ADP Review: Is It Right Payroll Solution for Business?

What makes ADP one of the most trusted payroll providers in the world? 🌐

Is it really better than the newer, tech-driven payroll platforms on the market today? 💸

And most importantly — Is ADP the right choice for your business, your budget, and your growth plans?

🎉 ADP Special Offer: 6 Months FREE Payroll!

Sign up with ADP today and get six months of payroll free! Simplify payroll, taxes, and compliance while saving big.

These questions come up for thousands of business owners every day, especially as they compare payroll solutions that promise automation, compliance, and peace of mind.

ADP has been a major force in payroll and HR management for decades, but the modern landscape is crowded with competitors that claim to be simpler, cheaper, or more innovative.

That’s why understanding the platform’s true strengths and its limitations is essential before committing.

In this comprehensive ADP Review, we dive deep into what ADP really offers small and mid-sized businesses.

We’ll explore its payroll accuracy, automation capabilities, tax handling, HR features, customer support, and the real-world usability that matters most when payday comes around. 📌

💰 ADP Payroll Deal: Get 6 Months Free Now!

Enjoy six months of free payroll services with ADP. Automate payroll, stay compliant, and focus on growing your business!

What is ADP? How it Manages Payroll? 💱

ADP, or Automatic Data Processing, is one of the leading payroll and HR service providers used by businesses of all sizes.

Known for its accuracy and compliance expertise, ADP helps employers automate payroll from start to finish. In this ADP Review, it’s important to understand how the system works behind the scenes.

ADP manages payroll by collecting key employee details such as hours worked, salaries, deductions, and tax information. It then automatically calculates gross pay, applies the correct tax withholdings, and delivers accurate net pay every cycle.

The platform also handles payroll tax filing on behalf of the business, including federal, state, and local taxes, as well as year-end forms like W-2s and 1099s.

Payments can be issued through direct deposit, paper checks, or prepaid cards, and both employers and employees get access to an online portal for pay stubs, tax forms, and personal updates.

With strong security, continuous compliance updates, and mobile access, ADP simplifies payroll while reducing errors and administrative work.

