Contents

Ready to supercharge your tax season? 🚀

Look no further than TurboTax! This user-friendly tax software simplifies the filing process and helps you maximize your returns. With TurboTax by your side, filing your taxes is a breeze.

Say goodbye to stress and hello to savings! 💰💡 Don’t miss out on the opportunity to get every deduction you deserve.

Discover why TurboTax is the go-to choice for millions of taxpayers and unlock your full tax-saving potential! 💼👨💼

Unlock The TurboTax Coupon Code Now!

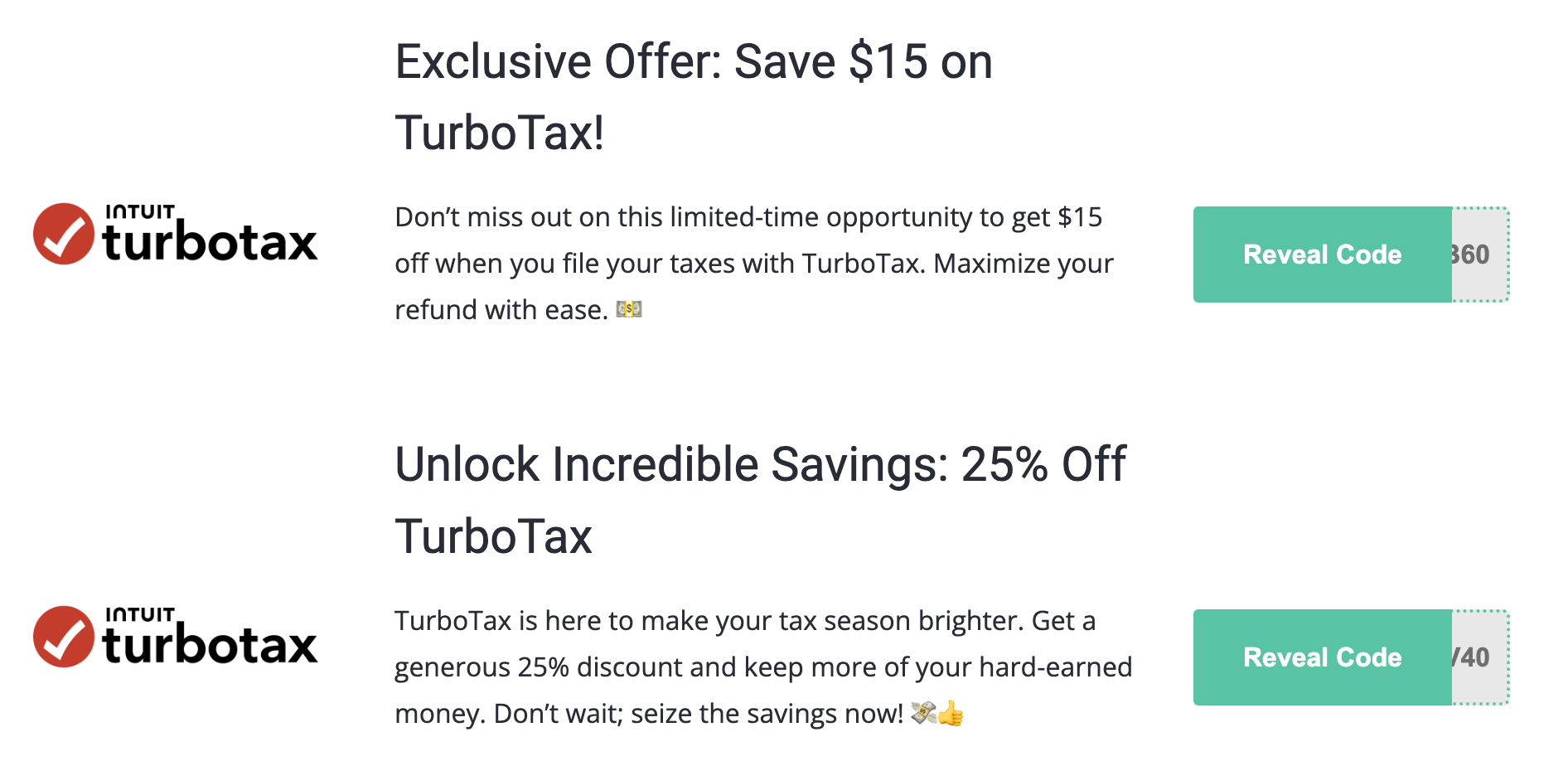

Exclusive Offer: Save $15 on TurboTax!

