Contents

Have you been mulling over whether to use Justworks payroll and administrative management services or not for your organization? 😊

Don’t worry, we’ve got you covered. In this detailed Justworks review we will be covering the majority of the aspects of the platform including onboarding procedure, pricing & plans, payroll features, HR compliance and tools, Employee benefits and customer support along with some frequently asked questions.

Justworks Overview

Founded in 2012, Justworks is headquartered in New York, NY and has received $50M in the latest E series funding. The venture is backed by numerous reputable investors like Union Square Ventures, Bain capital, Redpoint, Spark Capital, FirstMark, Index Ventures, Thrive Capital to name a few.

The platform endorses itself by a catchphrase and I quote “Justworks takes the busyness out of growing a business and alleviates the unknown” and honestly that is all that we really want.

You are allowed to run payroll which is made super easy for you, automatic tax filings for your W-2 and 1099 workers, can create profiles for salaried, full-time, part-time, hourly, contract workers as well as vendors, configure payments cycle according to your policies, create employee benefit plans and so much more. 😍

You might be wondering what makes Justworks different from any other payroll services? Well for starters, Justworks is a certified and accredited professional employer organization which sets it apart from other basic platforms. Let us get into the hefty details about various categories of the platform at hand.

Justworks Onboarding Process

To start using Justworks’ services and tools for your company, you firstly need to create an account on the platform. It usually takes a couple of minutes to register, follow the steps given below to do the same.

- Head to the official Justworks site and click on the “Get Started” button present at the top right corner of the home page.

- You’ll be redirected to a page where you need to fill a form asking for details regarding your identity and company. Enter the information such as email address, legal name, phone number, company’s name, number of employees, health insurance option and current payroll provider if any.

- After filling the entire form, click on the “Submit” button.

Also Read: Gusto Review: Is It Legit Payroll & HR Platform?

Justworks Pricing & Plans

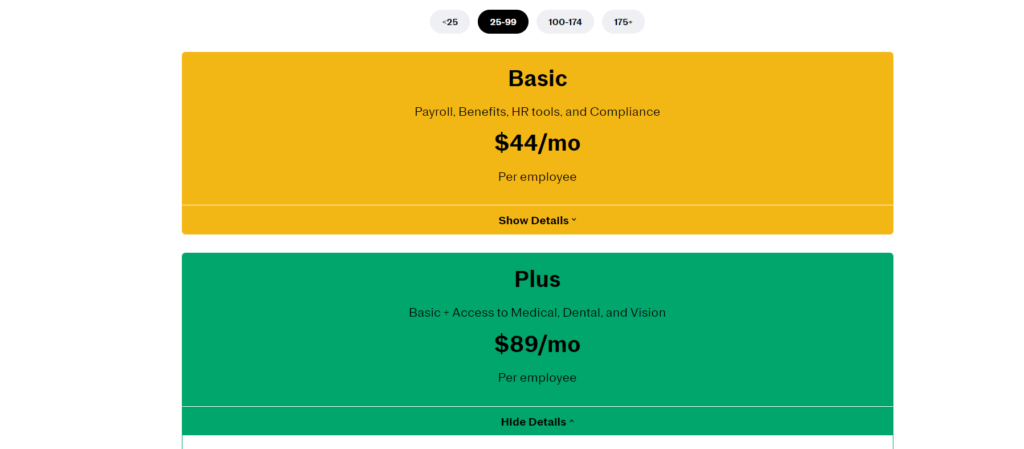

One of the most important deciding factors without any question comes down to the pricing structure. Justworks provides two different kinds of pricing models distinguished by health benefits inclusion. The pricing structure depends on the number of employees you’re subscribing to the plan for.