Key Features of ADP ⭐

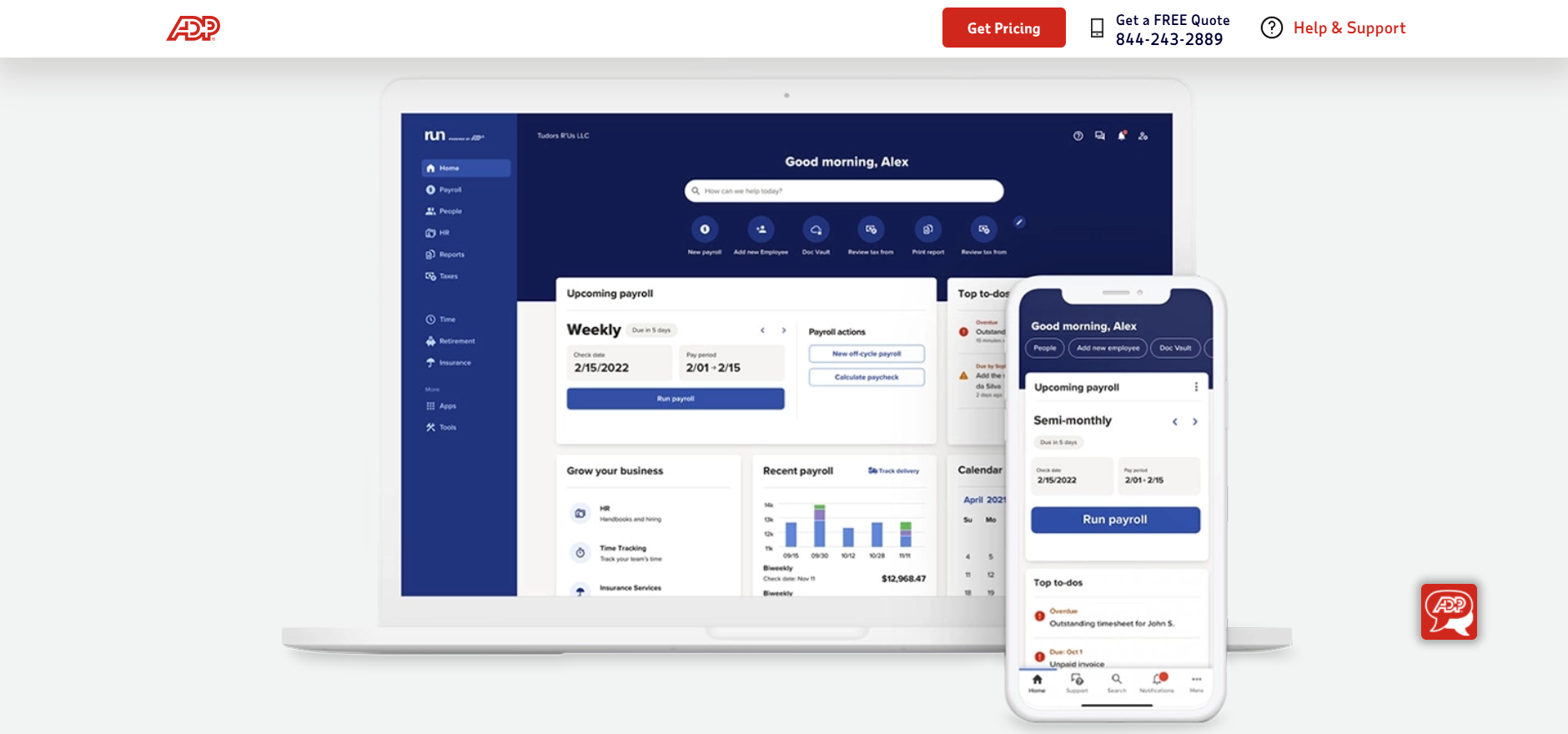

1. Automated Payroll Processing

ADP automates payroll calculations for wages, overtime, deductions, and benefits. This reduces manual work and lowers the chance of costly errors.

Payroll can be run from desktop or mobile, making the process efficient for busy business owners. Its automation helps ensure employees are paid accurately and on time.

2. Built-In Tax Filing and Compliance

One of ADP’s strongest features is its ability to handle payroll taxes automatically. The system calculates, withholds, and files federal, state, and local taxes on your behalf.

It also manages year-end forms like W-2s and 1099s. Continuous compliance updates help businesses avoid penalties.

3. Employee Self-Service Portal

Employees can log in to view pay stubs, download tax forms, track hours, and update personal information. This reduces administrative tasks for employers and improves the employee experience.

The portal is accessible on desktop and mobile devices. It gives workers more control over their own payroll data.

4. HR Tools and Workforce Management

ADP offers HR features such as onboarding, document storage, employee handbooks, and training resources. Businesses can streamline HR tasks and maintain important records in one place.

Some plans include live HR support for compliance and workplace issues. This makes ADP useful beyond payroll alone.

5. Time and Attendance Tracking

ADP integrates time clocks, mobile time tracking, and scheduling tools to ensure accurate payroll. Hours flow directly into payroll without manual entry, reducing mistakes.

Managers can track breaks, overtime, and PTO in real time. This is especially helpful for hourly or shift-based teams.

6. Integrations and Scalability

ADP connects easily with accounting platforms, point-of-sale systems, HR tools, and benefits providers. These integrations create a seamless workflow for growing businesses.

ADP also offers multiple service tiers, allowing companies to upgrade as their needs expand. This scalability is one reason ADP is trusted by both small and large organizations.