Don’t miss out on this limited-time opportunity to get $15 off when you file your taxes with TurboTax. Maximize your refund with ease. 💵

Unlock Incredible Savings: 25% Off TurboTax

TurboTax is here to make your tax season brighter. Get a generous 25% discount and keep more of your hard-earned money. Don’t wait; seize the savings now! 💸👍

TurboTax Mega Savings: Up to 40% Off! 🚀💰

Unlock incredible tax savings with TurboTax! Get up to 40% off on their top-tier tax preparation services. Ensure your maximum refund while paying less. Don’t miss out on these fantastic discounts – file your taxes the smart way! 💸📈

Save $34 on Your First Tax Filing!

It’s your first time filing taxes, and we’ve got you covered. Enjoy a $34 discount on your initial tax preparation with TurboTax. Get the expert assistance you need to maximize your deductions and ensure a smooth filing process.

How To Apply Your TurboTax Coupon Code?

Step 1: Begin by choosing your preferred TurboTax coupon code from the options provided.

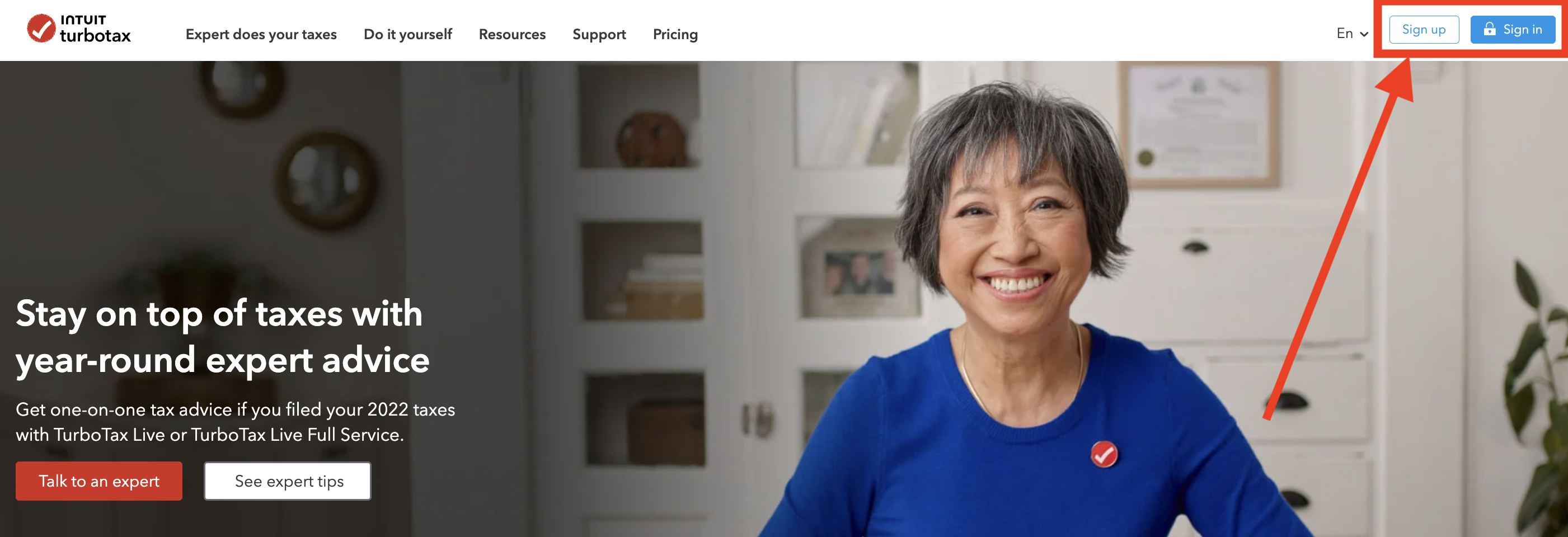

Step 2: Clicking on the coupon code will automatically redirect you to the official TurboTax website.

