Contents

Searching for the Best Accounting Software for your Business Growth?💰 📊

Well, here you will Explore a deep dive into the leading software solutions that redefine accounting excellence And Dive into our comprehensive guide on the best accounting software solutions available, tailored to meet your business needs.📈 💸

Accounting Software is an automated software that is responsible for maintaining accounts and records of clients for organizations.

Being an accounting software it also tracks payments and expenses made and received by clients which helps to keep the data organized.

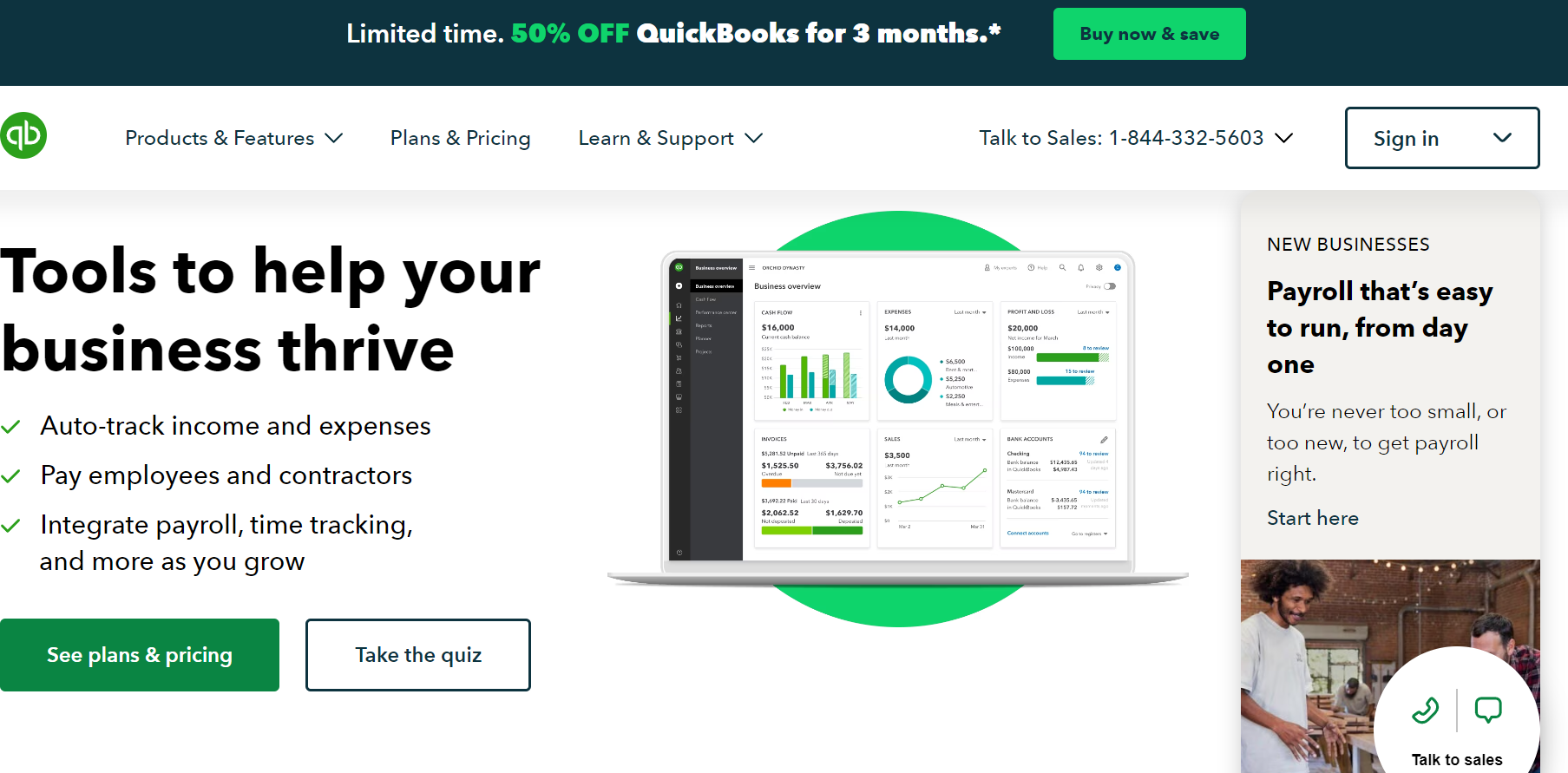

QuickBooks

QuickBooks is an accounting software that tracks and reports the income and expenses of the users, it also makes and receives payments for users from their clients and helps them to manage their financial health.

