Contents

Incfile offers business formation services and helps you focus on your niche instead of tediously tiring stuff.

The platform handles everything from choosing a name for your company, to LLC filing to bookkeeping while guiding you through all the processes. 😉

In this Incfile review we will be covering entity types, offered services, pricing plans, customer support along with pros and cons.

What is Incfile?

Founded in 2004, Incfile is one of the most popular and trusted business formation service platforms headquartered in Houston, Texas. They have assisted over 500,000 entrepreneurs and small business owners through paperwork,taxes and accounting which ultimately lead to the growth of their organisations.

The platform charges no fee excluding the state fee to launch your business. You can choose any of the three available subscription plans, though the prices are dependent on factors such as entity type and state of formation.

Pricing Plans

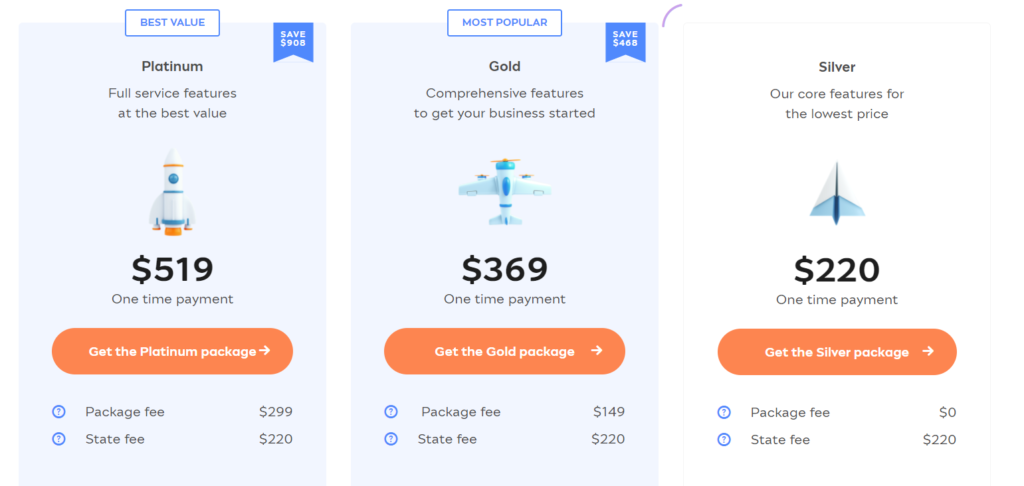

Incfile offers three different pricing plans which includes a variety of features depending on the plan you select, namely, Silver, Gold and Platinum.

The quoted price includes both the package and state filing fee. For example, considering LLC as entity type and Washing DC as a state of formation, it would have costed $220 for silver, $369 for gold and $519 for platinum. 😇

- Silver – It consists of all the Incfile’s core features and charges $0 as a package fee. The quoted price, however, would include the state filing fee also. Some of the functionalities offered in this plan are as follows; preparing & filing the articles of organization, unlimited name searches, free registered agent service for a year and statement of organizer.

- Gold – The package costs $149 excluding the state fees. In addition to all the core features it also offers the following comprehensive facilities; EIN business tax number, IRS form 2553, operating agreement, banking resolution, lifetime company alerts, online access dashboard, unlimited phone & email support, business banking account and business tax consultation.

- Platinum – The quoted price includes a package fee of $299 plus the state filing cost. It consists of all the Gold plan features along with business contract templates, expedited filing, domain name and business email.

Incfile Entity Types

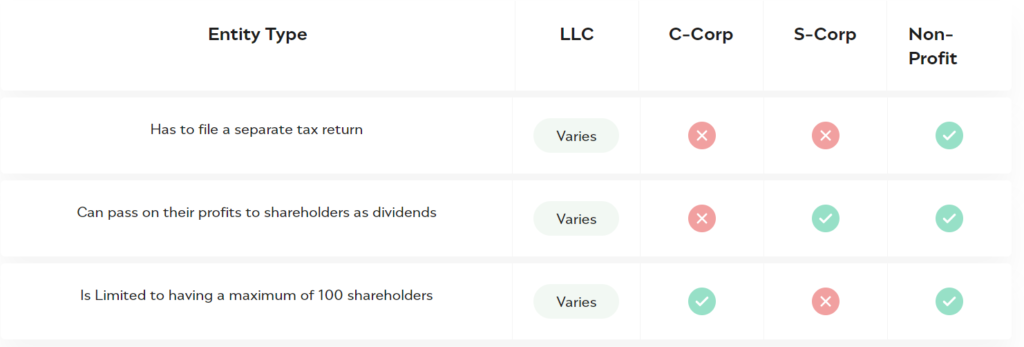

The platform supports four different types of entities, namely, LLC, S Corporation, C Corporation and Non-profit Corporation.