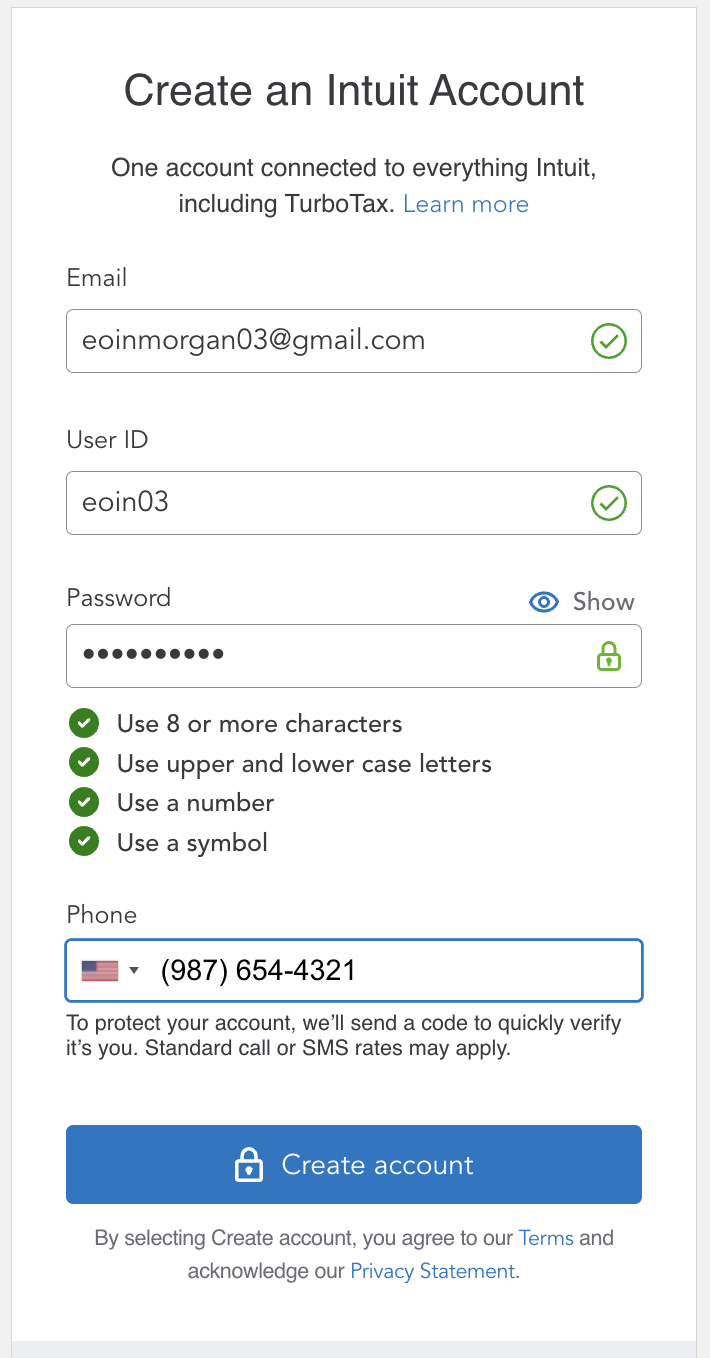

Step 3: If you’re a new user, click “Sign Up” and complete your account registration by providing your personal details.