Features of QuickBooks

Income and Expenses

This feature of QuickBooks keeps track of the income and expenses of the users by regularly updating their accounts for them so that users know how much they have received and where they spent. It maintains the data of the transactions made by users to make the information available for future reference.

Reporting

Reporting is an essential part of any software or application as it provides real insights into the platform and actions taken on the platform.

So QuickBooks too provides tools for reporting in which it initially creates various reports based on the data of the accounts of the clients and further it suggests the steps that need to be taken for the growth of the business. It helps companies to track their position in the market and also improve their chances of growth.

E-commerce tools

It provides tools that regulate bills and payments for online commercial platforms and also allows the platform to be integrated with QuickBooks which further regulates the payments received or earned on the commercial platform.

It automatically brings the orders and payments to the user company and maintains the account, it stores each detail of the transactions received so that the commercial platform can know how much they earned and what the profit made.

Pros and Cons of QuickBooks

👍 Pros

- It helps users to choose the suitable plan by providing complete information and checking their requirements

- It has a few free tools that include Invoice Generator, Timesheet Calculator, Paycheck Calculator, etc which can be accessed by anyone

- It keeps regular track of the time which helps you to pay the tax and interest on time so that you can be saved from extra fines

- They have tutorials on their official website to learn the functioning and use of features of the software

