Wise Review: Is It Fastest Way to Send Money Abroad?

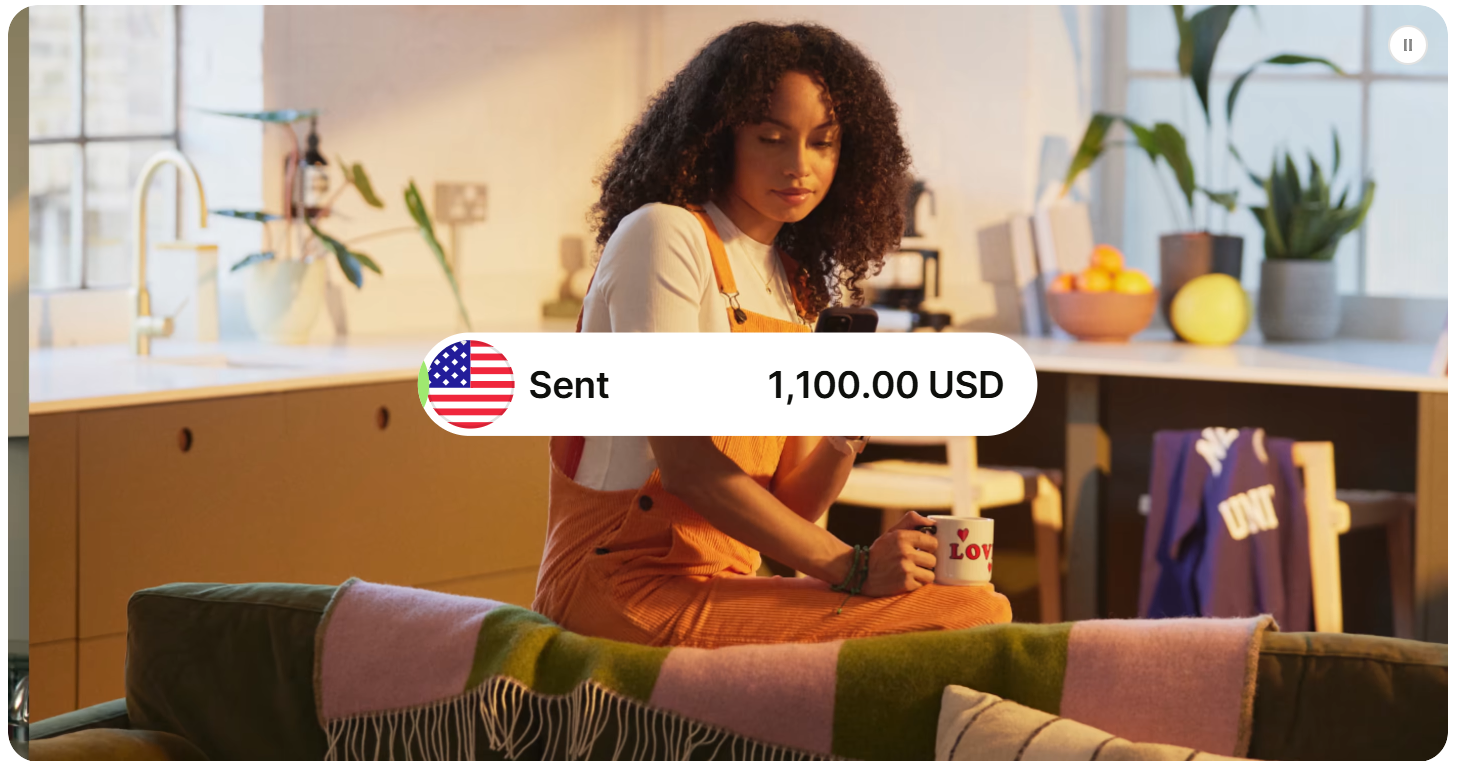

Thinking about sending money abroad without high fees or slow transfers? 💸

Wise might be the solution you’re looking for. 💰

In this Wise Review, we break down how the platform works, what makes it different, and why millions of people trust it for global payments.

Wise is known for fast transfers, low fees, and honest exchange rates. You can send, spend, and receive money in multiple currencies with ease. The app is simple. The costs are clear. And the service is built for both personal and business use.

If you want an affordable and transparent way to move money internationally, keep reading. This Wise Review will help you decide if it’s right for you.

What Is Wise & How Does It Work? 🔥

Wise is an online money transfer service that helps you send, receive, and manage money across borders at low cost. It was created to make international payments cheaper, faster, and more transparent than banks.