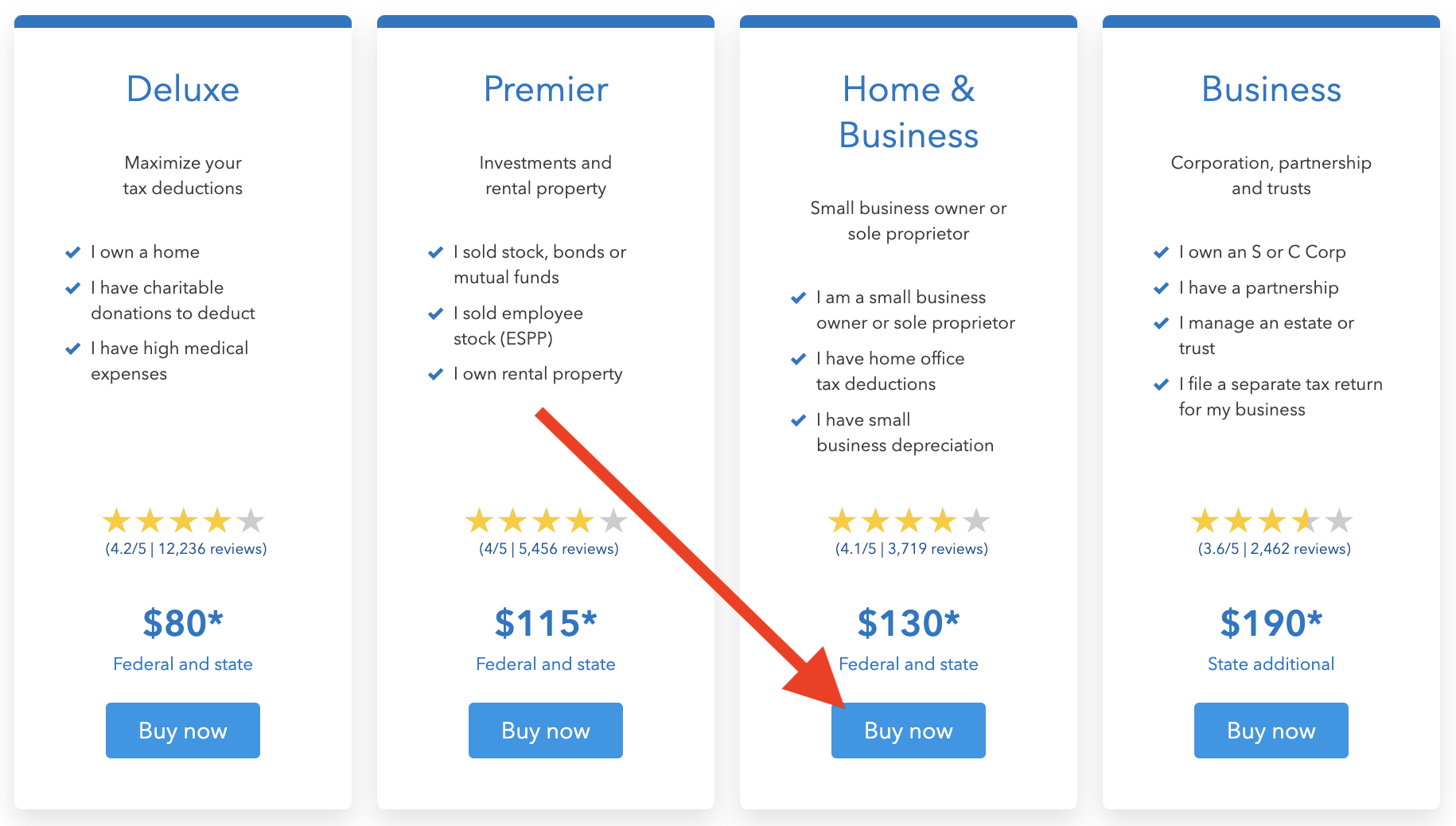

Step 4: Pick the tax filing package that aligns with your needs and is eligible for the coupon code you have.

