Payoneer Review: Is It Top Choice for Global Payments?

Have you ever struggled with getting paid internationally or managing multiple currencies for your business? 😍

Or wondered how freelancers, eCommerce sellers, and global teams streamline payments without high fees or complicated setups? 💸

That’s where Payoneer steps in – a platform designed to simplify cross-border payments for millions of users worldwide.

With support for 190+ countries, 70 currencies, and seamless integrations with global marketplaces, Payoneer acts as a financial bridge for anyone working or selling across borders.

It takes the complexity out of international transactions, making global business feel as easy as local.

In this Payoneer Review, we’ll break down how the multi-currency account works, its key features, who it’s best for, and why it has become one of the most trusted tools for global payments, payroll, and international business growth.

What is Payoneer? 💡

Payoneer is a global payment platform that helps individuals and businesses send, receive, and manage money across borders with ease.

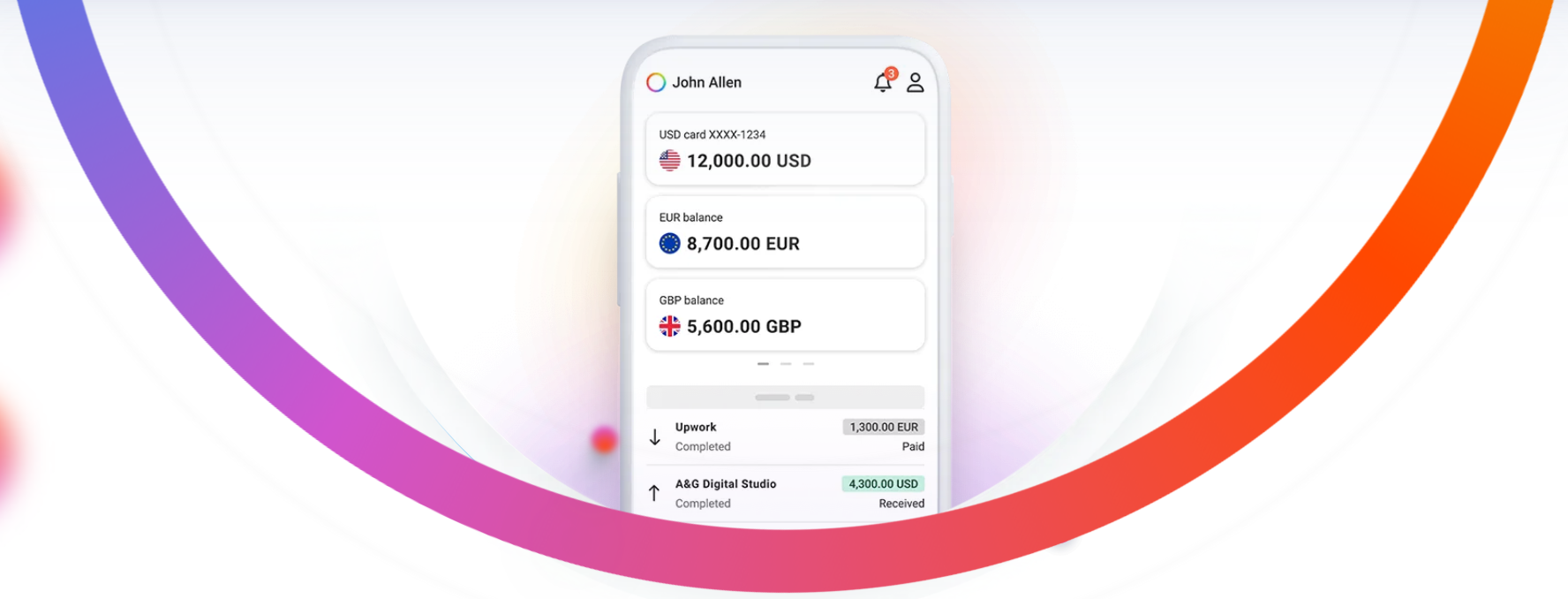

Instead of dealing with multiple banks, high international transfer fees, and currency limitations, Payoneer provides a multi-currency account that works like a virtual international bank account.