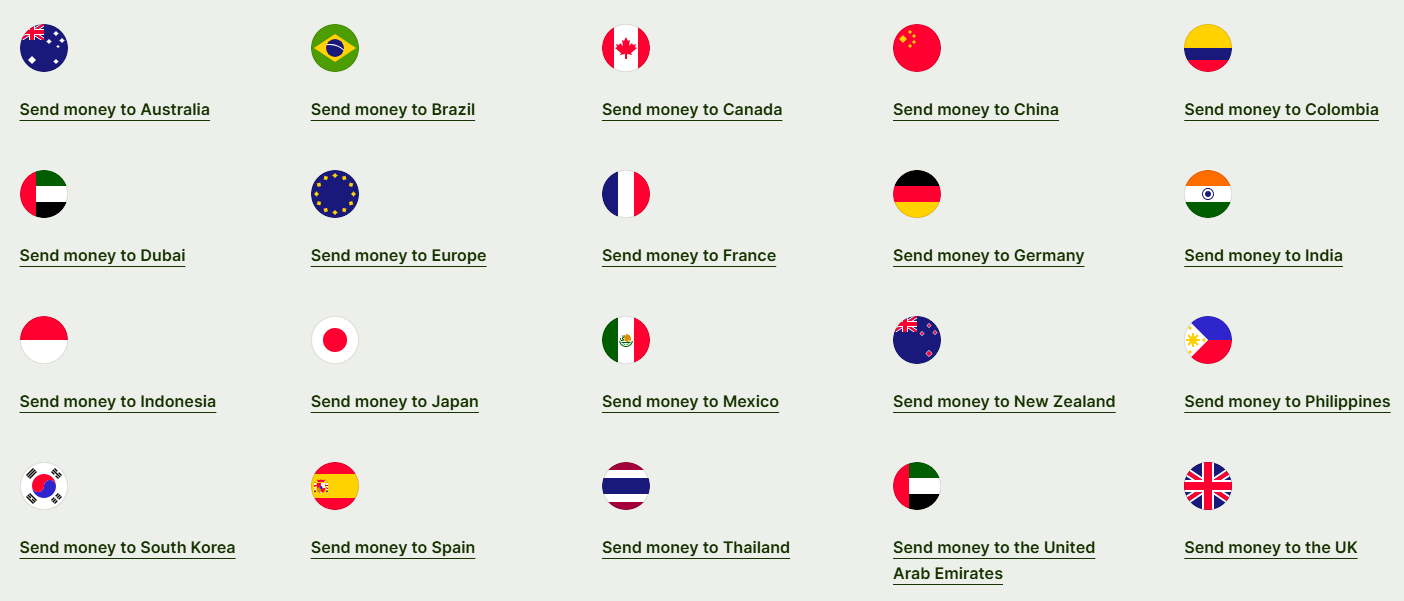

With Wise, you can send money to 140+ countries using the real exchange rate the same one you see on Google. There are no hidden markups, and the fees are shown upfront.

Wise also offers a multi-currency account. You can hold, convert, and spend money in many currencies. You even get local bank details in major regions, so receiving money feels like you’re living there.

For people who travel, work online, run a business, or send money to family abroad, Wise makes global payments simple and affordable.

If you want an easy way to move money internationally without paying high bank fees, Wise is designed for you.

Key Features of Wise ⭐

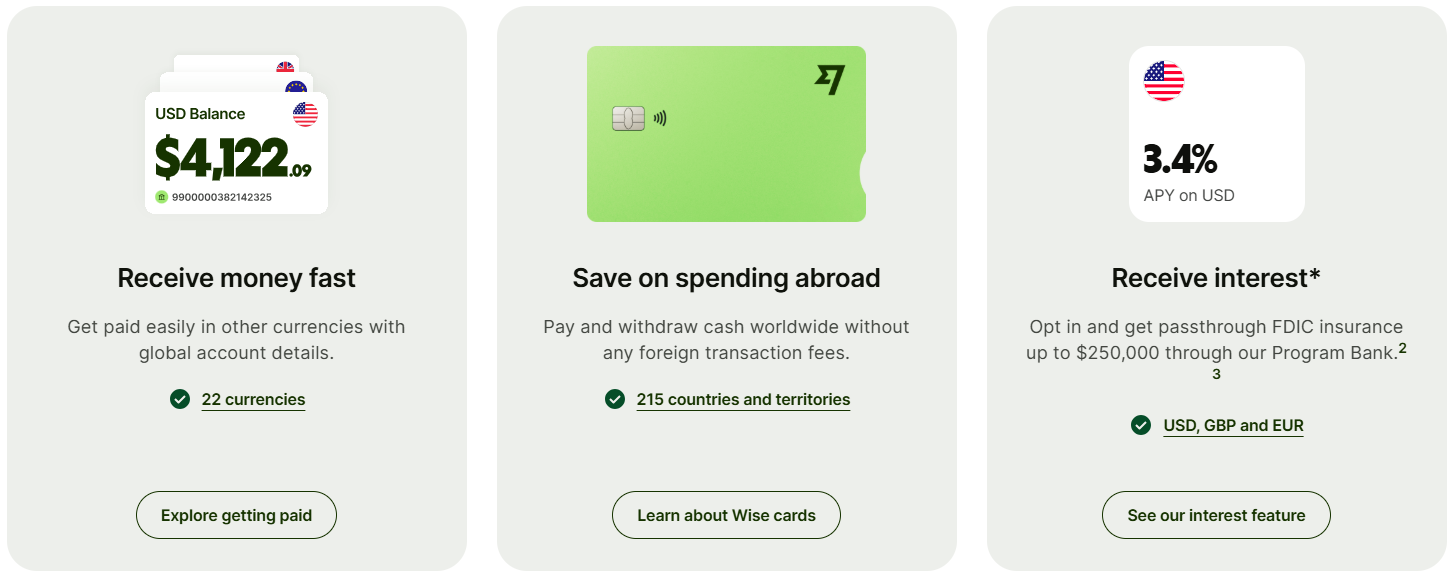

1. Multi-Currency Account

Wise lets you hold and manage money in dozens of currencies in a single account. This is perfect for frequent travelers, freelancers working with clients abroad, or businesses with international operations.

You don’t need separate accounts in every country you can receive and pay in multiple currencies from one account.

2. Convert Money at Real Exchange Rates

Unlike banks and many money transfer services, Wise uses the real, mid-market exchange rate — the same rate you see on Google.