- It has a user-friendly interface that helps beginners to learn it easily

👎 Cons

- It offers limited customization for invoice

- Allows a limited number of clients to be managed on an account

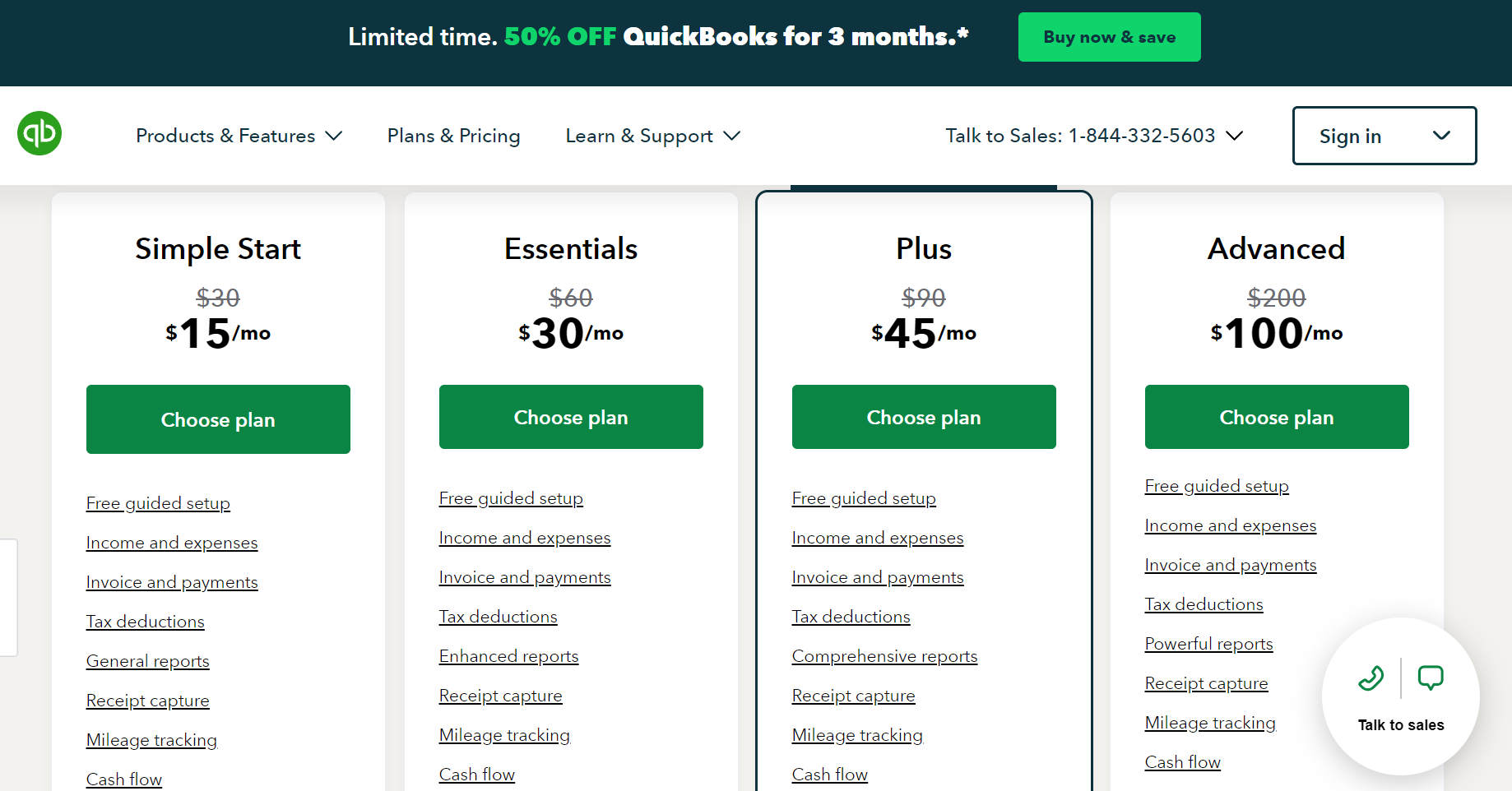

Pricing Plan of QuickBooks

- Simple start – $30/month

- Essentials – $60/month

- Plus – $90/month

- Advanced – $200/month

It offers a 50% discount on all of its plans if bought now for three months without any free trial.

NetSuite

NetSuite is primarily a cloud software that is responsible for maintaining the accounts, expenses, and taxes for respective organizations.

Features of NetSuite

Cash Management

This is one of the most relevant features of NetSuite that manages the cash flow and provides real insights into the finances of the users. It helps in making accounting efficient and accurate which will also help in creating an accurate and valuable financial data report.

Automation

The feature of automation allows the tools and other features to generate & function automatically based on the user’s requirements. It automatically generates bills, stores and arranges data, generates Invoices, files return, updates the software with laws, etc. This feature of NetSuite saves accountants and teams from manual work that can take more time and capital.

Flexible accessibility

Being a cloud software it stores data in such a way that it can be accessed anywhere anytime if needed. This reduces so much for the users by providing them flexible access to the software and data which can be presented in the way that they want to see it.

Pros and Cons of NetSuite

👍 Pros

- It allows banks to integrate with the software that further manages the data of bank transactions and store the information in a certain desirable format

- It allows flexible payments, one can make and receive payment accordingly which saves the user’s time and efforts

- It supports various Integrations that make accounting error-free and efficient as well

- It automatically maintains the data after the invoice is paid preventing further distractions

- Provides various advanced features and management systems for making accounts updated and organized

👎 Cons

- Reporting can be limitedly customized that cannot fulfill each user’s need

- Can cost extra for advanced tools and additional clients

- It makes take longer for beginners to get used to the functioning of the software

FreshBooks

It is an accounting software that helps businesses to keep accounts of payments, bills, and expenses in an organized way. It is preferable for small-scale businesses and freelancing, as they have many unorganized clients so it sends invoices to them and accepts payments from them.

Features of FreshBooks

Accounting Tools

FreshBooks provides various tools for accounting which include Free Invoice Generator, Accounting Templates, Invoice Templates, and Business Name Generator. It allows its users to customize the tools responsible for their business accounting, which further keeps track of billing, invoicing, and payment receipt.

Integration

This accounting software has the feature of integration that facilitates more than 100 third-party applications to work with FreshBooks.

These applications include Google, PayPal, Slack, Gusto, etc and it functions with these applications to keep the data organized and structured for the business or client.

This feature enables companies to utilise the time efficiently which also helps them to back other apps up.

Time tracking

It is one of the most important features of FreshBooks that keeps track of hours that have been spent on a project by the team. It can be accessed from Chrome too which makes it easy and convenient to use for optimizing the productivity of the business.

Must Read:

- Freshworks vs Salesforce: Which One Is The Best?