Users can receive payments in USD, EUR, GBP, AUD, CAD, and more just as if they had local accounts in those countries.

The platform supports over 190+ countries and 70 currencies, making it one of the most widely accessible financial tools for global transactions.

Whether you’re freelancing, running an online business, selling on marketplaces like Amazon or Fiverr, or hiring international teams, Payoneer offers a fast, affordable, and secure way to move money around the world.

Payoneer also includes features like mass payouts, global payroll tools, marketplace integrations, invoicing, and compliance-backed onboarding, making it a complete solution for cross-border commerce and remote workforce management.

Key Features of Payoneer ⚡

1. Multi-Currency Global Account

Payoneer lets you receive payments in major currencies like USD, EUR, GBP, AUD, and more. It works like having multiple local bank accounts worldwide.

Perfect for freelancers, marketplaces, and international businesses.

2. Low-Cost International Transfers

Payoneer offers significantly lower fees compared to traditional banks. You can send and receive money across 190+ countries efficiently.

Ideal for cutting cross-border transaction costs.

3. Marketplace & Platform Integrations

Connects easily with Amazon, Fiverr, Upwork, Walmart, and hundreds of global platforms. Payments arrive directly in your Payoneer account.

Great for sellers and freelancers working with global marketplaces.

4. Global Workforce Management (WFM)

Hire and pay employees or contractors in 160+ countries. Ensures compliance with local labor laws and taxes. Streamlines payroll in multiple currencies.

5. Fast & Simple Invoicing Tools

Create professional invoices and request payments directly from clients. Clients can pay via bank transfer, debit card, or credit card. Speeds up billing and reduces payment delays.

6. Currency Conversion & Balance Management

Convert currencies at competitive rates inside your account. Hold balances in multiple currencies for future use. Helps businesses manage cash flow globally.

7. Business Debit Card Access

Use your Payoneer funds immediately through the Payoneer Mastercard. Make purchases online, in-store, or withdraw from ATMs worldwide. Offers flexibility and quick access to earnings.

8. Advanced Security & Compliance

Payoneer uses industry-standard security, fraud prevention, and AML procedures. Regulated across multiple jurisdictions for safe global transactions. Protects your funds while ensuring compliance with international laws.

How to Get Started With Payoneer? (Step-by-Step)

