Contents

In this current age, Technology has really improved and changed traditional ways of doing things across all fields and industries.

The Financial industry is also not left out. Year after year, we have seen how financial institutions have incorporated tech into their services; from the conventional method of bank withdrawals to the use of atm cards, and even mobile banking.

These FinTech firms provide really good services to firms and businesses that partner with them. They help manage their expenses and provide cash regulation services.

One of such FinTech firms is Wallester and we will be reviewing it in detail. We will examine its services, features, highlights and downsides.

Wallester is a payment solution for businesses. It is a platform that enables you to issue cards (debit, credit, business cards, etc) to your employees and keep track of all their spending.

Going through conventional banks to issue cards to your employees is more complex and costly. This is because the exchange rate of these banks might not benefit your company and each card might have account charges. All these factors are tackled when you use Wallester Business.

To learn more about this solution, let’s take a look at the details of the platform and all it entails.

Wallester: An Overview

Wallester is a prominent FinTech company that enables businesses to issue personalized corporate cards (both physical and virtual) to their employees and keep track of their payments and expenses.

It was founded in 2016 and is majorly for startups and corporations.

The company is a partner with VISA and issues visa cards(debit, credit, prepaid, etc) for businesses. The virtual cards issued by Wallester reduce the complications faced by enterprises which include tracking transactions, approving payments, managing budgets, uploading invoices, etc.

Wallester provides its customers an extremely advanced API that can issue a countless number of virtual cards in a few seconds. With this solution, payments can be automated, enabling businesses to focus on other vital aspects of their organization.

This advanced platform can also be easily linked with any software. There is no need to hire programmers to install different payment functions and systems into them.

Setting up an account with Wallester is free and also easy. But afterwards, your account must be credited via bank transfer to pay for all your estimated business expenses.

Once your account has been credited, you are free to issue virtual and physical cards to your employees. It is from the credited account that they spend according to their needs and spending limits.

What is Wallester Business?Wallester Business is a financial solution created in 2018 for both new businesses and well-established businesses.

Since it is an official VISA partner, it concentrates on providing business customers with VISA products such as debit cards, credit cards, prepaid cards, and more.

Wallester helps you arrange employee spending and expenses by serving as a type of buffer account for your company.

After Wallester’s quick and free setup, you must credit your account by bank transfer to pay for all of your anticipated business expenditures.

Once funds are available in the account, you can give virtual and real VISA cards to your staff members, allowing them to make purchases from the expense account in accordance with their requirements and spending caps.

You can do this using the iOS and Android versions of Wallester’s mobile cash control app.

The best part is that Wallester enables full platform white-labeling. So, in addition to branding your cards, you can likewise white label the mobile application, thus ensuring that your workers are always engaged with your brand.

The app offers the tools necessary to manage your money, including automatic spending categorization, card issuance and freezing, password reminders, pin changes, automated expense reports, smart receipt attachments, invoice storage, and more.

Wallester’s payment cards can also be used to pay gig economy employees. Simply offer them access to a virtual card that has their salary loaded on it. After that, they can either move the money to their own account or begin using the virtual card to make purchases.

Wallester Business Major Features

- Official Visa partner with government authorization in Estonia.

- one of the sole cloud-based card-issuing options.

- Any company with a European Economic Area registration can utilize Wallester Business. The system it uses unifies all of the financial operations of the company’s European branches and guarantees the openness of both domestic and international trade. All other nations are subject to increased due diligence and a business case evaluation. (cards both virtual and debit work worldwide).

- Instead of using conventional banks, this is a much more affordable and practical option.

- European BIN cards are excellent for use with Facebook/Google and other networks.

- Possibility of purchasing a distinct BIN for your business’s requirements.

- It can create payroll for your team or maintain spending records;

- There is a directory with information on all of the company’s expenses.

- Integrating the solution into the business’s current infrastructure is simple;

- You are capable of effectively and simply handling the finances of your business.

- Utilizing a state-of-the-art API, Wallester Business virtual cards can be created and issued in an infinite number of cards within seconds.

- Platform created in-house with an API for efficient spend administration.

- Android and iOS accounts.

- 16 languages are supported by Platform.

- Quick boarding in 3 easy steps: director KYC, company information, and company papers to upload.

Key Features of Wallester

Expense Management

Wallester provides a unified system that enables you to monitor card funds and change the budget of your business at any time you desire. You can also modify the user setting of each card, enabling you to control the expenses and spending of your employees.

You can also give a particular group or individuals access privileges to a virtual card. For example, you can give every member of a team access to a virtual expense card for their purchases.