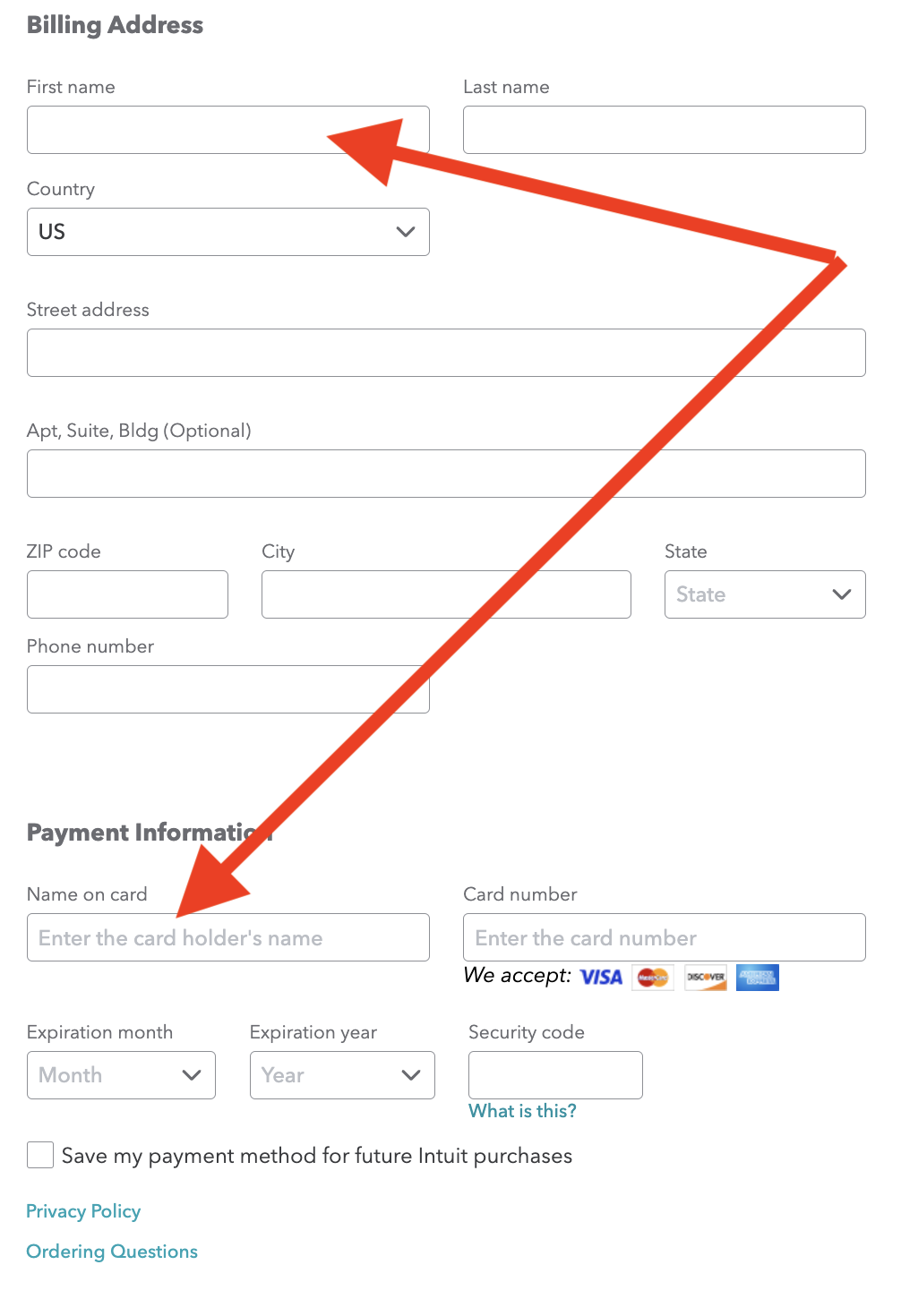

Step 5: Fill in your billing address and enter your credit card details for payment.

Step 6: If the discount is confirmed and you’re satisfied with the revised price, complete the transaction to proceed with your tax filing.

How Much Money You Can Save?