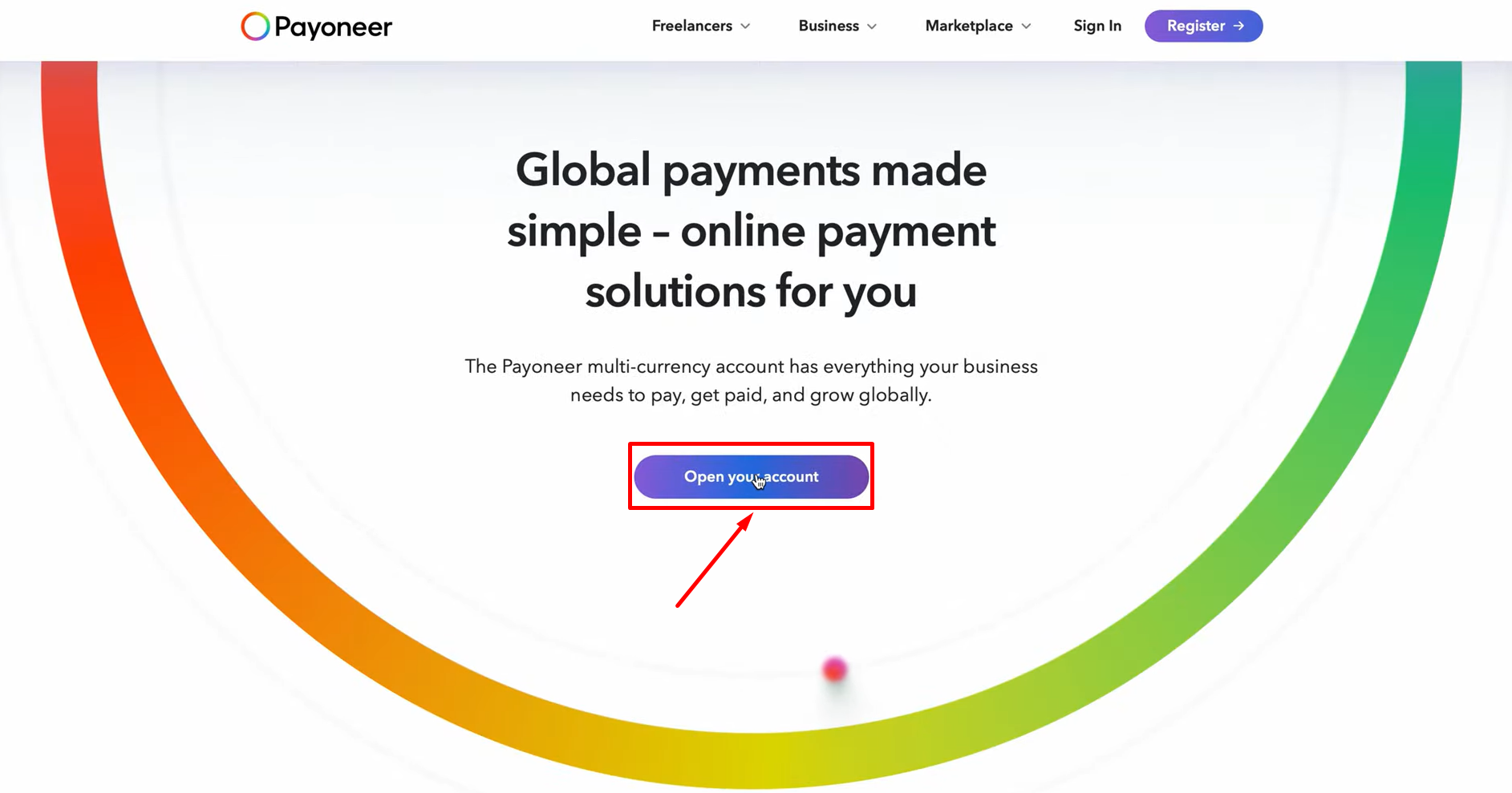

Step 1: Go to official website of Payoneer and click on “Open your account”.

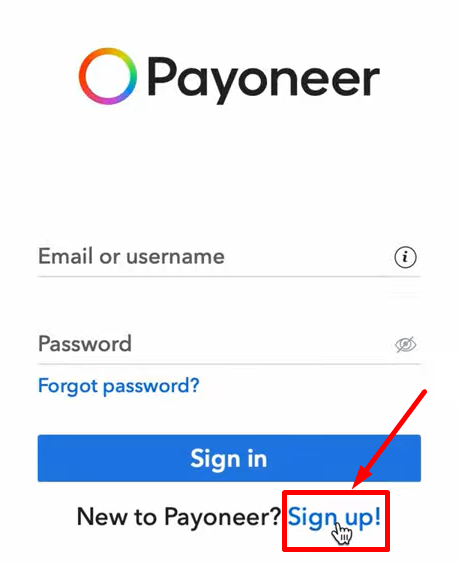

Step 2: Create your Payoneer account by clicking on “Sign up!“.