Limited Liability Company

LLC is the newest form of business corporation which needs less requirements and provides more flexibility in regard to ownership.

It is often described as a combination of a corporation and a partnership, however, is an excellent choice for sole proprietors since it provides the protection for your personal assets without the complexity and rigid regulations of a corporation.

One of the key aspects of LLC is that it has a choice in how it is treated as in reference to a taxable entity. It is federally taxed as a partnership in the case of a multi-member LLC and considered as a sole proprietor in the case of a single member LLC. 😍

LLCs are also flexible when it comes to how they distribute the profits. In LLC, members can distribute the net income or profits of the company in different proportions to the ownership percentage.

S Corporation

For a company to be a S corporation, a business owner must first be a C corporation before filing 2553 form. They do have greater operational and ownership constraints in comparison to LLCs, however, offer significant tax advantages.

One of the benefits of S corporation is that it is subjected to pass through taxation which implies that the federal income tax is not assessed at the entity level. You also have legal safeguards for your personal assets that are separate from the business’s assets.

Being the proprietor of a S Corporation allows you to define your income for tax purposes, where you can be an employee too. It doesn’t hurt that ownership of S Corporation can be easily transferred to another without significant tax impact or termination of the entire entity.

The following are the business requirements to be eligible for S corporation status:

- Shareholder should be a resident alien.

- The eligible shareholders include individuals, trusts and real estate whereas partnerships, businesses, or non-resident foreign shareholders are not allowed.

- Should bear only one class of stock

- Must not be an ineligible entity such as a financial institution, insurance company, domestic international distributor, etc.

- Form 2553 has to be submitted in order to achieve legal entity status S for tax purposes.

C Corporation

C corporation is one of the ways through which one can legally reorganize a business for various purposes such as tax, regulations, etc. Through this you can structure ownership of a firm and contrast it with other popular business formats like LLCs, S Corporations, Sole Proprietorships, etc.

The following steps have to be followed in order to file for a C entity status. 😚

- Pick a legal name for your new business.

- File “Article of Incorporation” to the applicable Secretary of state.

- Finalize your initial investors and shareholders while also creating your stock certificates.

- Apply for a business license from your state, county and township if required.

- Apply for necessary certificates which you might need to conduct your business.

- Get an “Employer Identification Number (EIN) from the IRS which can be filed online or complete form SS-4. Also complete any other required formalities which are asked by your state and local government agencies.

Non-profit Corporation

The main purpose of non-profit organizations is to help the society by donating the profits generated by them. It saves directors, officers and employees of an organization from a potential liability since they are exempted from federal, sales and property taxes.

Incfile Services

- Registered Agent – The registered agent is the official recipient of legal documents and correspondence for all types of entities. The service is renewed annually and can be managed via Registered Agent Dashboard. The annual fee for the Registered Agent service costs $119. The processes are uploaded to the dashboard and an email alert regarding the same is sent to inform you that the documents have been uploaded to your account.