- Freshservice Review: Is It Worth The Price? [Truth]

Pros and Cons of FreshBooks

👍 Pros

- It allows customization of Invoices i.e; one can choose desirable templates, colors, and fonts for the Invoice that will be generated

- It generates Invoices for free

- It functions for multiple currencies along with USD

- Its tools and functioning can be customized according to users’ or businesses’ needs

- It provides a platform for an individual to earn through Affiliate marketing & Referral Program

- It offers discounts on certain plans

👎 Cons

- It accounts for limited users and generates & accepts bills for limited clients

- It doesn’t provide access to the full audit trail to any business accountant

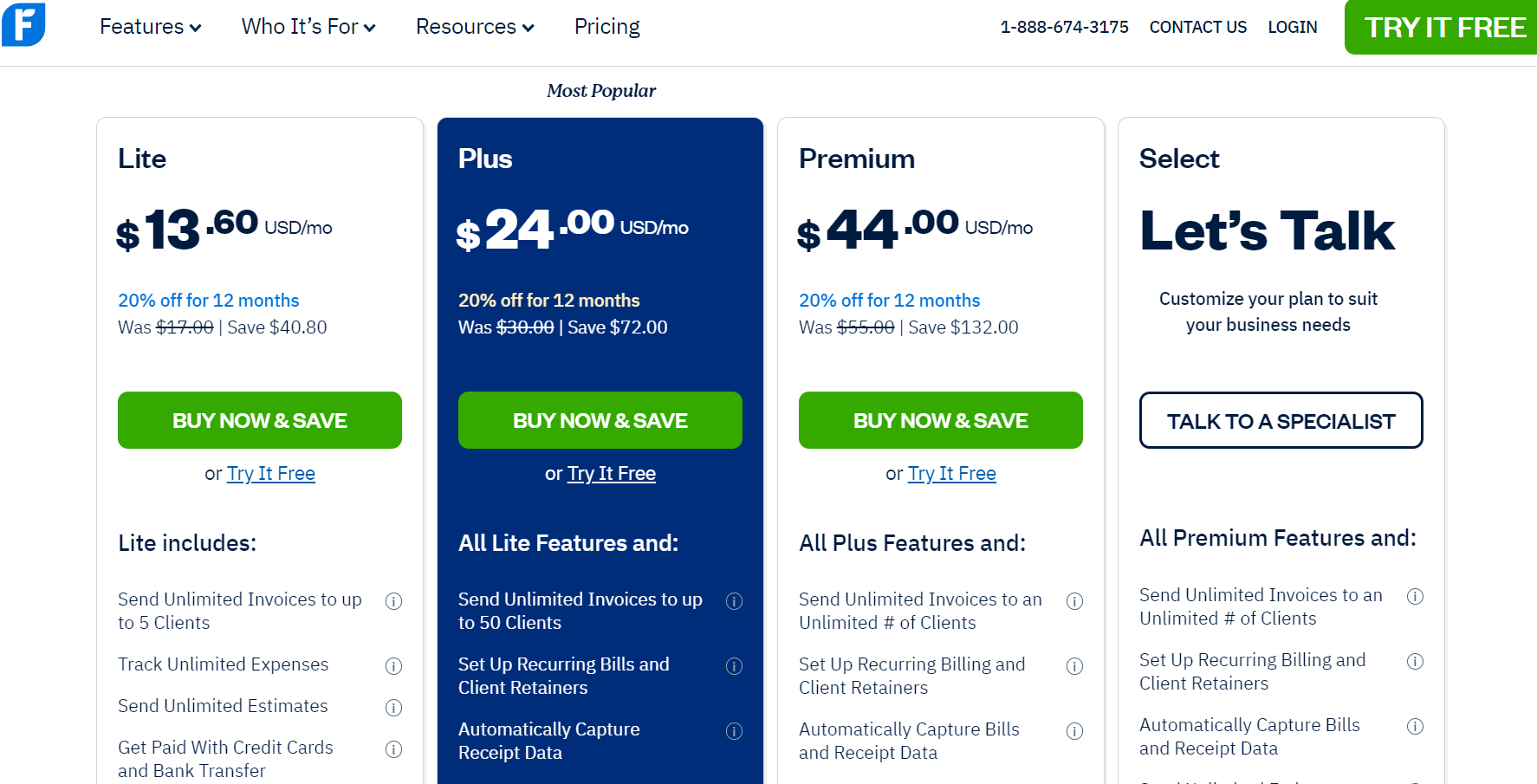

Pricing Plan of FreshBooks

Original pricing

- Lite – $ 17/month

$204/ year

- Plus – $30/month

$360/year

- Premium – $55/month

$ 660/ year

- Select – Custom (Based on Business needs)