One of the primary ways to save money with TurboTax is by taking advantage of their exclusive discounts and coupon codes.

These discounts can vary in terms of the amount you save, but they can provide significant reductions in your overall tax preparation expenses. Whether it’s a percentage off your total cost or a fixed dollar amount, these coupon codes are designed to make tax preparation more affordable.

For example, with coupon code “SAVEBIG20,” you might receive a 20% discount on your chosen TurboTax plan. Similarly, “TAXSAVINGS” could provide a $30 reduction in your total cost. These discounts can lead to substantial savings, especially if you have a more complex tax situation.

Furthermore, TurboTax offers specific discounts for students, teachers, and military personnel. Students can save up to $1,000 in education credits, while teachers enjoy an extra 10% off their tax preparation expenses. Enlisted and reserve military personnel can even file their federal and state taxes for free, making it an excellent way to save.

What To Do If These Promo Code Isn’t Working?

- Double-Check the Code: Ensure that you have entered the promo code correctly. Sometimes, a simple typo can prevent the code from working.

- Check the Expiration Date: Promo codes have expiration dates. Make sure the code you’re using is still valid.

- Review the Terms and Conditions: Some promo codes have specific terms and conditions, such as a minimum purchase requirement or restrictions on which products they apply to. Verify that you meet these criteria.

- Clear Your Browser Cache: Clear your browser’s cache and cookies. Sometimes, stored data can interfere with applying promo codes.

- Try a Different Browser or Device: Switch to a different web browser or device to see if the issue persists. Occasionally, certain settings or extensions can affect code application.

Why To Choose TurboTax Software?

Choose TurboTax for effortless tax filing. With user-friendly software, expert guidance, and maximum refunds, TurboTax simplifies your taxes.

Let us see reliable benefits:

1. Reliable Tax Filing with TurboTax

TurboTax, a leading tax preparation software, is known for its commitment to helping taxpayers navigate the complexities of the U.S. tax system. While it may come with a higher price tag compared to some other tax software, the reliability and range of services offered by TurboTax make it a top choice for many individuals and businesses.

2. Pricing Options to Fit Your Needs

TurboTax offers a range of pricing options to cater to different tax scenarios. Their free version is perfect for simple tax returns, including the 1040 and state filing, without the need for itemization or extensive schedules.

For more complex situations, their paid packages, including Deluxe and Premium, enable filers to itemize deductions, claim various tax credits, and even handle business income and expenses. This variety of packages ensures that you only pay for the features you require.

3. Free Version with Premium Features

TurboTax’s free version covers a lot, allowing you to file a 1040, claim earned income tax credits, child tax credits, and deduct student loan interest. It’s a cost-effective choice for those with straightforward tax situations.

4. Ease of Use and Comprehensive Support

One of TurboTax’s standout features is its user-friendly interface, designed to feel like a conversation with a tax preparer.

Whether you’re a first-time user or returning, TurboTax guides you through the process, making sure you claim every eligible deduction and credit. Their contextual help, including videos and explanations, simplifies tax jargon and ensures you stay informed.