This means you won’t lose money on hidden markups or inflated rates. You see exactly how much your recipient will get before making a transfer, giving full transparency.

3. Low and Transparent Fees

Wise charges a small, upfront fee for transfers and conversions, and nothing more. There are no hidden costs, which is often a problem with traditional banks.

You know the exact cost before confirming a transaction. This makes budgeting easier and reduces surprises.

4. Fast International Transfers

Many Wise transfers arrive within minutes, depending on the countries and currencies involved. On average, 70% of transfers arrive in under 20 seconds, and most others are completed within 24 hours.

This speed is a major advantage for urgent payments to family, suppliers, or clients.

5. Send and Receive Money Globally

Wise allows you to send money to over 140 countries and receive payments from abroad.

You can even get local account details (like a bank account in the US, UK, EU, or Australia) so receiving money feels like local transfers no international fees for your senders.

6. Wise Debit Card for Spending & Withdrawals

The Wise debit card connects directly to your multi-currency account. You can:

- Pay anywhere in the world without hidden foreign transaction fees.

- Withdraw cash from ATMs in different countries (limits vary by country).

- Use your money in multiple currencies without needing to manually convert.

This makes spending abroad convenient and cost-effective.

7. No Account Maintenance Fees or Hidden Charges

Opening a Wise account is free, and there are no monthly or annual maintenance fees.

You only pay when you use a service, such as sending money, converting currencies, or withdrawing cash. This keeps costs predictable and transparent.

How to Access Wise? (Step-by-Step)

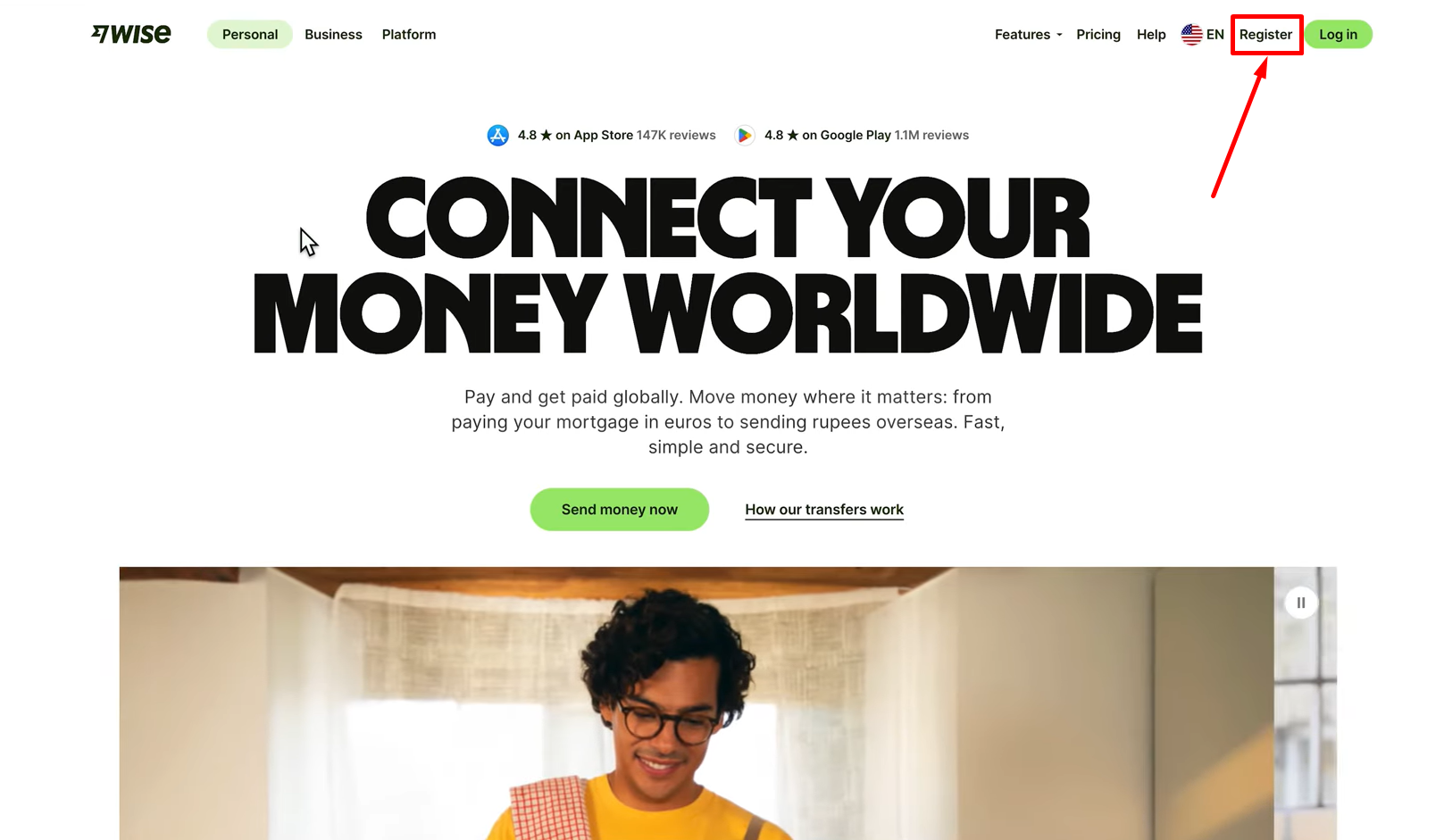

Step 1: Go to official website of Wise and click on “Register”.