Discounted price

- Lite – $13.60/month

$142.80/ year

- Plus – $24/month

$252/year

- Premium – $44/month

$462/year

- Select – Custom (Based on Business Needs)

Xero

Xero is an online accounting software used by small businesses for paying bills, claiming & managing expenses and it also provides a platform where clients as well as staff can come together for managing their accounts.

Must Read:

Features of Xero

Xero Tax

It manages tax for the users as it performs all the required tasks related to tax like filing tax returns and lodging returns. Businesses need to be updated with the latest laws and regulations regarding tax and Xero Tax helps users with compliance with requirements.

Reporting & Analytics

Xero keeps regular track of users’ finances and accounts by organizing all the data in certain ways. It also analyses the flow of cash, reports, and financial health, it further presents the possible future of finance of the business. This feature of Xero allows users to see their finances in an arranged and organized form.

Dashboard

This feature of Xero is responsible for the maintenance of bills & payments, and management of finance, and it also creates and sends invoices to the respective clients. It also secures the flow of bank transactions by connecting the Bank to Xero.

Pros and Cons of Xero

👍 Pros

- It keeps track of fixed assets and keeps updating them accordingly.

- It allows other applications to integrate, which further provides necessary services to make the accounting more accurate and efficient

- It also has an application that can be accessed on the phone that allows users to use it anywhere

- It can maintain accounts for more than 150 currencies which makes Xero a globally functional software

👎 Cons

- It may take longer for beginners to set up the software and understand the features of the application

- Its customer support can be slower in responding to any query

Pricing Plan of Xero

- Starter – $25/ month

- Standard – $40/month

- Premium – $54/month

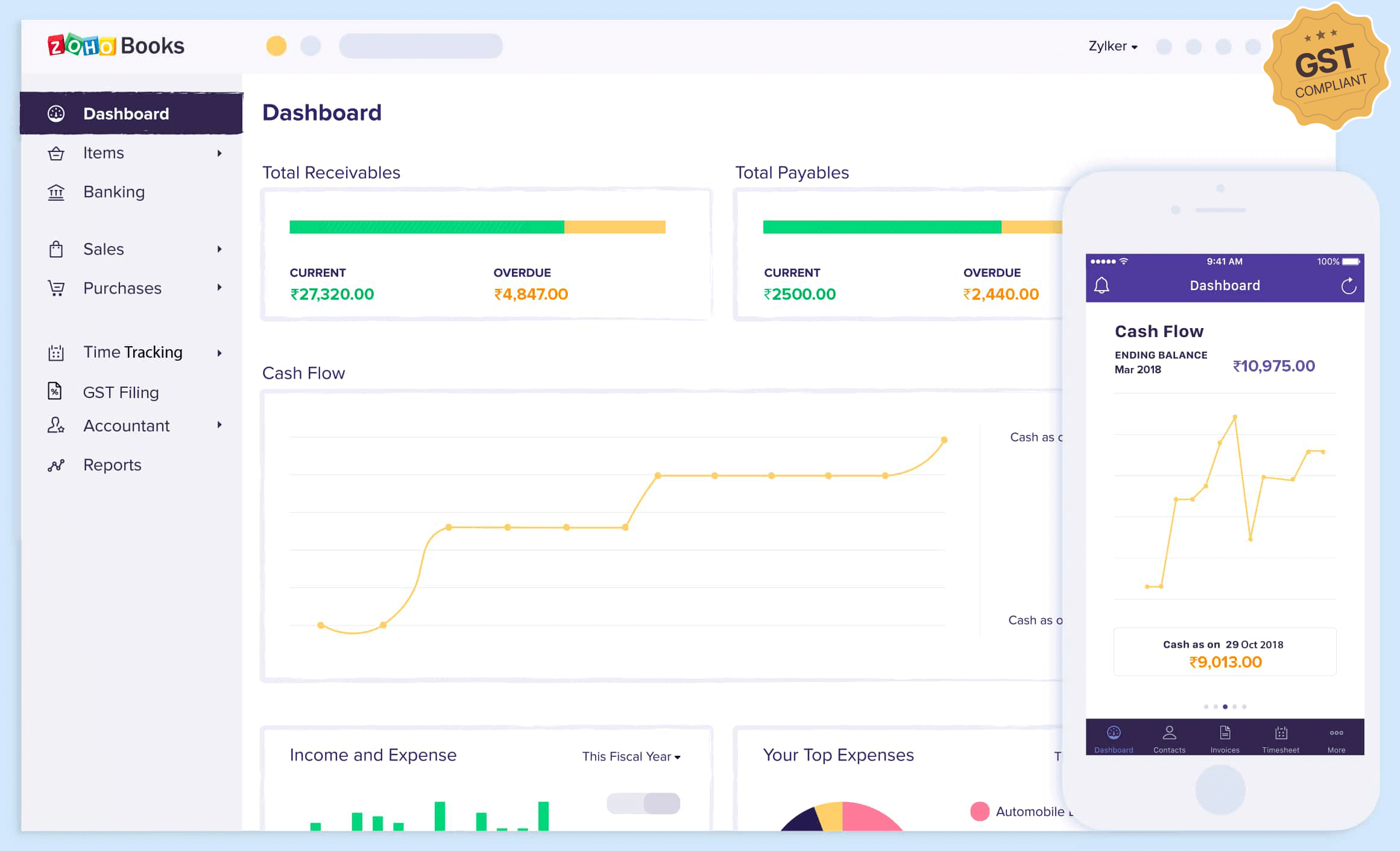

Zoho Books

Zoho Books is one of the most used accounting software for tracking accounts from ZOHO, stocks, bank transactions, and other financial health making it an all-in-one platform for managing business finance.

Features of Zoho Books

Invoicing

This feature of Zoho Books allows one to automatically create invoices and one can customize the invoice in the format that they want. It also helps users to get fast and easy payment by facilitating a secure online payment service to clients.

Compliance

It helps its users to maintain their finance while keeping all the rules and guidelines of IRS which is an important part of accounting. If it’s not done on time the industry can face charges, so this feature of Zoho Books makes sure that the users don’t need to worry about their tax, returns and other financial issues which also saves the manual efforts of the accounting team.

Portal service

Provides a specific portal for customers too, that helps them to monitor and regulate transactions made.

It arranges the data of their payments and other expenses in an easy-to-understand format which they can access at any time and check their account and financial activities.

It also allows them to upload receipts and payment information so that they can keep track of their cash flow.

Pros and Cons of Zoho Books

👍 Pros

- It provides a platform for companies to partner up with consultants to grow their business.

- It keeps users’ accounts up to date regarding laws and taxes

- Its support service is quite active and responds to each query of the user regarding the use of the software

- It facilitates a platform to reconcile with the respective banks

- It is available for Windows as well as iOS & Android

👎 Cons

- It doesn’t support flexible integration

- It allows a limited number of clients for the particular account being managed

- It doesn’t have a Payroll facility on its platform.

Pricing Plan of Zoho Books

Billed Monthly

- Standard – $20 per organization/month

- Professional – $50 per organization/month

- Premium -$70 per organization/month

- Elite – $150 per organization/month

- Ultimate – $275 per organization/month

Billed Annually

- Standard – $15 per organization/month

- Professional – $40 per organization/month

- Premium – $60 per organization/month

- Elite – $120 per organization/month

- Ultimate – $240 per organization/month

Conclusion – Final Say

Good accounting software makes running your business easier. It helps you see how your money is doing anytime, does regular tasks for you, and cuts down on mistakes.

Nowadays you can use some AI financial tools to make your accounting & financing activities more efficient

It keeps your bills, paychecks, and stock in order, making things run without problems. It keeps your information safe and follows rules easily, which means less worry for you.

With this software, you can make better choices, help your business grow, and keep things running smoothly. It lets you focus more on the main parts of your business and keeping customers happy.