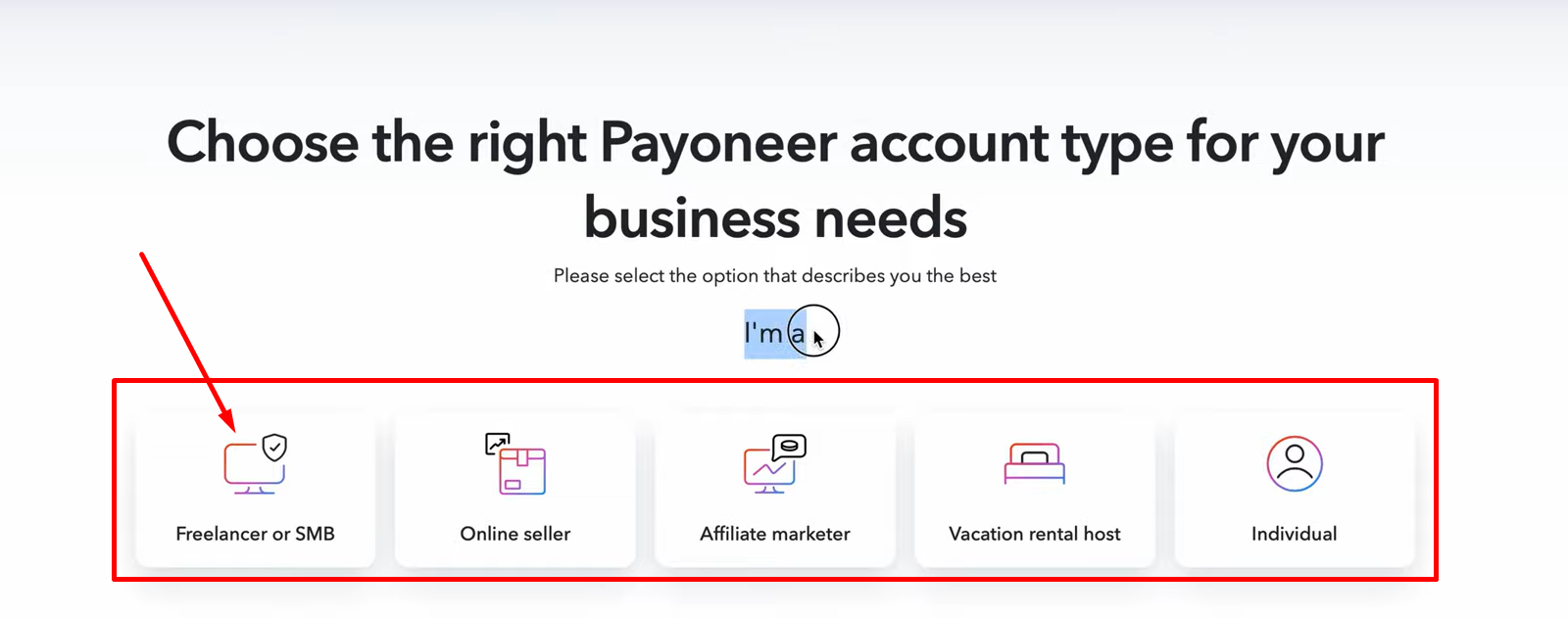

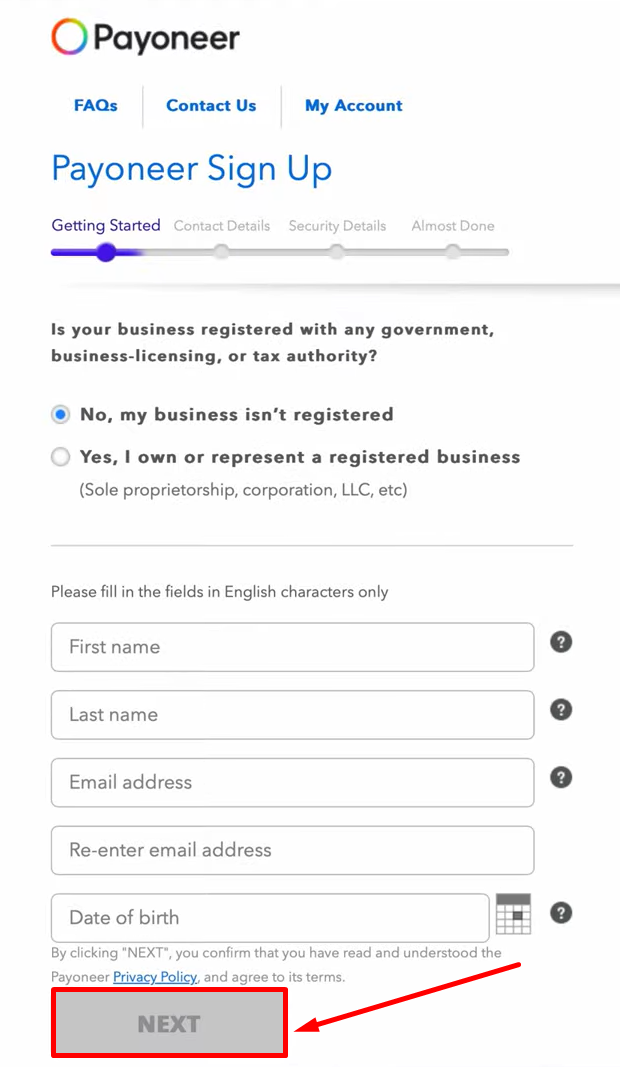

Step 3: Choose your Payoneer account type.