How To Access ADP? (Step-by-Step) 📑

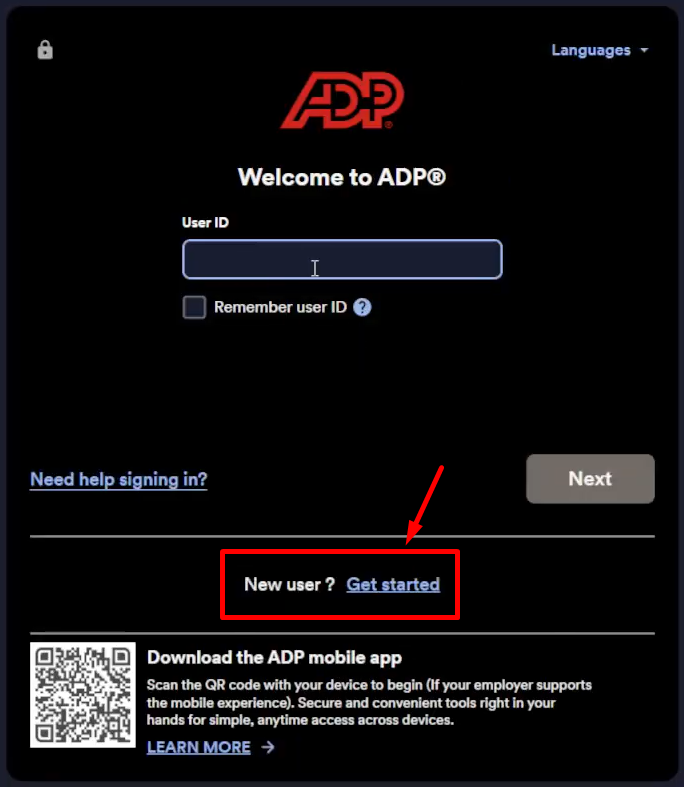

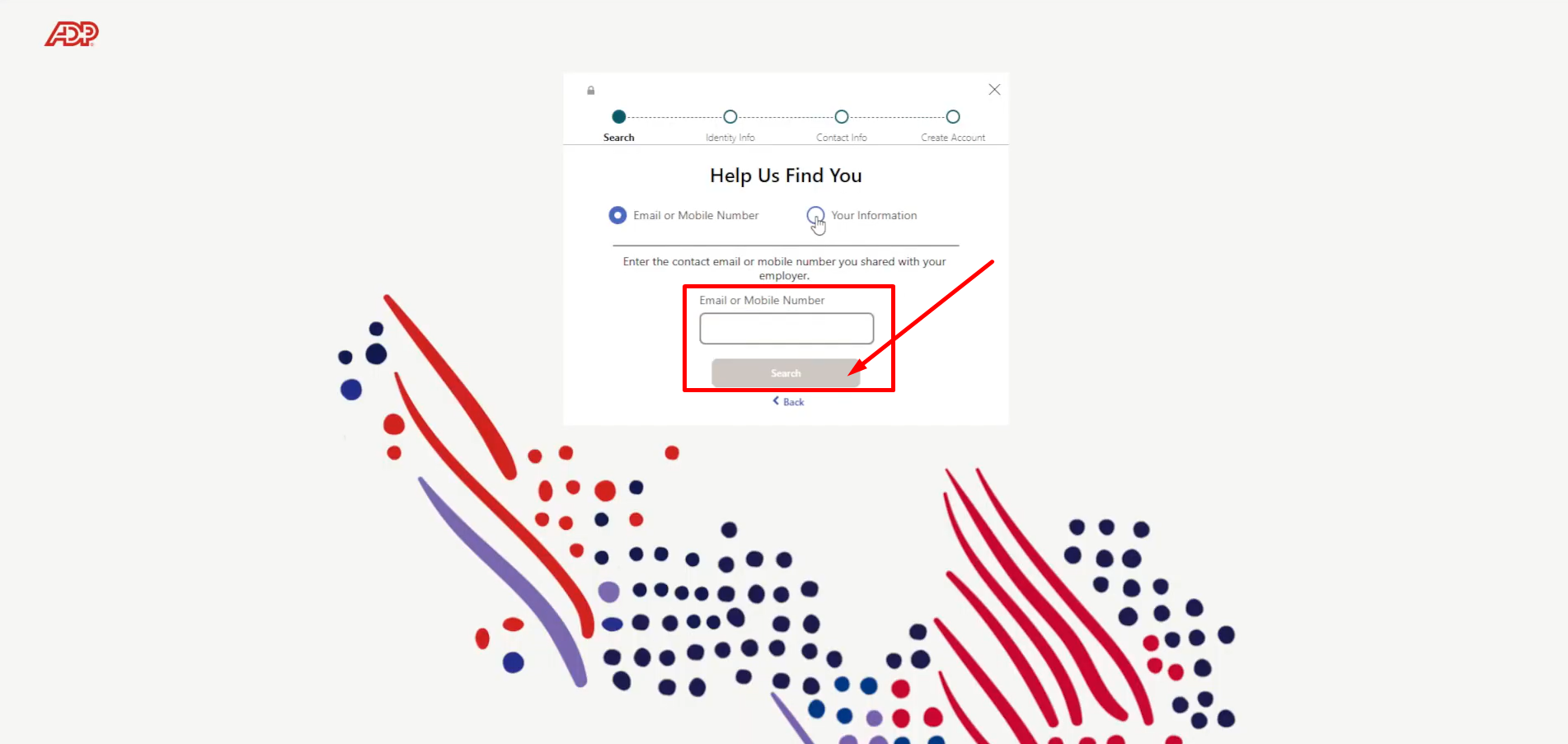

Step 1: Go to the official website of ADP and click on “Get Started”.