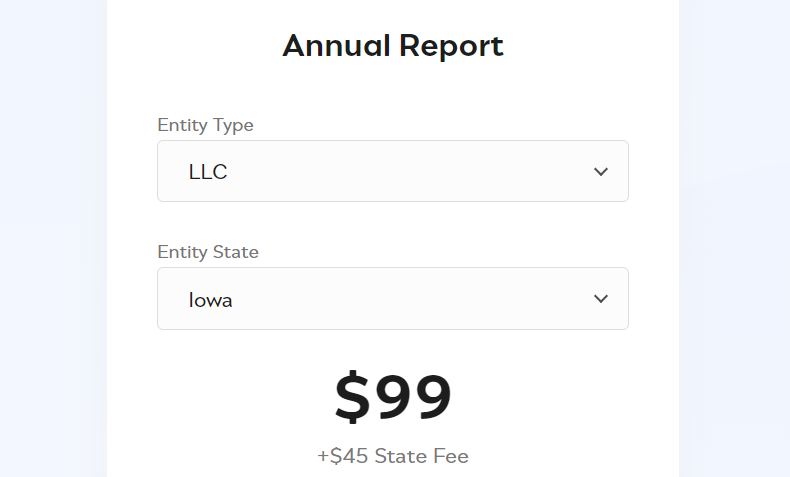

- Submission of an Annual Report – At the end of year, a report detailing company’s activities such as names, addresses of directors, managing members of a corporation, registered agent address, etc has to be filed and submitted to the state authorities. Incfile does all of it for LLC, Nonprofits and corporations at just $99 plus state fees.

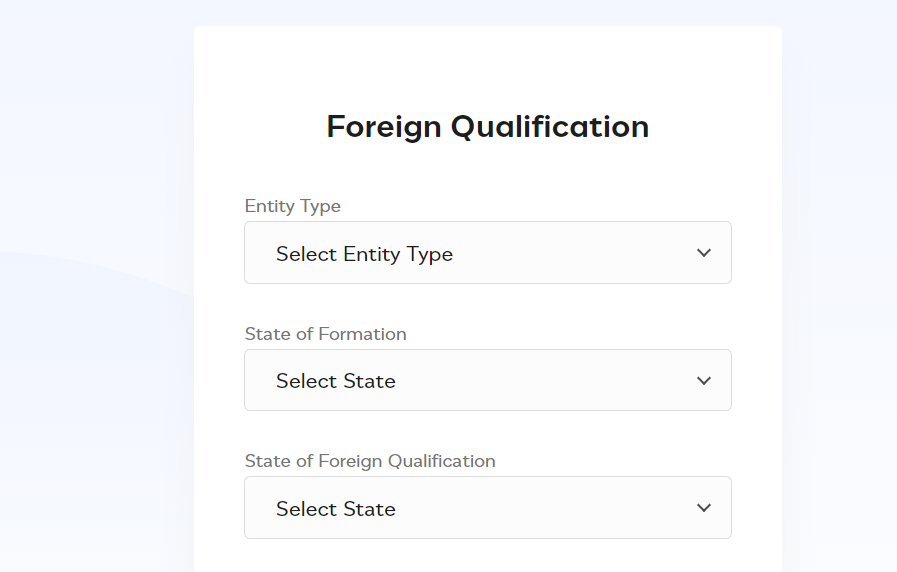

- Foreign Qualifications – To be able to conduct business in another state instead of just the one your company is registered in; you need to acquire an additional certificate of authority. The following will be done by Incfile; Name search to ensure no other company has already acquired it, allotment of a registered agent and certification of authority which states your right to operate business in that state.

- Certificate of good standing – It is an official document which is issued by the state’s secretary of state office that verifies and declares that your company is compliant within the state of incorporation and hence is in “good standing”. It helps you in getting a loan, renewing a business license, filing your business taxes and acts as proof that your business does in fact exist. Incfile can take care of this issue but costs $49 plus the state fees.

- Articles of Amendment – As the businesses grow changes are meant to happen and therefore these alterations are needed to be reported to the state’s secretary. The following business changes can be reported in amendment articles; changes to the company name, updates to the registered agent’s contact information, new company business address, director or member information, number of authorized shares and change in business activities. Although the state fee varies, the platform service fee to file Articles of Amendment is $119.