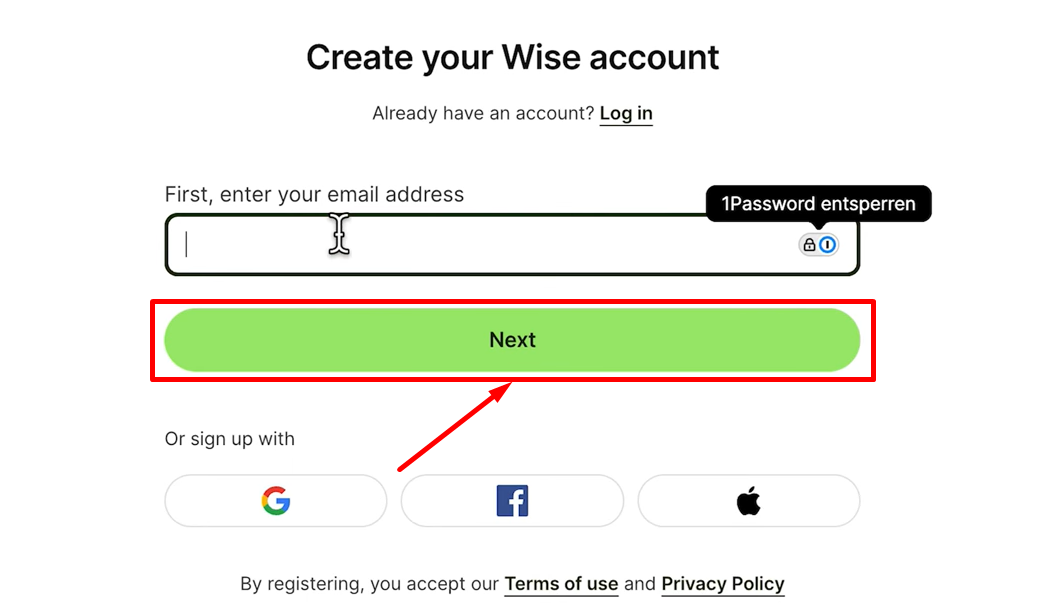

Step 2: Create your Wise account.

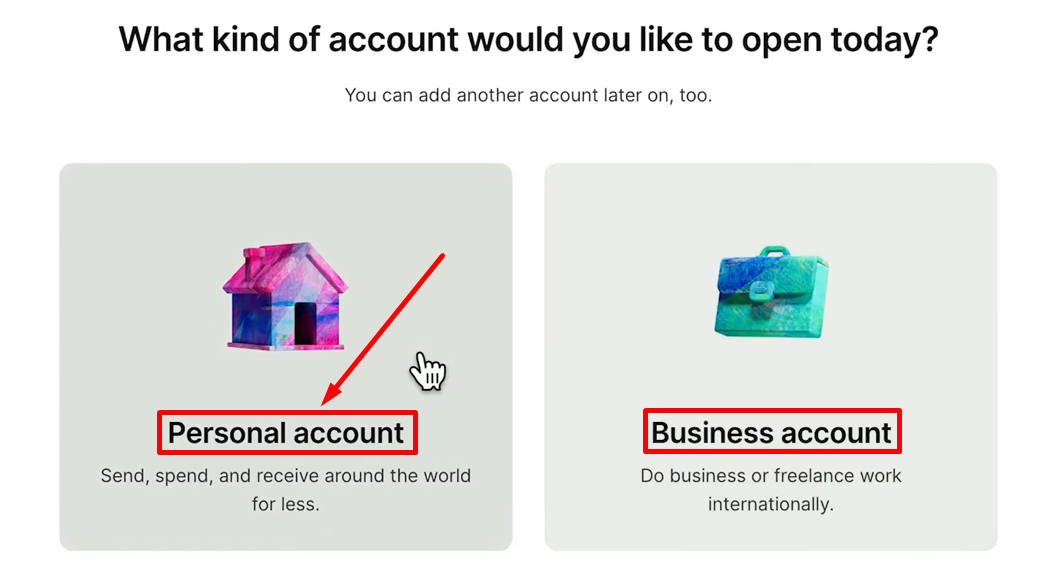

Step 3: Choose your account type: Personal account or Business account.

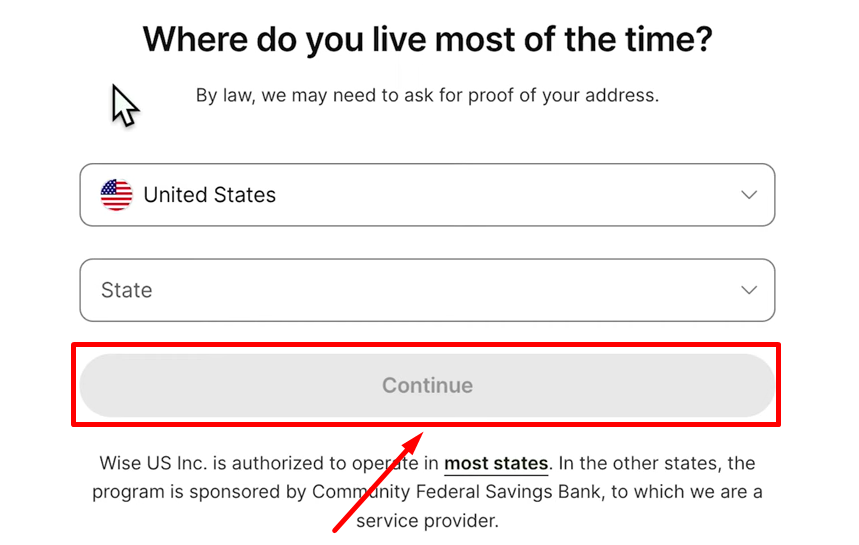

Step 4: Choose your country and state.