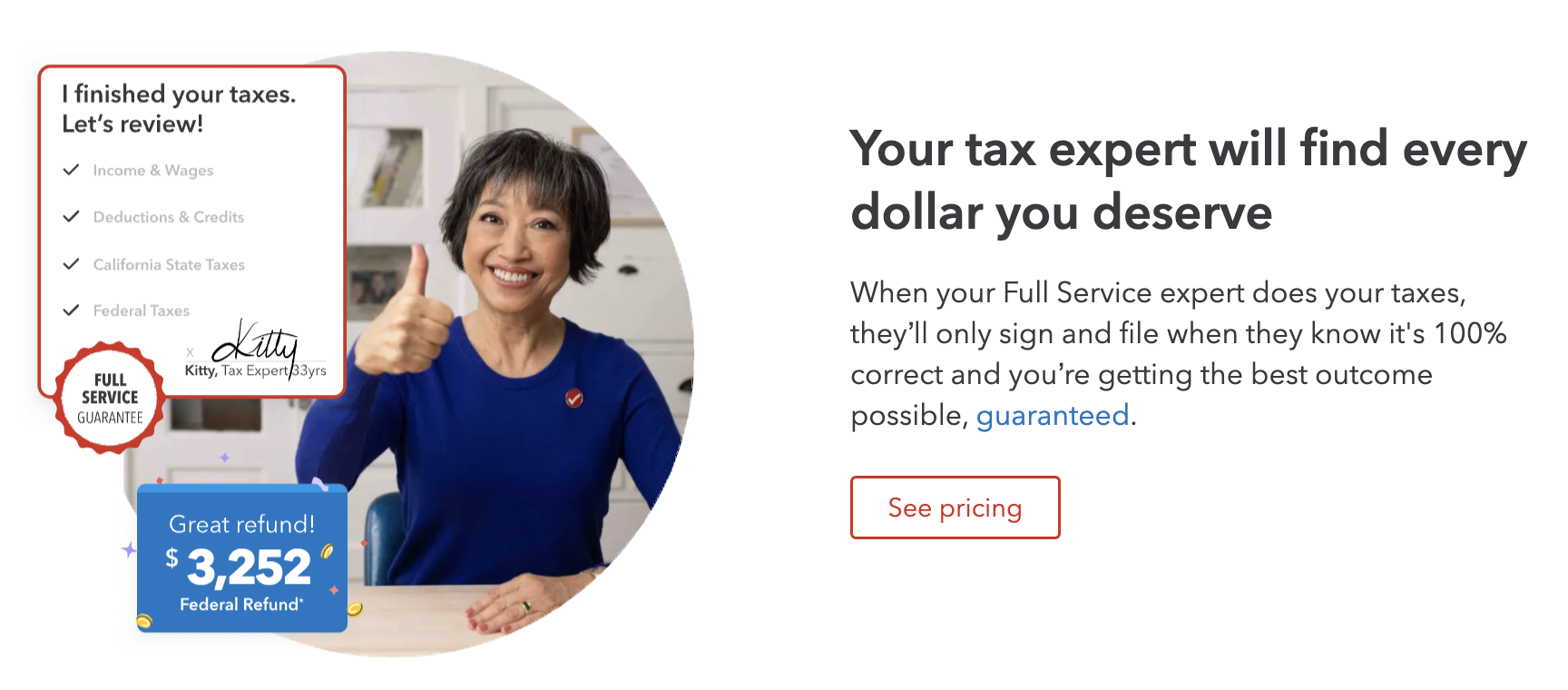

5. Human Tax Help at Your Fingertips

TurboTax offers a unique feature called TurboTax Live Assisted, where you can access tax professionals via screen sharing, phone, or chat. This option ensures you have support and guidance throughout your filing process. If you opt for Live Full Service, a tax expert can handle your entire return, providing extra peace of mind.

6. Audit Support and Defense

In the unlikely event of an audit, TurboTax has your back. They provide free audit support from a tax professional to help you understand the process and prepare accordingly. If you require representation before the IRS, their audit defense product, MAX, offers full support, including identity theft monitoring and restoration.

7. A Variety of Support Options

TurboTax offers various support options, including a searchable knowledge base, forums, calculators, and video tutorials.

Tech support is accessible via the TurboTax Digital Assistant, contact forms, or direct assistance from a TurboTax specialist for paid packages.

How You Can Save, Even Without a Working Discount Code

Saving money on your tax preparation is always a smart move. While TurboTax discount codes are a great way to reduce your expenses, there are alternative strategies to save, even when you don’t have a working discount code:

1. Choose the Right TurboTax Package: TurboTax offers various packages to cater to different tax situations. Select the one that aligns with your needs without paying for unnecessary features. This ensures you’re not overspending on services you won’t use.

2. File Early: Take advantage of early-bird discounts that many tax software providers, including TurboTax, offer at the beginning of the tax season. Filing your taxes early can lead to significant cost savings.