This feature also enables you to place daily or monthly spending restrictions on the cards of your employees. For instance, you can set a cap on the number of daily transactions or you can only allow transactions from certain categories like restaurants.

You may as well decide whether a card holder can make cash withdrawals or not. You can also stipulate that each payment must first be approved through a payment request. Finally, with this feature, you can make sure that your employees get automated notifications to upload receipts to the app so as to keep a record of all information that none is omitted.

Corporate Cards

Wallester allows you to order as many physical cards as you want or create virtual cards in a few seconds depending on the restriction set forth by your free or premium plan. Your staff can then use these cards to make business transactions and payments for expenses like corporate entertainment, travelling, software bills, etc.

As soon as the card is used, you (the employer) gets a payment alert and the expense is tracked. Your employees can also take a picture of receipts and invoices to add to their records.

Wallester’s partnership with VISA allows the card to be used anywhere in the world where VISA is accepted as a form of payment. Furthermore, the virtual cards are compatible with e-wallets like Google Pay, Samsung Pay And Apple Pay while the physical card can accept contactless payments.

Reports

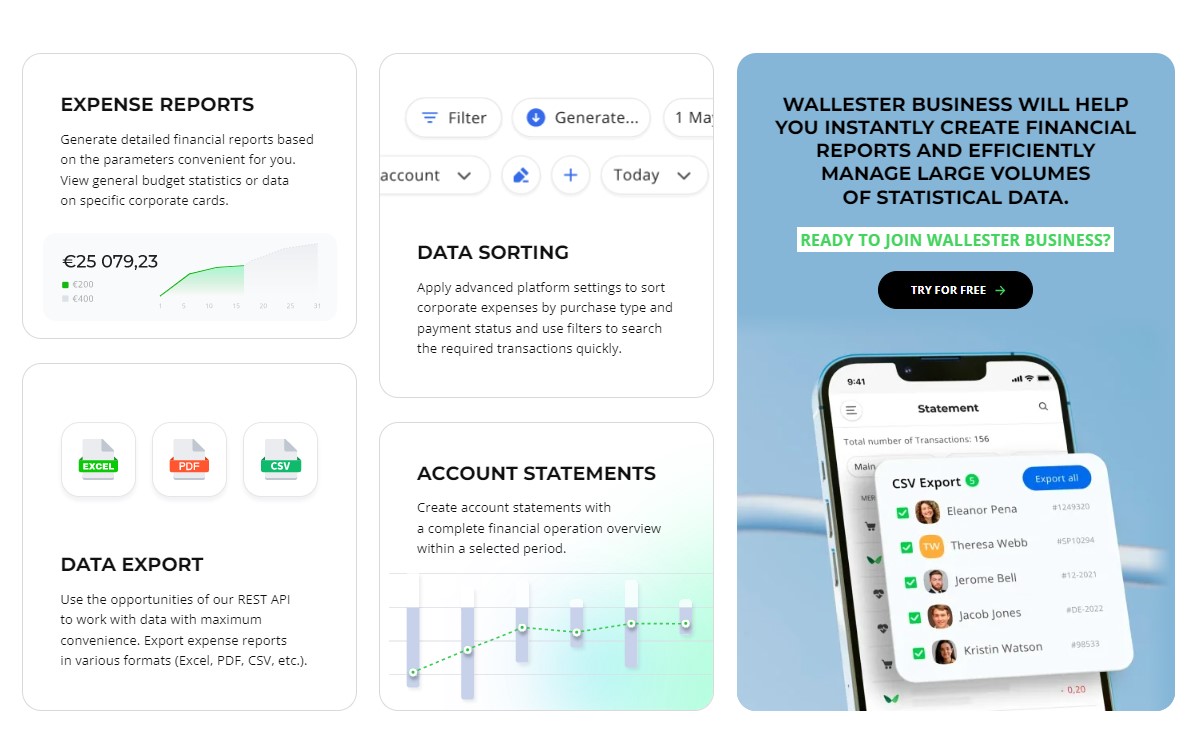

Wallester’s mobile app gives you information on your company’s expenditure. You will have access to expense reports using variables like general budget figures or information about specific cards. You may as well sort corporate expenses according to spending category and payment status.

You can also generate account statements for a specified timeframe and the data can then be exported as a CSV, Excel or PDF file.

The API allows for seamless platform integration with external financial accounting systems. This makes it easier to reconcile your monitored expenses, other bills and regular costs, your income and budget. However, this necessitates that someone on your team create their own integrations via the API as there are no inbuilt integrations with third-party accounting solutions.

Currency Conversion

Even if the only currency that Wallester accounts hold is Euro, you can make transactions in any currency you require. The conversion rate, according to Wallester’s website, is often four times less expensive than conventional banks.