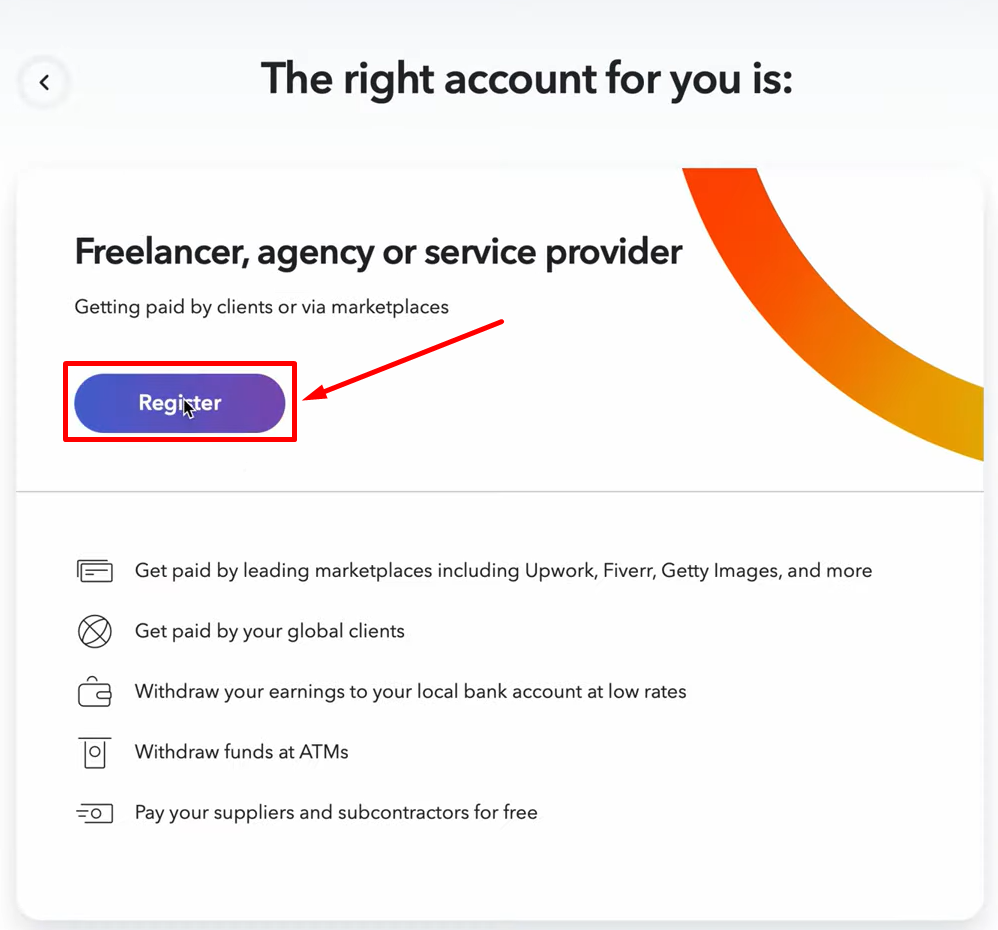

Step 4: Register your account type.

Step 5: Fill out the details provided in the sign up form.