Step 2: Enter your email address and click on “search”.

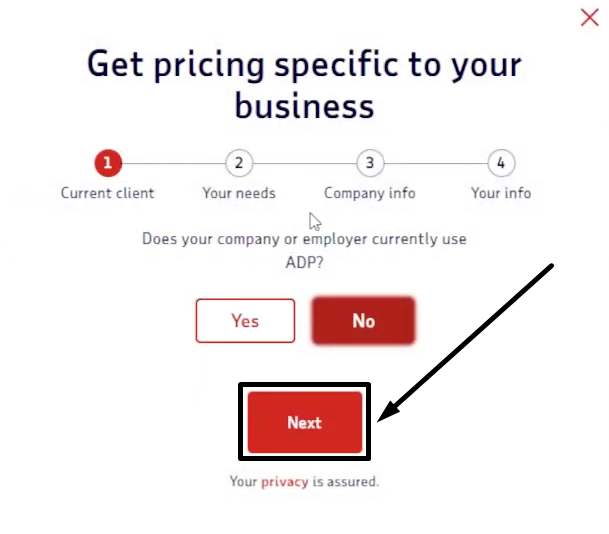

Step 3: Select “Yes” if you are a ADP user or select “No” if you are a new user.

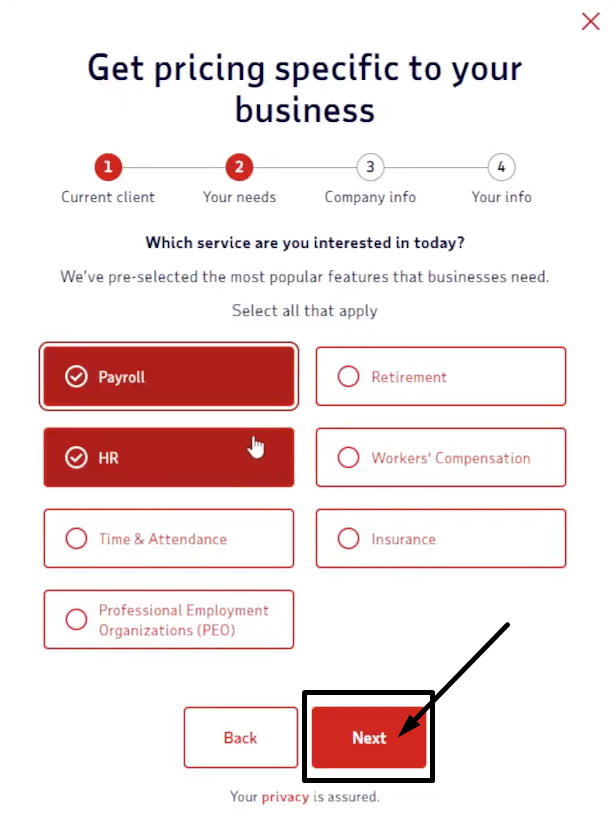

Step 4: Select the services you are interested in.