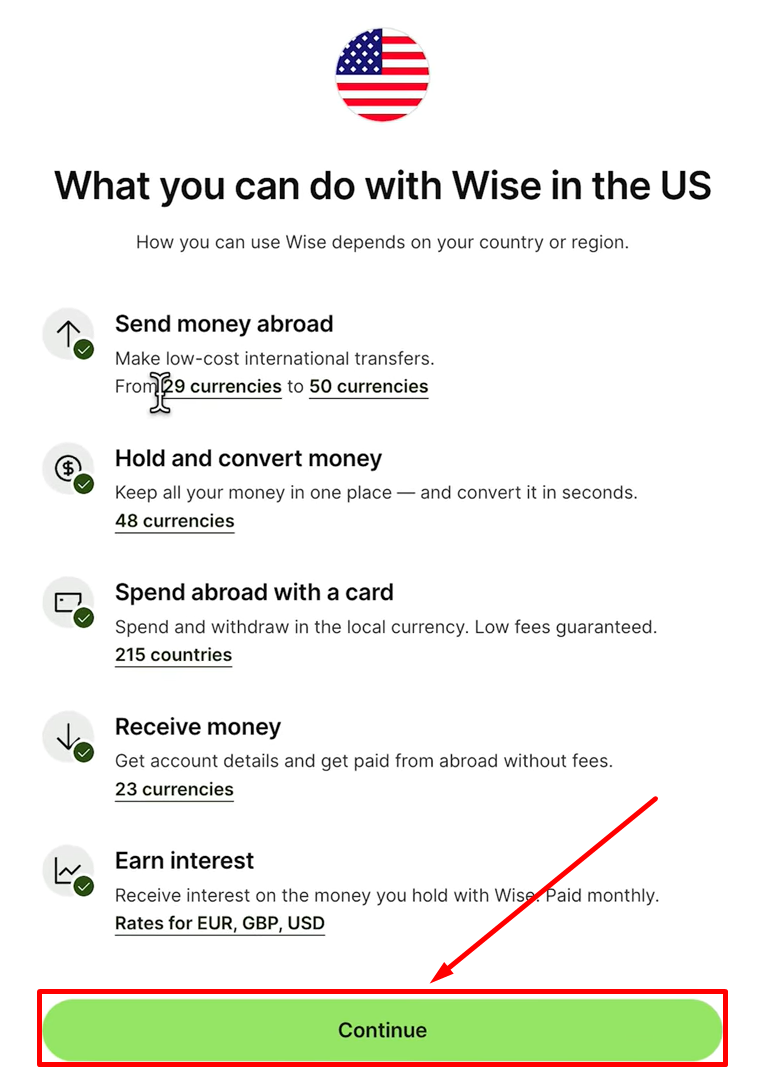

Step 5: Select what you want to do with Wise.

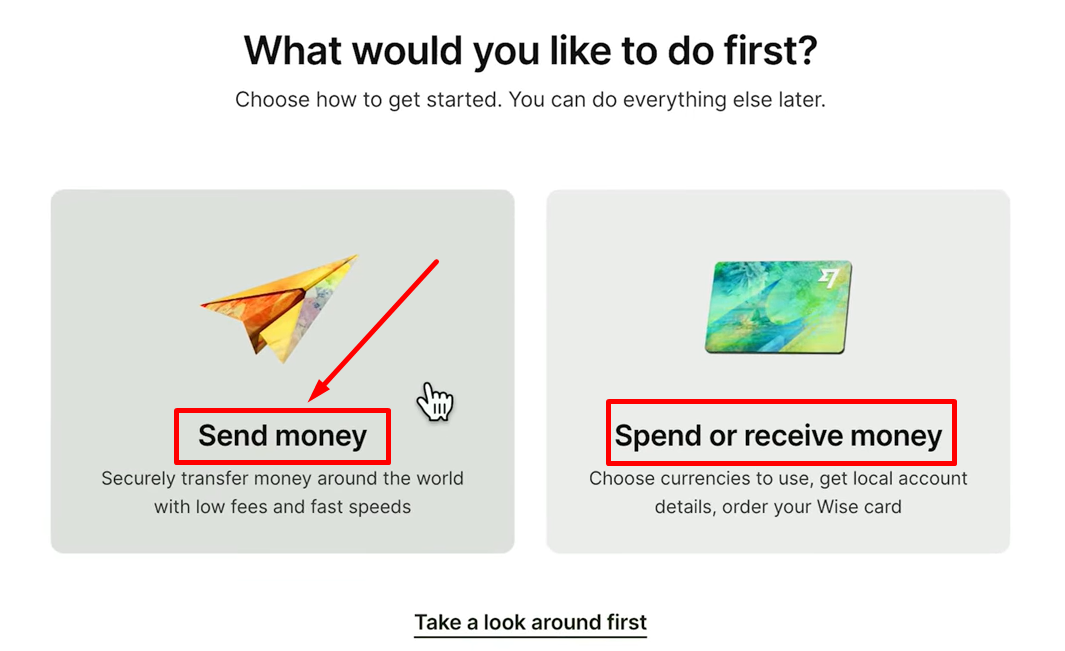

Step 6: That’s all! Now choose what would you like to do first – send money or receive money?