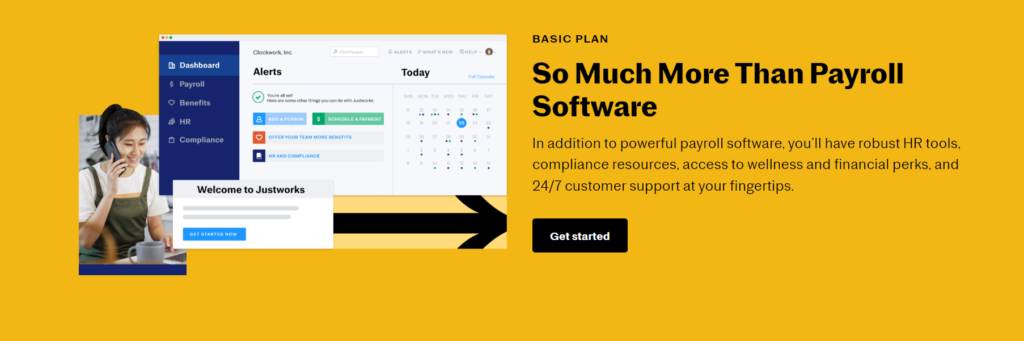

Justworks Basic

If your organization has employees less than 25 you are charged $49 per month for every employee. For a total of employees between 25 to 99, you’ll have to pay $44 per employee for a month and for a number of employees between 100 to 174 you’ll be charged $39 per employee per month. 😚

However, if your company has equal to or more than 175 workers you will receive a quoted price instead of a fixed one.

Some of the features included are as follows; Payroll For Salaried And Hourly Employees, Off-Cycle Payments, Vendor & Contractor Payments, Support From Certified Hr Consultants, W-2 & 1099 Filings, Unemployment Insurance Filings, Hr Consulting, Online Employee Onboarding, Harassment Prevention & Inclusion Trainings, Pto Management, Accounting Software Integrations, Plan Setup, Commuter Benefits, E-Signature, etc.

Justworks Plus

If you have fewer than 25 employees you’ll have to pay $99 for every employee each month, for 25 to 99 employees you’ll have to pay $89 and $79 per employee for 100 to 174 employees. Similar to the “Basic” plan for employees more than 174, you get a particular quoted price.

Along with the “Basic” plan you are offered functionalities such as COBRA administration, One medical and Health advocacy services.

You also have access to add ons which you have to pay additionally such as Workers’ Comp (required), Life & Disability Insurance, Health & Wellness Perks, Fitness Memberships, 401(k), Dental and vision insurance, Health savings account (HSA) and flexible spending account (FSA) access, Time Tracking and medical insurance.

Justworks Benefits

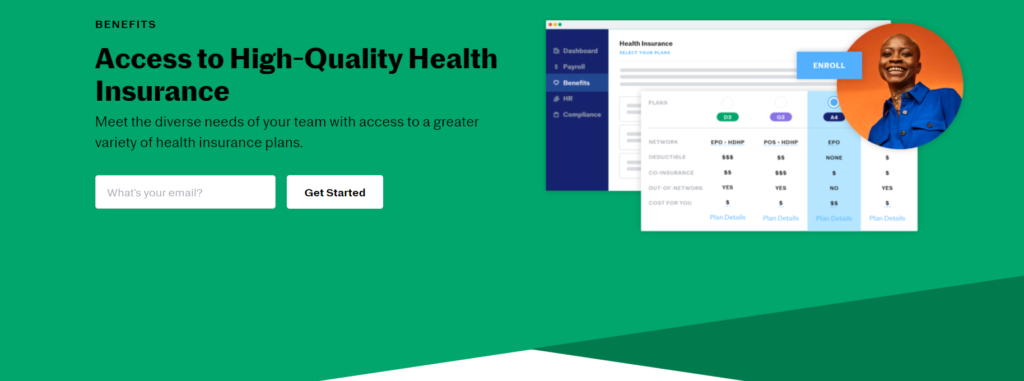

You can customize high quality benefits coverage for all your team members. Since Justworks directly contacts health insurance carriers you can be assured that you’ll have access to the best health insurance plans.

The additional perks of using Justworks’ benefits is that all your employees can access One Medical’s on-demand primary care services as well as Health Advocate’s personal health advocacy services at no extra charge.

The quoted price of health insurance renewals for your employees are accurately predicted according to your requirements during the data driven underwriting process.

As far as who all are eligible for benefits question is considered, the answer is, everyone. All full-time employees, part-time employees (an average of least 30 hours of service per week) and specific owners are eligible for benefits.