3. Utilize the Free Version: If your financial situation is relatively simple, you can use TurboTax’s free version. This option allows you to file your taxes without any cost, which can lead to substantial savings.

Pricing Plan

🔵 Deluxe: Maximize your deductions for $80* Own a home? Charitable donations? High medical expenses? This one’s for you!

🟣 Premier: For investments and rental property at $115* Sold stocks, bonds, or mutual funds? Employee stock (ESPP)? Own rental property? Dive in!

🟢 Home & Business: Small business owners or sole proprietors at $130* Got a small business? Home office deductions? Small business depreciation? This one’s your match!

🔴 Business: For corporations, partnerships, and trusts at $190* Own an S or C Corp? Manage a partnership, estate, or trust? Separate tax return for your business? Check it out!

💡 Get ready to file with TurboTax’s tailored solutions. *Prices subject to change. Federal and state included!

Try Risk-Free With a 60-Day Money Back Guarantee.

TurboTax Money-Back Guarantee: File with confidence, TurboTax has your back! 🚀

- Lifetime Guarantee: We offer a comprehensive package, including 100% Accurate Calculations, Maximum Refund, and Audit Support Guarantees, all valid for a remarkable 7 years.

- 100% Accurate Calculations: Rest easy knowing we’ll cover any IRS or state penalties resulting from TurboTax calculation errors. We’ve got you!

- Maximum Refund: We’re committed to getting you the best refund possible. If another method gets you more, we’ll refund your TurboTax purchase price. 💰

- Audit Support: In case of an audit based on your TurboTax return, our experts are here to provide one-on-one support. TurboTax’s got your back during audits!

- Full Service Guarantee: When our experts handle your taxes, we guarantee a 100% correct filing for the best outcome. See? We’re committed to your success! ✅

- Expert-Approved Guarantee: Our tax experts are here to help. If they make an error leading to IRS or state penalties, we’ve got you covered. TurboTax stands by you! 🤝

- Satisfaction Guaranteed: Try TurboTax Online for free until you’re satisfied, and only pay when you’re ready to file. We’re here to ensure you’re content with the results. 😃

With TurboTax, you’re in safe hands from start to finish! 📊

Quick Links:

- Incfile Review: Is It Legit? Or A Good LLC Platform?

- ZenBusiness Vs Incfile: Which One Is Best LLC Website?

- ZenBusiness Review: Can It Help To Start A Business?

From Where Did We Get These Coupon Codes?

At TurboTax, we’re all about helping you save while simplifying your taxes. Our coupon codes come from various trusted sources, ensuring you get the best deals. You can find them on our official website, promotional emails, and affiliated partners.

Also, check out special seasonal offers and events like Black Friday, Cyber Monday, and more. TurboTax ensures that you have access to money-saving options when you need them most. Get ready to maximize your savings! 💰

🔥 Conclusion

TurboTax coupon codes are your golden ticket to a more affordable and hassle-free tax preparation experience. With a variety of discounts and savings opportunities, including percentage-off deals, free trials, and more, TurboTax helps you keep your hard-earned money in your pocket while ensuring that your tax return is accurate and reliable.

So, why pay full price when you can use TurboTax coupon codes to save? With the convenience, accuracy, and affordability of TurboTax, you’ll be on your way to a stress-free tax season in no time.

It’s time to put more money back in your wallet and less to the IRS – and TurboTax coupon codes are here to make that happen. Don’t miss out on the chance to maximize your tax savings today!

FAQs

Yes, TurboTax offers a free version for simple tax returns, including 1040 forms. However, more complex returns may require paid versions.

To use a TurboTax coupon code, select your desired product and enter the code during the checkout process. The discount will be applied to your purchase.

TurboTax coupon codes and discounts are available on the official website, through promotional emails, and on partner websites during special events like Black Friday and Cyber Monday.

TurboTax offers packages like Home & Business for small business owners, helping them navigate complex tax situations, including deductions, depreciation, and more.