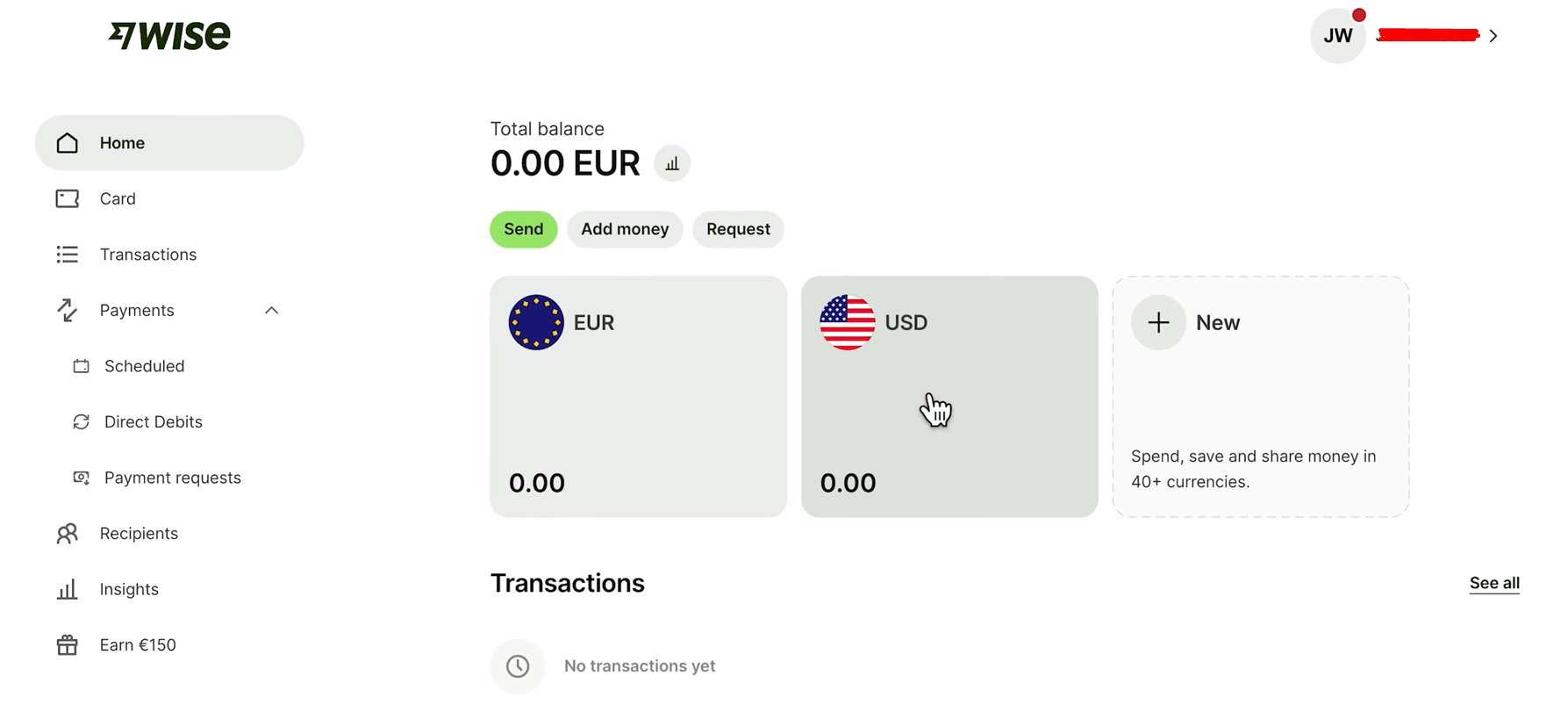

Step 7: You are all set!

Now, start managing your global payments instantly with Wise!

Wise Pricing and Fees 💸

| Feature | Personal | Business |

|---|---|---|

| Registering with Wise | Free | Free |

| Sending Money | From 0.57% (varies by currency) | From 0.57% (varies by currency) |

| Using Wise Multi-Currency Card | No subscription fee, $9 for card | No subscription fee, $31 setup fee |

| Spending / ATM Withdrawals | Free up to $100/month, then $1.50 per withdrawal / 2% | Free up to $100/month, then $1.50 per withdrawal / 2% |

| Converting Money | From 0.57% (varies by currency) | From 0.57% (varies by currency) |

| Holding Money in Account | Free | Free |

| Receiving Account Details (in 22 currencies) | Free | $31 |

| Receiving Domestic Payments | Free (AUD, CAD, EUR, GBP, HUF, NZD, SGD, TRY, USD) | Free (AUD, CAD, EUR, GBP, HUF, NZD, SGD, TRY, USD) |

| Receiving USD Wire / SWIFT Payments | $6.11 per payment | $6.11 per payment |

| Receiving GBP SWIFT Payments | £2.16 per payment | £2.16 per payment |

| Receiving EUR SWIFT Payments | €2.39 per payment | €2.39 per payment |

Why Choose Wise For Global Payments? 💰

When it comes to sending and receiving money internationally, Wise stands out.

Many people struggle with hidden fees, slow transfers, and poor exchange rates when using traditional banks. Wise solves these problems with transparency and reliability.

You can trust Wise for your global payments because it’s built around clarity and fairness.

Every transaction is straightforward, so you know exactly how much your recipient will get. No surprises.

It’s also designed for anyone, whether you’re a freelancer, a remote worker, a student studying abroad, or a business dealing with international clients.

Wise makes cross-border payments simple, fast, and predictable.

In short, choosing Wise means peace of mind, lower costs, and faster transfers when moving money around the world.