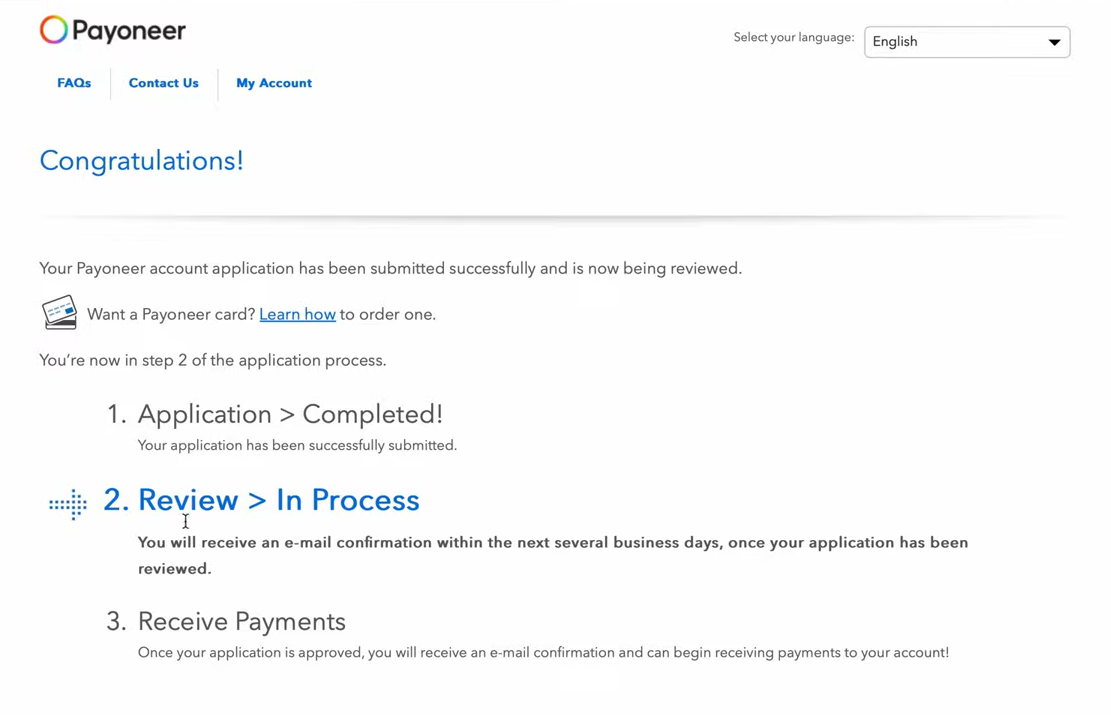

Step 6: That’s all! Your Application is created and will be sent for review.

You are all set! Once your application is approved, you will receive e-mail notification.

Payoneer Fees & Charges 💲

| Service | Fee | Notes |

|---|---|---|

| Receive from another Payoneer user | FREE | Any currency (USD, EUR, GBP, etc.) |

| Receive via client payment (Credit Card) | 3.20% + $0.49 | Applicable for all currencies |

| Receive via ACH bank debit (US only) | 1% | |

| Receive via PayPal (US only) | 3.99% + $0.49 | |

| Withdraw to local bank account (different currency) | Up to 3% | Example: USD balance > INR bank account |

| Annual account fee | $29.95 | Applies only if total received < $2,000 in 12 months |

| Pay a Payoneer user (Credit Card) | 3.20% + $0.49 | |

| Pay a Payoneer user (ACH/Local bank) | 1% | US ACH or other local bank transfers |

Why Choose Payoneer? 🎯

Payoneer is a trusted platform for freelancers, businesses, and online sellers who need to send or receive money across borders efficiently and securely.

It enables seamless international transactions without the usual delays or high fees associated with traditional banks.

With Payoneer, you can access local bank withdrawals in multiple currencies, receive payments from global marketplaces, and stay compliant with international financial regulations.

Beyond payments, Payoneer empowers businesses and freelancers to manage their finances easily, streamline operations, and focus on growth rather than administrative hassles.

Whether you’re receiving payments from clients worldwide, paying contractors, or running an online store, Payoneer provides a scalable, convenient, and secure solution for managing money globally.

Pros & Cons of Payoneer 🤩

| Pros | Cons |

|---|---|

| Supports global payments across 190+ countries | No fixed pricing plans; fees vary by transaction |

| Multi-currency account simplifies international transactions | Currency conversion fees up to 3% on withdrawals |

| Low transaction fees compared to traditional banks | Some fees apply for credit card payments (3.2%+$0.49) |

| Free payments between Payoneer accounts | ACH and PayPal transfers in US have additional fees |

| Easy integration with marketplaces like Fiverr, Upwork, Wish | Annual account fee $29.95 if < $2,000 received/year |

| Quick local currency withdrawals to bank accounts | |

| Supports SWIFT and receiving accounts in multiple currencies | |

| Compliant with global regulations for secure payments |

Who Should Choose Payoneer? 📢

If you work or do business internationally, managing payments across borders can be challenging. Payoneer simplifies this process, making global transactions fast, secure, and cost-effective.

- Freelancers: Receive payments from international clients and marketplaces quickly, securely, and with minimal fees.

- Businesses: Pay suppliers, contractors, and partners worldwide while managing multiple currencies and staying compliant.

- Ecommerce Sellers: Streamline payments from platforms like Amazon, Fiverr, Upwork, and Airbnb, and access funds easily in local currency.

Payoneer is perfect for anyone whose work or business goes global, offering a seamless solution for international financial transactions.

Payoneer vs PayPal vs Stripe 🤝

| Feature | Payoneer | PayPal | Stripe |

|---|---|---|---|

| Primary Use | International payments for freelancers, businesses, and marketplaces | Online payments for individuals and businesses | Online payment processing for businesses and e-commerce |

| Supported Currencies | 70+ currencies | 25+ currencies | 135+ currencies |

| Countries Covered | 190+ countries | 200+ countries | 45+ countries |

| Receiving Accounts | Local receiving accounts in USD, EUR, GBP, and more | Not available | Not available |

| Fees | Low, transparent; some transactions free, others 1–3% depending on method | 2.9% + $0.30 per transaction (domestic) | 2.9% + $0.30 per transaction (domestic) |

| Payout Speed | 24–48 hours to local bank account | Instant or 1–3 days depending on account | 2–7 business days depending on bank |

| Target Audience | Freelancers, businesses, sellers, marketplaces | Individuals, online shoppers, small to medium businesses | Businesses, e-commerce platforms, developers |

| Payment Methods Supported | Bank transfer, credit card, ACH, SWIFT | Credit card, PayPal balance, bank account | Credit card, debit card, digital wallets |

Customer Reviews & Testimonials 🙋🏻♂️

Nancy P.

⭐⭐⭐⭐⭐

Payoneer makes receiving international payments so easy. I can withdraw to my local bank in just a couple of days. Amazing Experience!

Conclusion 🔥

Yes, 100%! Payoneer is undoubtedly one of the best solutions for managing international payments with ease and efficiency. Its multi-currency account allows users to receive, hold, and withdraw funds in multiple currencies, making cross-border transactions smooth and cost-effective.

The platform’s integration with top global marketplaces like Fiverr, Upwork, Wish, and Airbnb ensures that freelancers, businesses, and online sellers can get paid directly without hassle.

Beyond just payments, Payoneer offers a secure and compliant system that meets global regulatory standards, giving users peace of mind while handling large transactions.

With low fees for account-to-account transfers, quick local currency withdrawals, and support for SWIFT payments, it’s an all-in-one solution for global financial operations.

Whether you’re a freelancer expanding your client base, a small business selling internationally, or an online marketplace seller, Payoneer empowers you to manage your money efficiently, save on costly banking fees, and focus on growing your business.

In short, Payoneer combines speed, security, and convenience, making it an indispensable tool for anyone who wants to operate confidently in the global marketplace.

Quick Links:

- Papaya Global Review: Is It Best Workforce Solution?

- ADP Review: Is It Right Payroll Solution for Business?

FAQs ⭐

Payoneer is used for sending, receiving, and managing international payments easily and securely.

Freelancers, businesses, and online sellers can all benefit from Payoneer’s global payment solutions.

Yes, Payoneer follows strict global regulations and secure protocols to protect your transactions.

Most account-to-account transfers are free, while some withdrawals and credit card payments have small fees.

Yes, Payoneer allows quick withdrawals to your local bank account in multiple currencies.