Unfortunately, there is no means to keep different currencies in your account. This makes it less suitable for multinational firms.

Mobile App

Wallester has a mobile application that is user friendly. With this app, you can issue physical and virtual cards to your staff and easily set limits on accounts. You can also use it to delete, block, and activate cards. The app also links your card to mobile wallets. The Wallester app is a solution for keeping track of all business expenses and receiving real time statistical data all in one location.

Creating Employee Profile

Using Wallester, you can create a profile for your employees which also allows you to set a personal spending limit for each employee. This tool enables you to provide an expense plan for each employee in your organization.

Fraud Detection

Wallester has developed a unique fraud detection service to reduce the potential for financial loss for its customers. Its function includes tracking all transactions in order to identify and stop payment card fraud.

Wallester’s Pros and Cons

Pros

- With Wallester’s card, you can receive up to four times better exchange rates than with traditional banks.

- The cards from Wallester are accepted wherever VISA payments are accepted (which is practically worldwide).

- Wallester is a cheaper way of issuing cards to employees. Traditional banks are more expensive. Additionally, Wallester does not charge you an additional membership cost for each separate card as long as the total number of cards used does not go beyond the permitted number in your freebor premium plan.

- You can order as many physical cards as you require with no recurring charge on each card.

- Your business can create a more specialized experience using Wallester Business’ white-labeling capability.

- Setup is quick and simple, and there is a basic free plan that grants access to 300 virtual cards.

Cons

- Wallester mainly works with companies based in the UK or European Economic Area.

- EUR is the only account currency recognized.

- Although integration with Accounting softwares is feasible using an API, there is no readily available one-click integration.

Wallester Pricing Plans

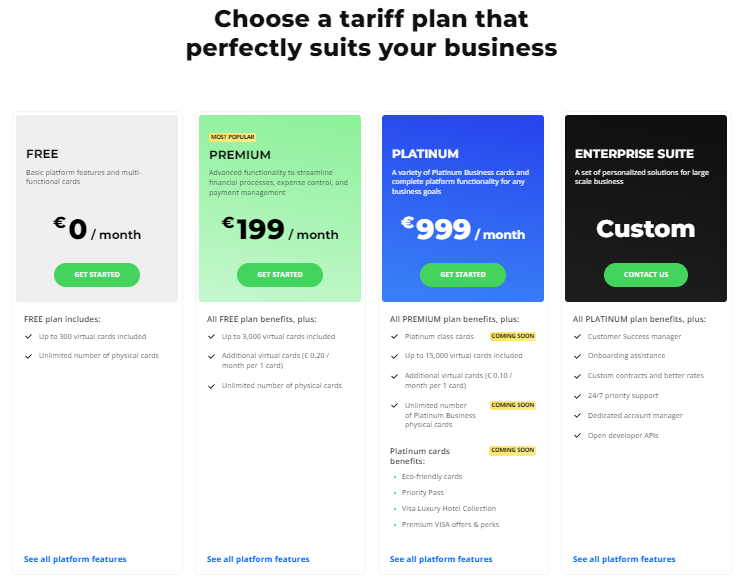

Wallester has four pricing tiers which includes a free plan and an Enterprise plan. At this point, it is important to note that the delivery of physical cards costs 5 EUR per card and on every item. You are permitted to order as many as you want. Once you have received your card, there are no further annual fees.

The pricing plans are listed below:

- Free: €0 per month.

- Premium: €199 per month

- Platinum: €999 per month

- Enterprise Suite: Custom

Conclusion – Final Words

Overall, I think Wallester will be a useful solution for companies that want to consolidate their expense management. Apart from the benefits mentioned above, for clients who opt to use the company’s services, Wallester guarantees their protection and safety.

It should be noted that the company is devoted to the security of the transactions carried out by its clients and offers a cheap, quick and easy way to issue both physical and virtual cards. This makes the company even more desirable.

Frequently Asked Questions

The Wallester Business program is designed to fit the business needs of any profile and scale. That’s why it’s suitable for any company willing to streamline key financial processes. Any juridical person registered in the European Economic Zone and Great Britain can join the program.

Yes, it is. Wallester’s advanced API enables you to integrate the platform with any financial accounting software. It enables you to fully card behavior, automate your current manual work, and make an instant data export.

To join the program, create an account on the website. After successful company data verification, you’ll receive a notification allowing you to sign a program participation agreement. Once signed, the complete platform functionality will be available to you within a free package. If necessary, you can expand your opportunities, choosing a paid package that perfectly suits your business’s needs.