Pros & Cons of Wise ✅

| Pros | Cons |

|---|---|

| Transparent and fair pricing | Limited cash deposit options |

| Fast international transfers | Some currencies have higher fees |

| Mid-market exchange rates used | Not all countries supported for all services |

| Easy-to-use web and mobile app | Limited customer support hours in some regions |

| Multi-currency accounts available | Cannot send to every country instantly |

| Supports both personal and business users | |

| Secure and regulated worldwide | |

| Free transfers between Wise users in same currency |

Who Should Use Wise? 📌

- Freelancers, contractors, and remote workers: If you receive payments from overseas clients or platforms, Wise makes it easy to accept funds in different currencies and convert them at fair, mid‑market rates.

- Digital nomads, expats, and travelers: Holding a multi‑currency account means you can switch currencies as needed, pay or withdraw money abroad, and avoid bad bank‑exchange rates.

- Students studying abroad or paying international tuition/expenses: Wise helps you receive or send funds globally without high fees or hidden exchange‑rate markups.

- Small to medium businesses (SMBs) and e‑commerce sellers: Businesses that deal with international payments, suppliers, or global clients can benefit from Wise’s transparent fee structure, multi‑currency support, and easier cross‑border payments.

- Anyone making occasional overseas transfers (family support, gifts, personal transfers): Even if you send money abroad just once in a while, Wise often costs less than traditional banks, and you see exactly what you pay before you send.

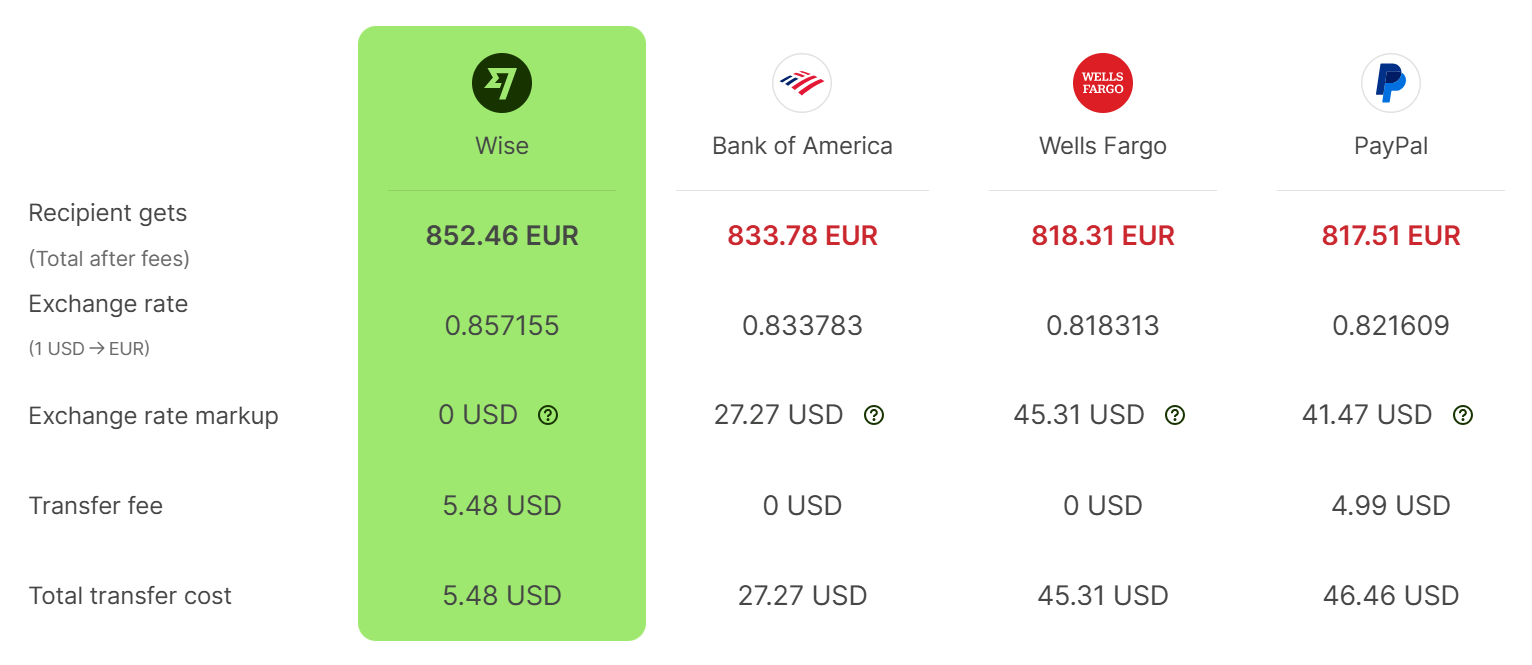

Wise vs Bank of America vs PayPal 🔥

| Service / Feature | Wise | PayPal | Bank of America |

|---|---|---|---|

| Exchange Rate / Currency Conversion | Mid-market rate, no markup | Markup on exchange rate (3–4%) | Often uses bank’s exchange rate with markup |

| International Transfer Fee | Low starts around 0.5–1% | Higher often 5% + fixed/variable fees | High – wire & SWIFT fees plus bank fees |

| Speed of Transfer | Often back in hours or same day | Instant between PayPal accounts, bank withdrawals may delay | Often slow – days for SWIFT/wire transfers |

| Transparency (Fees & Rates Visible Upfront) | Yes – fees and final amount shown before sending | Fees + markups often hidden until checkout | Often unclear: hidden wire fees & exchange rate markups |

| Multi-Currency / Global Account | Yes – multi-currency account & debit card | Limited and more expensive for conversions | No – standard domestic accounts only |

| Cost for Spending / ATM Withdrawals Abroad | Much cheaper for card spending & ATMs abroad | Currency conversion + fees make spending abroad expensive | High fees + poor exchange rates for foreign withdrawals |

| Best For | Freelancers, remote workers, global citizens, small businesses | Users already using PayPal, occasional transfers | Users needing domestic banking, local deposits/withdrawals |