Health Savings Account

It is a tax advantaged account eligible only for employees enrolled in a qualified high deductible health plan. HSA accounts let you make tax-free contributions which can be paid for health insurance.

It covers expenses like doctor and hospital visits, prescriptions, co-payments, eyeglasses, long-term care insurance premiums and COBRA premiums. Employees can change their HSA contributions at any time they want and can withdraw the whole amount available in their account.

Flexible Spending Accounts

Justworks provides two different types of FSA accounts, namely, Healthcare and Dependent Care FSA. FSAs allow employees to use their pre-tax dollars to settle out-of-pocket health insurance or dependent care expenses. The total pre-tax amount decided to be kept aside by an employee is deducted for an entire calendar year from each paycheck in equal proportions.

Healthcare FSA – The maximum amount limit which can be invested in Healthcare FSA is $2,850. You can use it to cover medical, vision, dental co-pays and deductible expenses.

Dependent Care FSA – Your employees are covered for work-related cost of care for a qualifying dependent. To be a qualified dependent either of the following categories should be fulfilled; A tax dependent of the employee who is under age 13 or an elderly parent or a spouse (physically or mentally incapable of self-care).

Also Read: ZenBusiness Review: Can It Help To Start A Business?

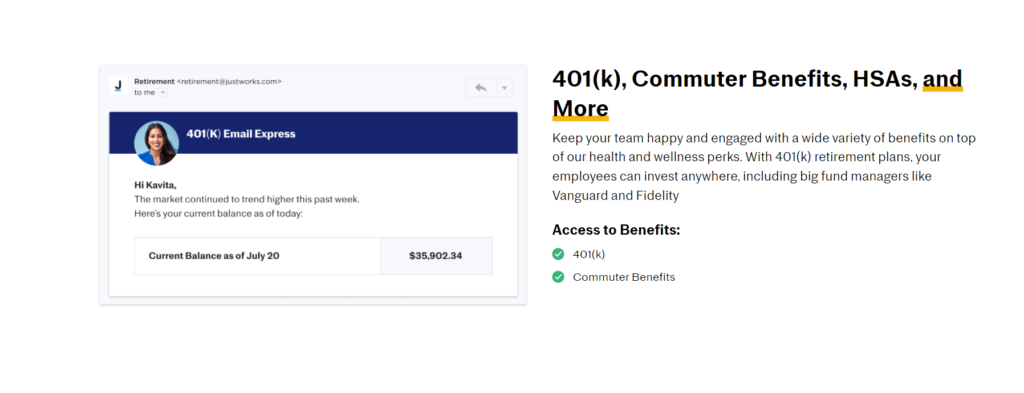

401(k)

Justowrks help you set up a 401(k) account for your employees through a tie up with Slavic 401(k) allowing you to have access to funds from top notch financial institutions. You can get support from institutions like Fidelity, Schwab and Vanguard.

Commuter Benefits

It reimburses your employees via pre-tax dollars against qualified work related transportation and parking expenses. The pre-tax amount limit imposed by the IRS states that an employee can contribute or use upto $560 on a monthly basis for commuter benefits including transit and parking. 😇

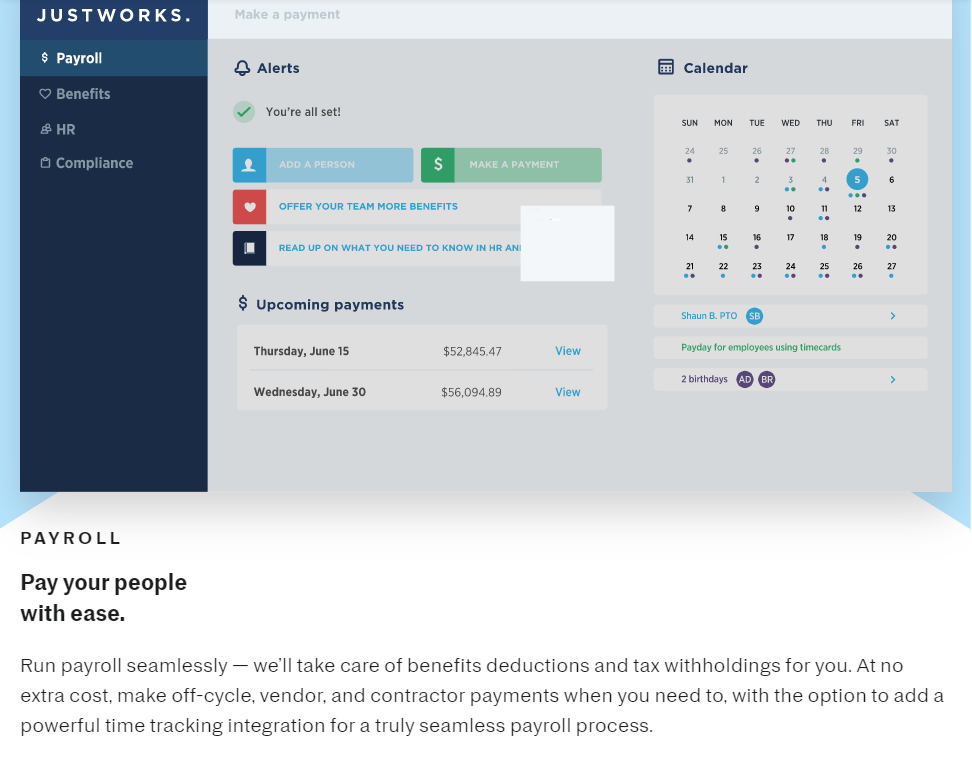

Justworks Payroll

You can very effortlessly pay both salaried and hourly employees working for you, make one-off commission or reimbursement payments, automate direct deposits, follow payroll tax and employment regulations and so much more using a simplified payroll system. Let us discuss the main aspects related to payroll in detail.

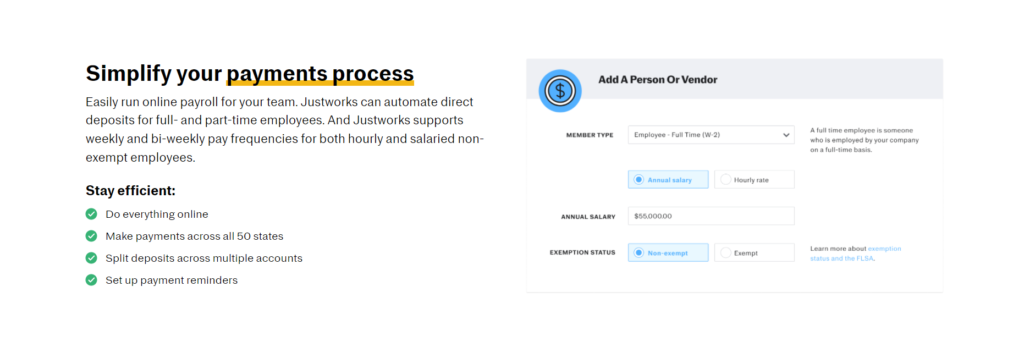

Payment Processing

Justworks lets you automate and simplify everything related to payroll including deposits, off cycle payments, expense reimbursements, etc.

Although the payments are debited from a single verified company account which was set up during organization configuration, the salaries can be split up to be deposited in multiple accounts. You can send payments to all 50 US states and can set up reminders in order to process them timely.

Payment Management

Justworks allows you to automate and pay off domestic payments to all your vendors and contractors across all the 50 states. You can make payments which include bonuses, automated direct deposit, commissions, one-time payments, reimbursements and overtime payments.

Comply With Taxes & Employment Regulations

Justworks takes care of payroll tax filings of W-2s and 1099s, offers resources and support that help you stay compliant and update you on employment regulations.

State Unemployment Insurance (For Employers) – It is calculated on factors like wage base which specifies the maximum amount of your earnings that can be taxed in a given year and rate (based on the number of former employees that filed unemployment claims in the past).

Local and State Income Tax – Local income tax depends on your work and residential location. Every state imposes their own varying income tax along with the federal income taxes.

Justworks HR Tools

The platform provides numerous HR administrative resources, integrations and tools to let you manage and handle your team and related tasks easily. 😉

Hiring And Onboarding

You can quickly hire highly skilled employees and get them onboard in just a few simple steps. You get tools that help you maintain a company directory and set up your employee handbook while Justworks file your W-2’s, update I-9 information on file and paperwork associated with out-of-state employees.

Paid Days Off Tracking

You can manage, track and approve more than just mere vacation and sick leaves with the help of Justworks tools. You have access to mark and categorize the paid offs in the following divisions; floating holidays, jury duty, bereavement leave, volunteer time and leave of absence.

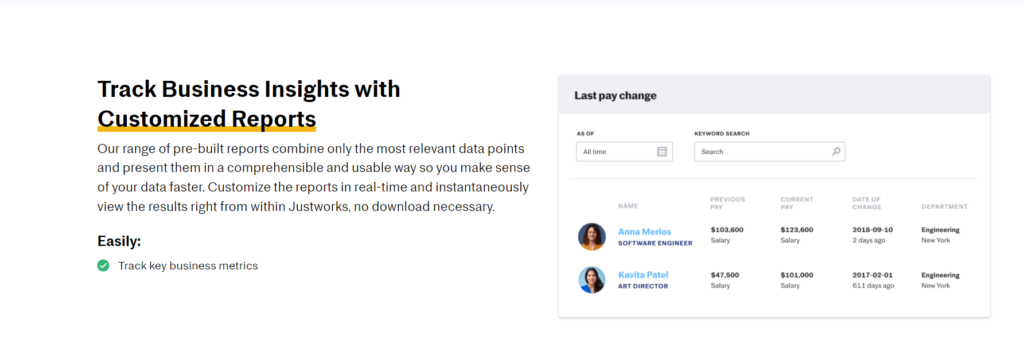

Insights And Reporting

Justworks offers multiple tools and pre-built reports divided and dedicated to various topics which lets you gain important business insights. Some of the included reports are as follows; PTO Balance, Training Status Report, Onboarding Status, Last Pay Change, Headcount, Work History, Timecard usage, etc

Also Read: Gusto Vs Justworks: Which Payroll Platform is Best for You?

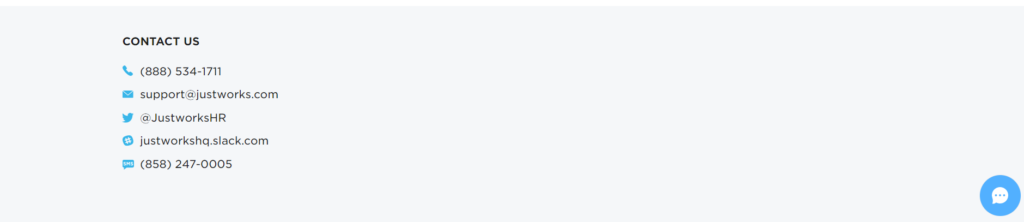

Justworks Customer Care

Better the customer care services, more reliable the services automatically becomes. So here’s what all you have access to regarding both the self help and expert choices. The platform offers a Resource center as well as Help center, both of which incorporate articles, guides, and featured videos.

You also have access to webinars, newsletters, various events along with dedicated product updates pages, employment law updates, Referral Program and MWBE Directory. You can reach out to Justworks’ support team via five different methods which includes phone, email, live chat, SMS, and Slack.

You connect and join Justworks’ various social forums to become a part of the community on platforms such as Instagram, YouTube, Facebook, Twitter and LinkedIn.

Justworks Review – Final Conclusion

Wrapping up our Justworks review by summarizing all that we have covered so far. Justworks is a PEO which can partner up with your organization to serve as a co-employer. The platform offers multiple benefits which can be assigned to your team members resulting in greater employee satisfaction.

You get access to top tier HR tools, compliance, insights and reports, payroll tools, integrations, time tracking tools and so much more along with great customer support. The only downside, the prices are a little higher than their competitors.

FAQs 🤔

Newly hired employees have 30 days to pick their desired plans. According to Justworks, employees are eligible for benefits after the first month of their joining date. The eligibility date however can be delayed if your particular company has set up a 30 or 60-day waiting period.

No, HSA funds never expire and can be rolled over at the end of the calendar year.

Absolutely yes. They help you navigate and understand complex health issues, provide mental health services, work & life services along with significant savings on medical and dental bills.