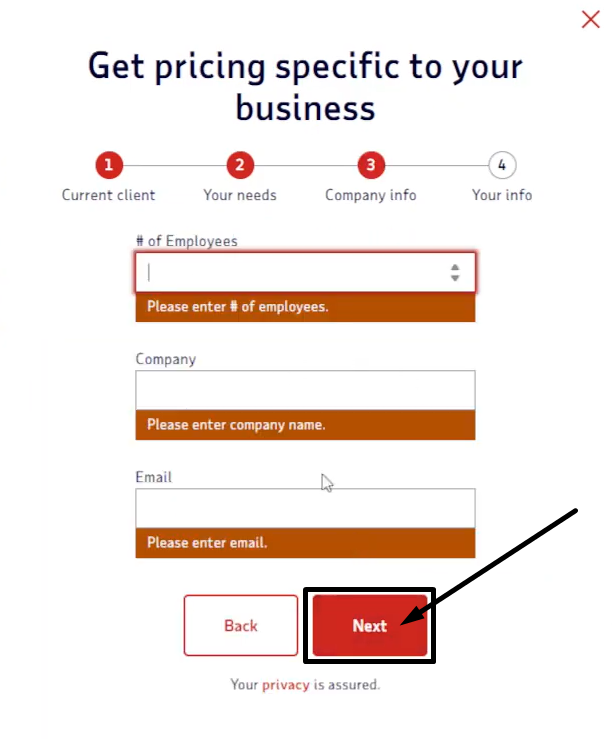

Step 5: Enter number of employees and company details.

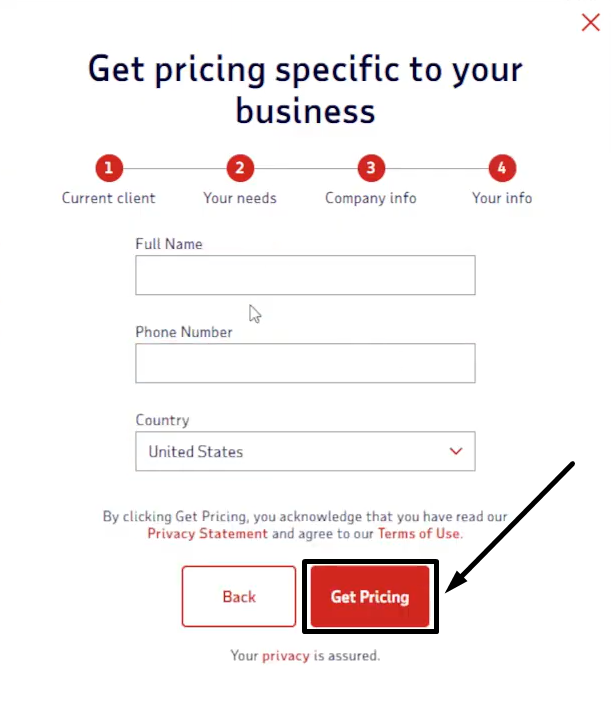

Step 6: Enter your name and phone number and get pricing as per your needs and complete your payment.

That’s all! Now manage your payroll in just few clicks!

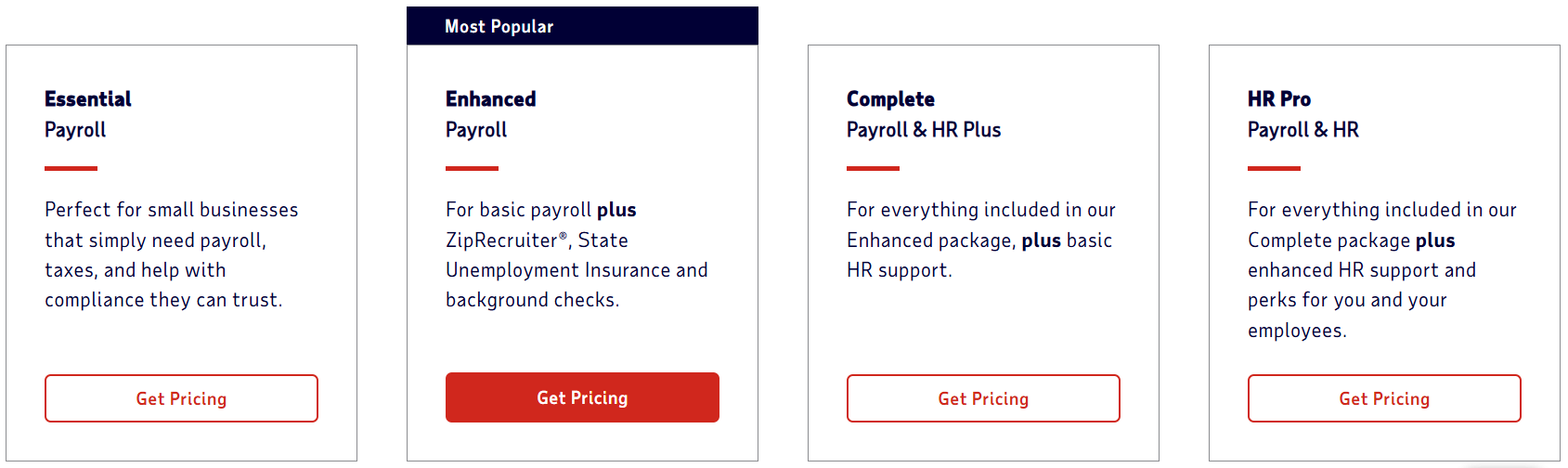

ADP Pricing Plans 💰

Why ADP Is Best For Small Businesses? 🚀

ADP is trusted by small businesses for its reliability and decades of experience in payroll and HR management.