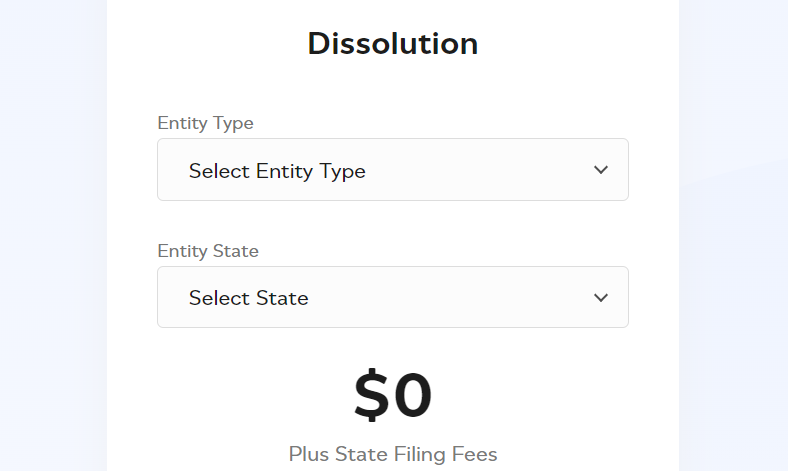

- Dissolution – In case you want to terminate your company and future operations, doing it the proper way is necessary to stop the further tax filings and other requirements. The necessary forms must be completed, signed and filed by the registered agent of your company. Following that you will get a Certificate of Dissolution which officially declares the termination of your business. Once it is properly documented, all the other branches will be automatically dissolved as well. Incfile costs $149 for Articles of Dissolution service excluding the state fees.

- EIN/ Tax ID Number – The SS4, an IRS form needs to be completed to acquire an Employer Identification Number. To open a bank account in the name of your company you need EIN. It also helps you file taxes, earn credits, maintains a good outstanding, pays employees’ wages and accurately accounts for it. This service can be availed at $70 and everything regarding EIN will be handled by Incfile. 😊

- Fictitious Business Name – If you want to operate your business under an alias, you can achieve this through a trade name. Although, it won’t be able to protect your LLC or Corporation’s legal name, one can see this as an additional step. It could be used in a number of cases, for example, you are expanding your business to multiple states, privacy issues, there’s a change in your products or services, etc. The fees for registering for a made-up name and the necessary forms vary depending on the state. Furthermore, states like Washington, Virginia, South Carolina, Nex Mexico, Massachusetts, Kansas and few others do not support fictitious business names.

Pros and Cons

👍 Pros

- Several entity types are supported.

- Helpful services and tools for accounting, tax and certificates filings, EIN, etc.

- Easy to use interface and super quick order process.

👎 Cons

- Add on services such as articles of amendment, dissolution, etc are quite expensive.

Incfile Customer Support

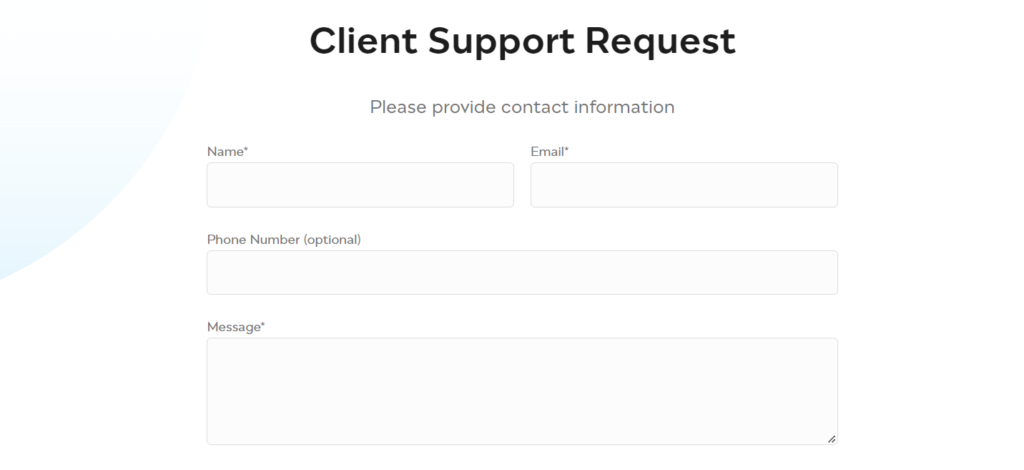

The Incfile platform publishes blog posts along with FAQs regarding their services. The detailed articles are also present on the website on topics like order history, track status, company’s information, etc.

The support team can be reached out by submitting a support ticket on the website, fax services (877.919.2613) or phone call (844.830.8267) available Monday to Friday from 9 a.m. to 6 p.m. CST.

Conclusion – Is Incfile Good For You?

Wrapping up our Incfile review by stating that it is indeed one of the best business formation service platforms. The services can cost anywhere from $0 to $299 excluding the state fees. However, the add-on services can be quite costly.

Nonetheless, it offers excellent customer support, has an easy-to-use interface, quick order processing and everything in between. Is Incfile worth it? We’d say yes.

FAQs 🤔

You can use the Business Name Search Tool and enter your proposed LLC or corporation name. It will search the business name registry for your desired state and will inform you in case it matches.

You may also like it: