view and click on “Filter”.

It is to be noted that Project time tracking is currently available to Complete and Concierge customers only. 😍

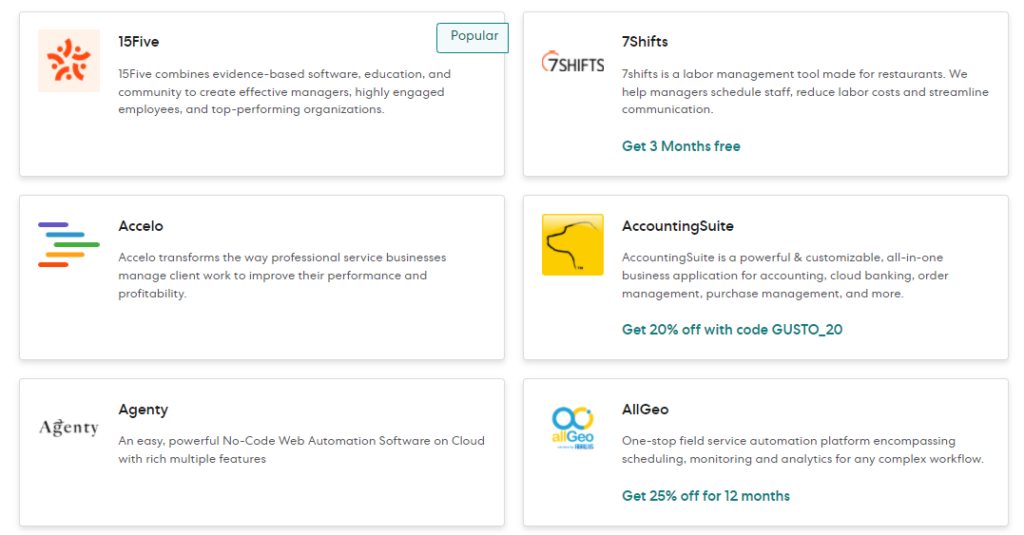

Third-party Software Integrations

Gusto offers a plethora of app directories and software integrations which enables you to run and operate your business seamlessly. The platform provides applications and integrations for various purposes some of which are as follows:

- Accounting – Aplos, Freshbooks, Quickbooks Online, Xero, etc.

- Business operations – Clover, Shopify, Brex, Capbase, etc.

- Collaborations – Google Workspace, Microsoft 365, Zoom, Asana, Dropbox, etc.

- Expense management – Expensify, Expense Management, etc.

- Legal & compliance – Capbase, Secureframe, Vanta, Hyperproof, etc.

- Performance management – 15Five, Bonusly, Empuls, etc.

- Tax preparation – Ardius, Clarus R+D, TaxTaker, YearEnd, etc.

- Time tracking – Homebase, When I Work, Deputy, QuickBooks Time, etc.

- Insights and analytics – Pave, Dataddo, The Calculate Hub, etc.

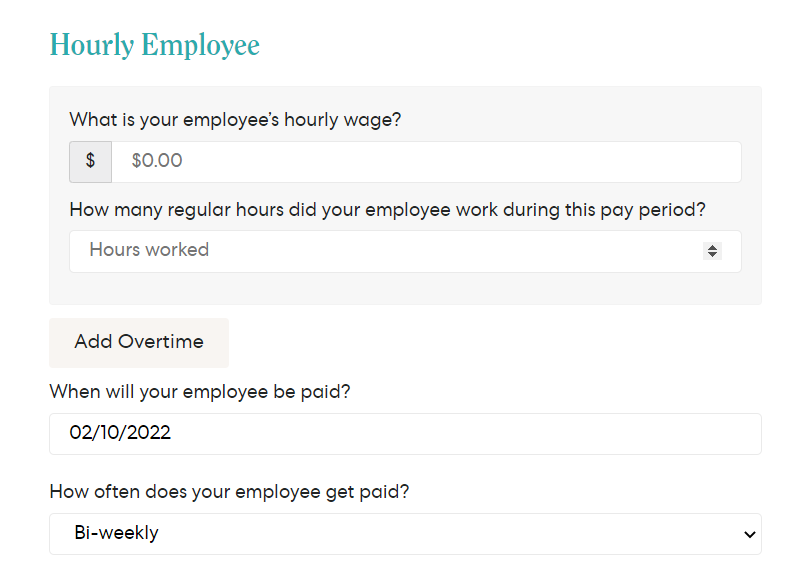

Calculators

Gusto provides a number of HR work related calculators and tools to make the operations easy and quick to deal with. For example: hourly paycheck, salary paycheck, payroll tax, employer tax, burn rate calculator, salary comparison tool and new hire checklist.

User Experience & Customer Support

Gusto has an intuitive platform with an easy-to-use interface. It has minimalistic designing that’s pleasant to work with. The navigation bar can be used for quick access to almost every service and resource. Help center consists of extensive documentation with detailed explanations.

It consists of videos, business guides, frequently asked questions along with blogs. The company’s representatives can be contacted via live chat, email and phone call services which are available from 8am – 5pm MST Monday to Friday.

Pros and Cons

👍 Pros

- Provides easy contractor and employee full payroll services and HR related resources and tools

- Can automatically calculate, file and submit the taxes accurately.

- Gusto offers multiple courses like People Advisory certification and Accelerator program to help users build their own People Advisory practice at their firm.

- Offers excellent customer support, API and software integrations, simple to understand and use dashboard, features like time tracking, hiring & onboarding tools, employee benefits, etc.

👎 Cons

- Gusto services are limited to all the 50 states of the U.S, yes, they do not operate on a global level just yet.

- The per person criteria for pricing can get quite expensive when businesses start scaling up.

Gusto – At a Glance

Let’s wrap up our Gusto review by summing up all that we have covered so far.

- Gusto offers their services starting from just $6 per month/ person.

- It is a great platform for people who want to use and exploit the following features for good; full payroll, automated tax filings, time and project tracking, employee benefits, PTO, reports, insights, experts help, insurances, robust hiring and onboarding along with few additional functionalities.

- The platform is easy to use, offers mobile applications, follows robust security measures and has pretty good customer care services.

This Might be Helpful: ZenBusiness Review: Is It Really Helpful To Start A Business?

FAQs 🤔

Yes, Gusto is great for small businesses since they offer their services based on number of employees, making it affordable. Easy setup, intuitive dashboard and comes jam-packed with useful resources and features.

Gusto was launched in 2012 as ZenPayroll and has survived in the market ever since. They are backed by renowned investors and are valued at $3.8 billion as of July, 2019.