It ensures accurate, timely payroll while keeping businesses compliant with federal, state, and local regulations.

The platform is scalable, allowing small businesses to start with basic payroll and upgrade as they grow. Its user-friendly interface and mobile access make running payroll simple, even without a dedicated HR team.

ADP also provides trusted support, helping owners navigate taxes, compliance, and labor regulations. With a strong track record and secure platform, ADP gives small businesses peace of mind and a solution they can grow with.

Beyond payroll, ADP helps small businesses save valuable time and resources.

By automating repetitive tasks, reducing errors, and providing self-service options for employees, business owners can focus more on growth and operations rather than administrative tasks.

This combination of efficiency, compliance, and support makes ADP an ideal choice for small businesses aiming to streamline their workforce management.

ADP Pros & Cons 📊

ADP vs Rippling vs Gusto ⚖️

Who Should Choose ADP? 🧐

- Small to mid‑size businesses looking for simplicity and compliance.

If you run a small business and don’t have a large HR or accounting team, ADP helps you automate payroll, handle taxes, and stay compliant without hiring someone just for payroll. - Companies expecting growth.

If you start small but plan to expand, ADP’s scalable plans let you begin with basic payroll and later add HR tools, time tracking, benefits administration, and more, without migrating to a new system.

- Businesses needing reliable compliance and tax support.

For firms operating across states or dealing with changing tax laws, ADP’s automated tax calculations, filings, and compliance updates reduce the risk of fines or mistakes. - Teams that benefit from self-service and remote access.

If employees need to view pay stubs, update information, or access payroll data remotely especially in hybrid or remote workplaces ADP’s employee self-service portal and mobile-friendly system makes life easier.

- Businesses with complex payroll or HR needs.

Companies requiring features like benefits management, time & attendance tracking, multi‑state payroll, or HR compliance support may find ADP’s comprehensive packages valuable. - Organizations that want to offload administrative burden.

If your leadership team prefers focusing on growth or operations instead of payroll paperwork, ADP provides an outsourced, professional-grade payroll and HR solution that reduces internal admin load.

Customer Reviews & Testimonials 👨💼

Emily Taylor

★ ★ ★ ★ ★

ADP’s payroll automation saved us countless hours. Taxes and compliance have never been easier!”

Conclusion: Is ADP Worth It? 🏆

Yes, 100%! If you’re a small or growing business looking for a reliable payroll and HR solution, ADP is a smart choice. It automates payroll, handles tax compliance, and provides scalable plans that grow with your business. With decades of experience and a strong reputation, ADP ensures accuracy and peace of mind, allowing you to focus on running and expanding your business.

The platform’s employee self-service portal, mobile access, and robust compliance management make payroll and HR tasks simple and efficient. Business owners save time, reduce errors, and avoid costly penalties, which is critical for small teams with limited resources.

While ADP may be a higher investment than some simpler payroll tools, the value it provides in reliability, support, and long-term scalability outweighs the cost for most small and medium-sized businesses. For anyone seeking a trusted, feature-rich payroll and HR solution, ADP is 100% worth it.

Quick Links:

- Gusto Review: Is It Legit Payroll & HR Platform?

- Papaya Global Review: Is It Best Workforce Solution?

FAQs 📢

ADP is a payroll and HR platform that automates payroll processing, tax filing, compliance, and employee management.

Yes, ADP offers scalable plans designed for small businesses, helping them manage payroll and HR efficiently.

Pricing varies by plan and business size. ADP offers Essential, Enhanced, Complete, and HR Pro packages with custom quotes.

Yes, ADP provides an employee self-service portal and mobile access for pay stubs, tax forms, and personal info updates.

Absolutely. ADP automatically calculates, files, and manages payroll taxes to keep businesses compliant with federal and state laws.