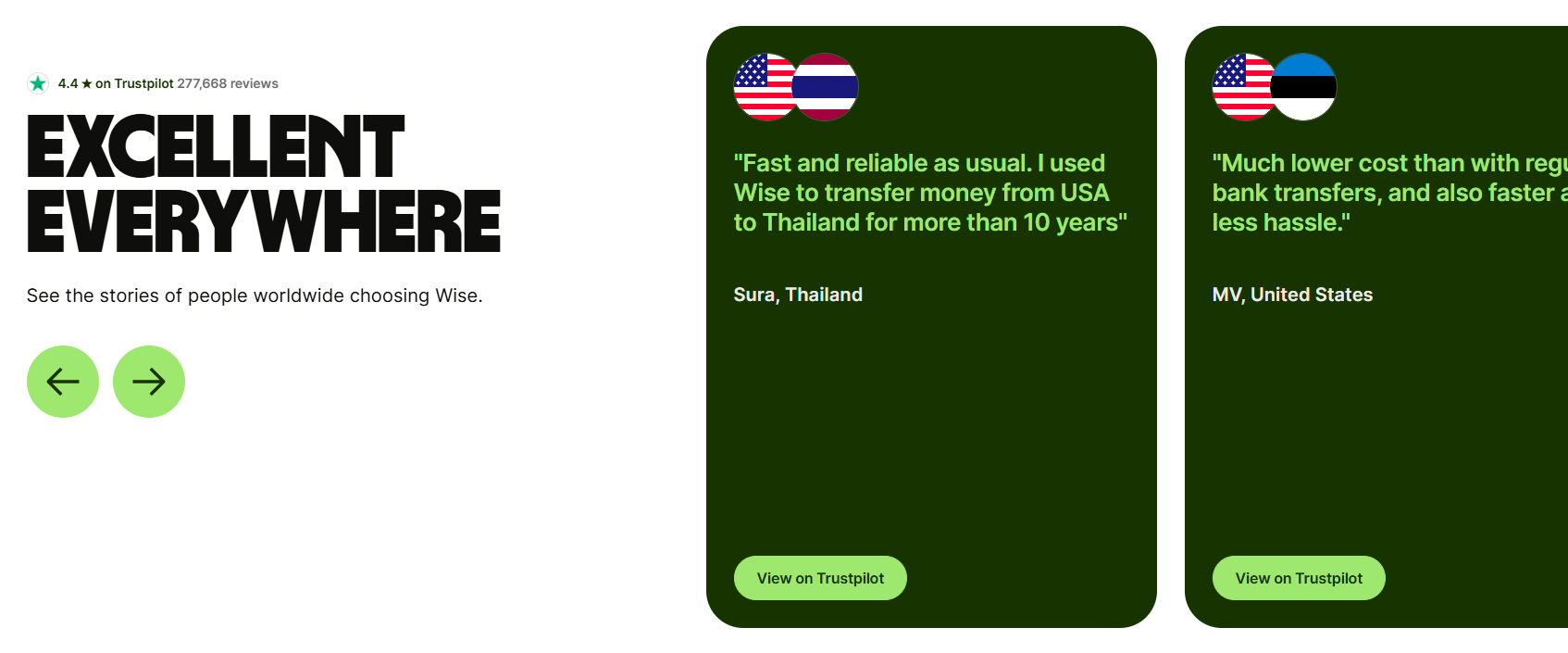

Customer Reviews & Testimonials 🙋🏻♂️

Jolly Rose

⭐⭐⭐⭐⭐

Wise makes sending money internationally so easy and affordable. I know exactly what my friends receive – no hidden fees!

Conclusion: Is Wise Worth It? 😊

If you need to send, receive, or manage money across borders whether for work, travel, business or personal use — Wise is more than worth considering. Its transparent pricing, real‑market exchange rates, and clear fee structure ensure you always know exactly what you pay and what your recipient gets.

Wise often costs much less than traditional banks or generic money‑transfer services, saving you significant money on conversions and transfers. Because it supports many currencies and works globally, it’s ideal if you operate internationally as a freelancer, remote worker, student abroad, or business owner.

The platform is also easy to use — sign‑up is quick, and transfers are straightforward and often fast. Its security measures and regulation by financial authorities add a layer of trust that many users value.

Overall, Wise delivers great value for money, simplicity, and global flexibility. For anyone dealing with international payments or currency conversions from travelers and expats to freelancers and businesses — Wise is a smart, practical, and often cost‑effective choice.

Quick Links:

- Papaya Global Review: Is It Best Workforce Solution?

- ADP Review: Is It Right Payroll Solution for Business?

📝 FAQs

Wise charges around 0.5% – 1% as international transfer fee.

Most transfers arrive within seconds, and 95% are completed within 24 hours.

Yes. Wise is regulated, uses advanced security, and keeps your money in safeguarded accounts.

No. Fees are transparent, and you always see exactly what you’ll pay before sending money.

Individuals, freelancers, businesses, travelers, and anyone needing international money transfers can use Wise.